The holiday season is almost here — and for many merchants, it’s the most important sales time of the year. While they’re busy prepping promotions, stocking shelves and scheduling seasonal staff, there’s one critical area they can’t afford to overlook: digital payments.

Every year, the stakes get higher. Consumers have more choices, younger shoppers hold more spending power, and competition (both online and in-store) is fiercer than ever. The checkout experience plays a major role in whether a sale is won or lost. And when it comes to payments, the margin for error keeps shrinking.

To help payments providers prepare, we surveyed 1,000 U.S. consumers to find out how payment preferences are shifting and how digital tools are shaping shopping behavior. In this article, we’ll dive into the results and offer some insights into how payment providers like independent sales organizations (ISOs) and software-as-a-service (SaaS) platforms can help merchants meet rising expectations this holiday season.

Even the Youngest Consumers Still Love Shopping in Stores

Young consumers gain more spending power every year, and businesses can’t afford to miss the mark on how they want to pay. But assumptions about what those expectations look like aren’t always accurate. For instance, although Millennials are seasoned online shoppers, and Gen Z is the first generation of true digital natives, young consumers still shop in stores just as frequently as older generations.

Our survey found that:

- 74% of Gen Z and 76% of Millennial respondents shop in stores at least once a week, which is nearly identical to Gen X (76%) and Baby Boomers (75%)

- Gen Z and Millennials are twice as likely as Gen X to shop in stores daily and seven times more likely than Baby Boomers

- Only 58% of Gen Z respondents say they shop online weekly

While online sales are still crucial for maximizing holiday revenues, your merchants also need to be ready to meet the needs of young consumers in stores by offering things like click-and-collect sales, also known as buy online, pickup in-store (BOPIS) and tap to pay to bust long queues and speed up the checkout experience.

Digital Wallets Are a Must-Have Payment Option

Consumers of different ages may be similar in where they shop, but how they prefer to pay varies greatly from generation to generation. Credit cards still lead across all groups, with an overwhelming 59.3% of consumers saying they prefer to pay by credit card both in-store and online. That was almost four times higher than the next largest group: people who prefer to use digital wallets for both online and offline purchases.

But who’s using those digital wallets falls very clearly along generational lines. Gen Z (32%) is almost twice as likely to prefer digital wallets in stores and online compared to Millennials (17%), and over 3.5 times more likely than Gen X (9%).

With a third of Gen Z shoppers looking to pay with a digital wallet wherever they shop, it’s critical for your merchants to offer the most popular options, like Apple Pay and Google Pay.

Frictionless Digital Payments Can Increase Spend

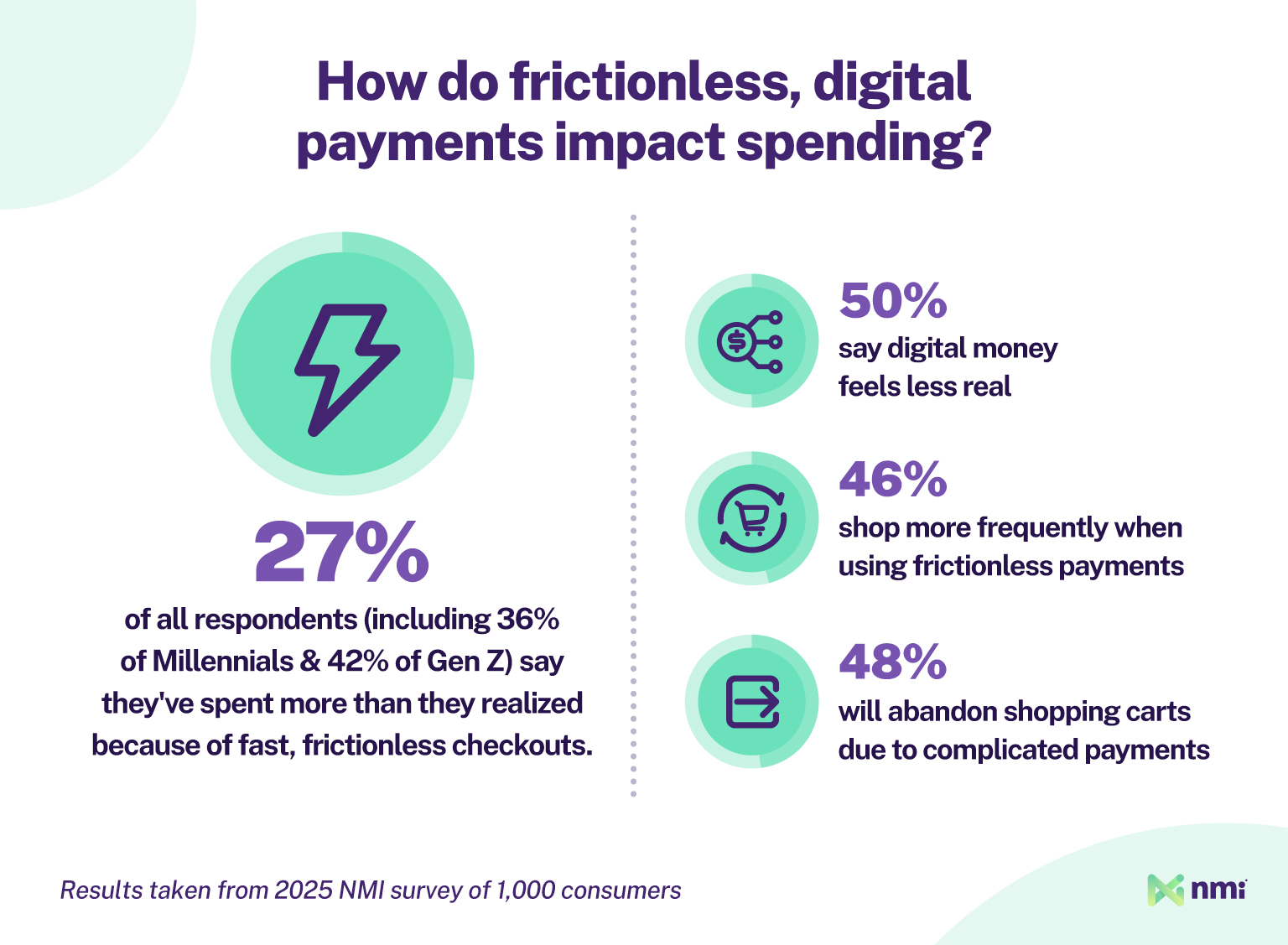

Digital payments offer the speed and convenience that modern consumers demand, but they also change the way people shop. Our survey found that:

- 50% of all consumers and a staggering 68% of Gen Z say money feels “less real” when they’re paying through a digital option like a digital wallet or even just a credit card

- 46% of respondents say they consistently shop more frequently thanks to more seamless payments

- 27% of all consumers say they’ve definitely spent more than they realized due to fast, frictionless checkouts, including 36% of Millennials and 42% of Gen Z

That means offering digital payments may provide your merchants with a boost in holiday revenue, especially as customers are more likely to make last-minute impulse buys near the in-store checkout or accept more cross-sell opportunities during online checkout when you make those purchases easy.

The flip side is that a checkout that involves more friction than a shopper deems acceptable can easily lead to the loss of the sale altogether. Nearly half (48.2%) of all respondents said they often abandon shopping carts when the payment experience becomes too frustrating or complicated, including over half of Gen X and Millennial respondents.

Action Items for Payment Providers

With these insights into how and where customers prefer to shop and pay, you’re in a strong position to help your merchants prepare for the holiday rush. Here are three key steps you can take now:

- Make sure your merchants are omnichannel-ready

- Get as many merchants as possible set up with digital wallet payments

- Eliminate any easily solvable friction points in the online and offline checkout experience

1. Ensure Your Merchants Are Set Up for Seamless Omnichannel Sales

The importance of in-store shopping means there is still an opportunity for small retailers to compete with giant online platforms like Amazon. The better integrated and orchestrated a merchant’s in-store and online channels are, the more likely they’ll be able to offer an exceptional shopping experience to the widest possible range of customers.

The lead-up to the holidays is an ideal time to talk to your merchants about omnichannel options. If your brick-and-mortar merchants aren’t already selling online and through social channels, they’re missing out. For primarily online merchants, temporary physical locations like pop-up shops in malls or markets can be a powerful way to connect with younger shoppers eager to meet their favorite online brands in the real world.

Talk to your merchants about potential channels and their options for ensuring the shopping experience can move from one to the other without interruption. The key is to make sure your merchants aren’t missing out on omnichannel opportunities due to a lack of understanding or easily solvable hardware or software limitations.

2. Ensure Merchants Understand How Easily They Can Offer Digital Wallet Payments

Our data shows that credit cards are still king both in-store and online. But with roughly a third of Gen Z holiday shoppers looking to use digital wallets, failing to offer them could be eroding the shopping experience for an important demographic.

The good news is that it’s extremely easy for your merchants to offer digital wallet payments. In stores, any contactless terminal compliant with Europay, Mastercard and Visa (EMV) can already accept tap payments from smartphones. Young customers probably already know that, but make sure your merchants do too so that they can advertise it at staffed cash registers and self-checkout lanes.

On the online side, enabling digital wallet payments is often as easy as toggling on the option in an ecommerce platform’s backend. For custom-built integrations, partners like NMI make adding Apple Pay and Google Pay exceptionally easy with both low-code and no-code options. Check out the NMI Developer Portal or talk to your provider to learn more about enabling digital wallets.

3. Look for Easy Ways To Lessen Friction Points in Online Checkouts

With so many consumers willing to abandon carts after a negative experience, there is no room for checkout friction during the holidays. To help your merchants maximize their revenue (and your residuals), offer effective but easy-to-deploy solutions to cut checkout friction. Some options include:

- Network tokens to boost approval rates, minimize fraud and enable one-click checkouts

- Automatic card updating to ensure shoppers using pre-saved cards don’t have to waste time updating details to complete purchases or continue using subscription services

- Tap to pay systems that allow in-store retailers to use smartphones as floating checkouts, reducing congestion at the front counter and increasing customer throughput

NMI offers a complete omnichannel payments platform designed to offer maximum payments choice and frictionless orchestration between sales channels, right out of the box. To find out more about how NMI can help your merchants make the most of the holidays, reach out to a member of our team.