Although COVID-19 will long be remembered for the disruption it caused, facing such a huge crisis also inspired innovation and change for the better. Independent software vendors (ISVs) and independent sales organizations (ISOs) rose to the challenge to provide their customers with the software, omnichannel payment solutions and services they needed to stay viable during uncertain times.

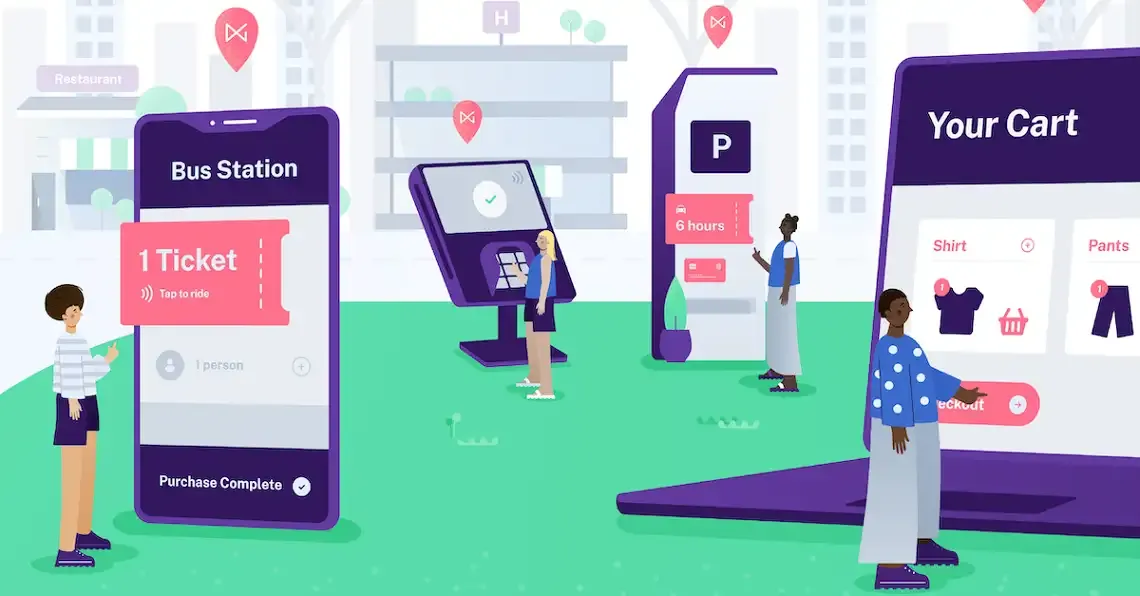

Omnichannel is the new normal

After a year of sweeping changes, forward-thinking ISVs and ISOs recognize that the market for payment solutions has evolved. Merchants that only accept digital payments on a countertop terminal are becoming a thing of the past, primarily for two reasons:

1. Consumer behaviors have shifted

During the pandemic, seasoned omnichannel shoppers turned from making card-present purchases at brick-and-mortar stores to shopping via other channels. For example, from February to April 2020, Upserve reports an 840 percent increase in weekly sales from restaurant online ordering. In response, merchants had to expand their payment solution features to accommodate the new ways consumers wanted to engage.

2. Competition

The second reason merchants who only accept card-present payments are becoming few and far between is that if they don’t offer the payment experiences consumers demand, they won’t survive. NMI research in 2020 revealed some proof of this phenomenon, finding that 43 percent of consumers actively avoid shopping with retailers that don’t accept contactless payments.

ISVs and ISOs that have evolved from providing only card-present payment solutions to equipping their clients with omnichannel payment solutions will help them stay in business. And the ISVs and ISOs, too, will remain competitive.

Omnichannel technology extends beyond the countertop PIN pad

Savvy ISVs and ISOs have worked with their payment company partners to expand their offerings to include:

Contactless and touchless payments

As our research found, consumer preferences trended away from using cash or handing a card over to a cashier and, instead, preferring contactless experiences. The Visa Back to Business Study, 2021 Outlook found that contactless payments transactions – using a contactless card, mobile wallet or wearable device – grew 43 percent worldwide in 2020. When consumers tap or wave a card or smartphone to pay, nothing changes hands, and the transaction is quick, which helps keep lines moving.

Still, some merchants, especially small and medium-sized businesses (SMBs) and microbusinesses, recovering from shutdowns aren’t in a position to invest in technology so that they can accept contactless payments. Smart solution providers are helping these merchants offer touchless payments in other ways, such as text-to-pay and QR code payment solutions. PayPal’s implementation with CVS helped to bring this option to the forefront in the U.S.

Online payments

Even if consumers intended to drive to a store or a restaurant to retrieve their orders curbside or in-store, many are paying in advance online to save time and minimize or eliminate time waiting in line. From January to April 2020, e-commerce sales grew 27 percent YOY, the biggest gain in a decade.

ISVs and ISOs are ensuring that merchants that want to add an e-commerce channel to their brick-and-mortar operation can do so – and manage payments on all channels efficiently from a single platform.

Recurring payments

Many ISVs and ISOs are implementing virtual terminals for their clients, which make it easy to set up recurring payments for customers ordering subscriptions or regular services.

Merchants are hooked on omnichannel payments’ agility and efficiency

ISVs and ISOs who have elevated themselves from a payment technology provider to a problem-solving solutions provider have learned to connect the dots for their customers. Putting on their consulting hats, these solution providers have become the voice of reason, helping their customers define their challenges, set goals for how to overcome them and build better customer experiences – then deploy the right payments technology to make it happen. Moreover, they’re helping their clients build resilience into their businesses so that they can adapt if consumer behaviors change again – in response to a crisis or other unforeseen circumstances.

Merchants want partners who can provide answers, payment solutions and advice that help them operate most competitively and profitably. And the ISVs and ISOs that emerged from 2020 with new offerings, including omnichannel payments, are just what they’re looking for.

Are you on the cutting edge, or have you realized you’re about to face stiff competition from a new breed of ISV or ISO?

Contact us for more information about what it takes to stay competitive.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.