Today, travelers using the tube and mass transit in the London area have the ability to pay for their fares using their own bank-issued debit and credit cards. This wasn’t always the case. Prior to a few years ago, the only way to get around London was by purchasing traditional tickets or using the closed user group cards available.

Since the ability to use debit and credit cards was made available, London has experienced a number of benefits. First, it makes using public transportation much easier for tourists not familiar with the ticketing process and closed group cards. Additionally, using debit and credit cards rather than paying in cash has streamlined the boarding process and actually helped buses in heavily populated areas stay on schedule. Finally, while the closed group cards in use are effective, they carry overhead and require additional administration. Shifting some fares to debit and credit cards has reduces these expenses for London.

This presents a significant opportunity to ISVs serving the mass transportation industries of buses, rail, and subways.

With such tangible benefits — and now that travelers expect comparable payment options everywhere in the UK — surrounding areas as well as municipalities and cities in the US have been rushing to implement similar electronic payment technologies. Clearly, this presents a significant opportunity to ISVs serving the mass transportation industries of buses, rail, and subways. However, there are a couple challenges ISVs must overcome before they can address this need.

First, there are interoperability challenges. With the London project, the technologists involved had the benefit of creating a solution for one customer that controlled the entire system of buses and rail. Other municipalities will be more complicated as travelers will need to be able to purchase fares that allow them to then cross borders, change operators, and use different types of transportation. Clearly, such an undertaking can be daunting.

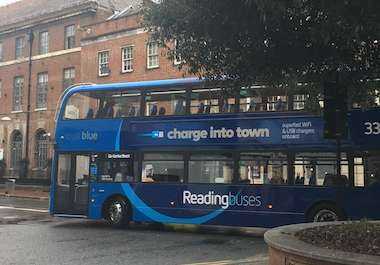

Second, add in the payment processing integration — contactless EMV in particular — and things can become even more intimidating to an ISV. It’s not unrealistic to believe that for most transportation-focused ISVs and municipalities, implementing contactless payments can take months or even years to complete. In fact, UK-based Reading Buses spent 3 years floundering through their own EMV certification nightmare before finally meeting the right payment partner.

While most ISVs lack the internal expertise to bring contactless payments to their platforms, payment expert Creditcall has proven success in contactless payments, a 100-percent first-time EMV certification record, and experience with the nuances of the transportation industry.

While most ISVs lack the internal expertise to bring contactless payments to their platforms, payment expert Creditcall has proven success in contactless payments, a 100-percent first-time EMV certification record, and experience with the nuances of the transportation industry. Within a couple of months, Creditcall helped Reading Buses with its contactless integration and had an approved pilot. A few weeks later the company was able to roll out a fully certified contactless solution.

Travelers in Europe and the US now expect to have the option of payment with debit and credit cards when traveling. While you might be great at building software for this industry, Creditcall is great at building payment solutions. With a combined effort, you can easily turn a contactless payment integration into a reality to capitalize on this trend.

By Liz Gibson, Head of Payment Services at Creditcall.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.