The payments industry is competitive. An ever-growing number of independent sales organizations (ISOs) are vying for merchant sales. For your business to thrive, it must be flexible and dynamic. Relying on outdated systems and workflows will only hold you back.

In January 2022, NMI acquired IRIS CRM and added the payment industry’s most powerful customer relationship management (CRM) system to its Full Commerce Enablement platform. This software enhances operational efficiency across sales, support, onboarding, residuals management and more. With an industry-specific CRM like IRIS CRM, you can monetize payments and manage merchants through a single partner.

In this blog, we explore how a payments-centric CRM can save you time, money and effort while improving your ability to compete and grow your ISO business.

Shorten Your Sales Process and Recruit More Merchants

At the heart of every great CRM is lead management. Your CRM should include an automated lead collection and management system that keeps your funnel fuller and enables sales agents to understand each prospect better. With this tool, your team can create laser-targeted solutions to meet merchant needs and successfully close leads.

More Leads, Fewer Leaks

With automated lead collection, your CRM will instantly create new lead accounts whenever merchants interact with your business. The system will track customer touchpoints across several mediums, including web forms, email, QR codes and even inbound phone calls.

Automation ensures more merchants are captured into the system organically. It saves time and reduces your dependence on expensive paid leads.

An excellent lead management system will also automatically categorize accounts based on customizable, pre-set triggers. Automated lead tracking and classification ensure:

- Fewer leads slip through the cracks

- Follow-up is more consistent

- Sales agents always know how to prioritize their efforts.

More Personalized, Data-Driven Sales

Because the CRM automatically captures data from every interaction (including phone calls, emails, SMS messages and website visits), your sales team will always have access to the most up-to-date information available.

High-quality data ensures your team is always prepared for sales meetings, can better understand each prospect’s needs and provide every merchant with a personal, consultative experience. With a payments-centric CRM, your team can spend less time filtering through unorganized data and more time closing sales.

Onboard Merchants Faster and Reduce Time-to-Processing

NMI’s full commerce offering combines access to a full suite of payments services, including over 200 payment processors, an industry-leading gateway and IRIS CRM’s innovative automated boarding tools. The result is a payments monetization and complete onboarding solution that enables ISO’s to board merchants with unparalleled speed – without ever having to leave the CRM.

Board New Merchants to Payment Services in Five Minutes or Less

The IRIS CRM Turbo App is the proprietary automated onboarding tool that drives merchant acquisition with NMI’s Full Commerce offering. It saves time and money by using electronically-signed digital merchant processing applications (MPAs) to automate the slowest and most error-prone aspect of traditional onboarding – manual data transfer.

Instead of your agents or boarding team having to enter the data from an MPA into a processor’s boarding portal line-by-line, TurboApp automatically configures an application based on the chosen processor’s requirements and populates fields instantly. All the user has to do is check the information for accuracy, review pricing and hit submit.

With an automated onboarding solution, your application accuracy will skyrocket. This maximizes application success and reduces the boarding process from thirty minutes (or more) to under five minutes – even for brand-new users.

Board Low-Risk Merchants With a Single Click

With a payments-centric CRM like IRIS CRM, you can board merchants directly from e-signable, web-based application forms. This means you can complete the full boarding process online with as little as a click.

One-click boarding offers the fastest time-to-processing possible, enabling you to compete with popular payment platforms like PayPal and Square in delivering a fast, frictionless merchant signup experience.

Bundle Gateway Processing and Value-Added Services

NMI’s Full Commerce offering is a one-stop payment solution that gives ISOs access to a leading payment gateway, a variety of value-added services and over 200 payment processors.

With NMI’s CRM, you can seamlessly board and manage merchants while accessing everything within the Full Commerce offering, all from a centralized point of control. Then, with Mass Enablement, you can add value-added services like Kount® Advanced Fraud Protection, Level II/III processing or Electronic Invoicing to a new merchant’s profile in a matter of clicks.

You can also offer your existing merchants the same advanced services using the CRM’s built-in merchant management and ticketing tools. This feature opens up a new revenue stream, turning your entire merchant base into a pre-qualified pool of familiar leads.

Enable Your Support Team To Do More for Each Merchant

There is no shortage of competitors for your merchants to choose from, and switching to a new processor has never been easier. The quality of service and support you offer your merchants on an ongoing basis is crucial to reducing customer attrition. The combined NMI and IRIS CRM solutions are designed to make it easier than ever to deliver elevated service and maximize merchant “stickiness.”

Manage Support Tickets From Within the CRM

Your CRM’s built-in helpdesk should automatically track, update and report on all newly submitted, ongoing and resolved support tickets. It should also notify you when new tickets and support cases have gone too long without a response. This ensures agents never lose track of merchant issues and can easily access the details of in-progress tickets and a merchant’s complete history.

The result is a higher quality of support that can be delivered to a broader merchant base without wasting time or resources.

Automate Residuals Management To Save Time and Eliminate Headaches

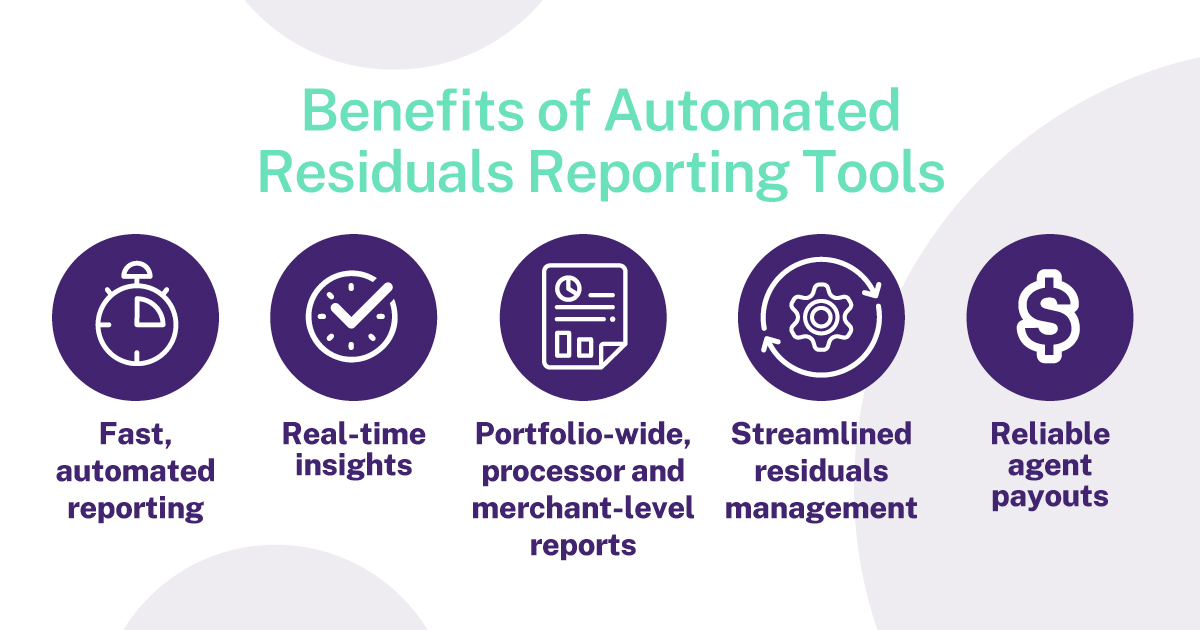

Managing residuals is a slow, complex and often frustrating task – but it doesn’t have to be. A leading-class payments CRM like IRIS CRM will offer a complete suite of automated residual tools designed to make residual calculations, reporting and management automatic and straightforward.

Generate a Clear Picture of Residuals Faster With Unified Reporting

One of the most frustrating parts of being an ISO is juggling and combining unique residuals reports from each processing partner. Although this is necessary to generate the data needed to manage operations, measure profitability and plan ahead, it’s also time-consuming and prone to error.

With IRIS CRM, you won’t have to worry about manual reporting – the software completes the process on your behalf. Processor reports are automatically combined as they hit the CRM each month. Afterward, the software makes data available in real-time through a built-in residuals reporting dashboard.

The user-friendly reporting interface can be searched, sorted and customized to present residuals data at the portfolio-wide, processor or merchant levels. This functionality lets you quickly and easily find the information you need without swimming through a sea of data.

Automate Residual Calculations and Speed Up Agent Payout

Another benefit of CRM-powered automated residuals management is that your net earnings and agent splits are available as soon as monthly numbers drop. This means you’ll never have to manually calculate the commissions owed to your independent agents or other stakeholders again – saving you countless hours month in and month out.

More reliable split calculations also ensure faster payouts – a critical factor in recruiting and retaining the most talented independent sales agents in the space. You can even make payouts through the CRM using built-in Automated Clearing House (ACH) payments integration, further streamlining your workflows.

See the CRM in Action

In addition to making sales, boarding, support and residuals more efficient, IRIS CRM offers a full array of productivity tools designed to streamline and enhance all areas of your operations. The right CRM will promote better:

- Communications

- Scheduling

- Marketing

- Invoicing and more

To learn more about how an industry-specific CRM can enhance your operations, improve productivity and provide a better merchant management experience, contact a member of our team to schedule a consultation.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.