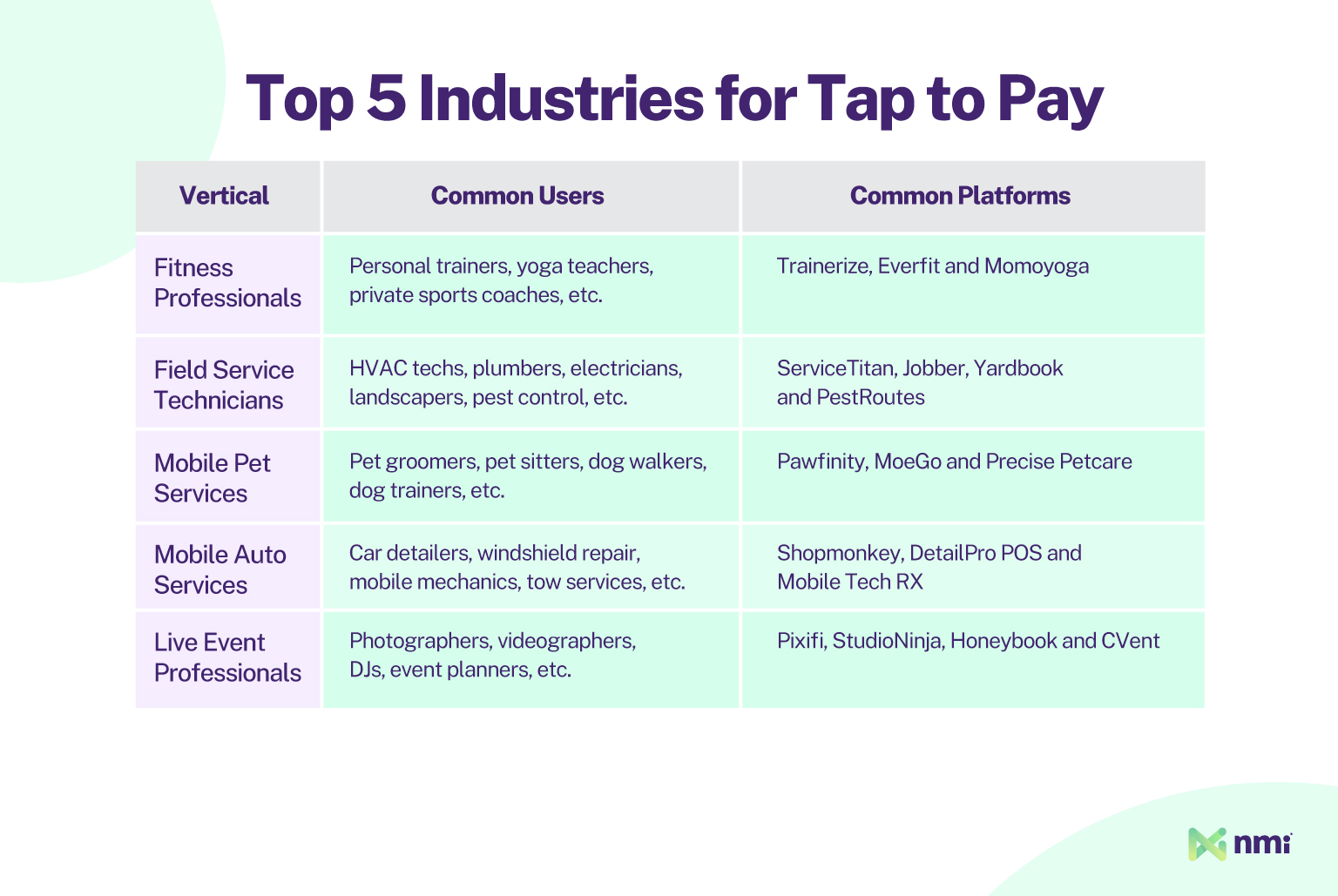

If your software users take in-person payments, they’ll expect contactless payment acceptance. The question is: how do you offer it to them?

The short answer is tap to pay technology.

Tap to pay uses a secure app and the near-field communication (NFC) technology built into smartphones to turn the devices merchants already own and love into secure, powerful tap payment terminals.

According to Mastercard, global consumers tap contactless cards or digital wallets to make two out of every three in-person payments, a 2x increase over pre-pandemic adoption. That means contactless tap payments are a table-stakes capability for any merchant selling in-person.

Until recently, taking an in-person tap payment meant your users had to have dedicated payments hardware that could sync the transaction details back to your software. That was a headache because dedicated payments hardware can be bulky, expensive and difficult to learn. But now, tap to pay is changing how physical payments are accepted and making it possible to create a frictionless tap experience that lives completely within your SaaS (software-as-a-service) platform.

Your users can access tap to pay through third-party applications, like Mastercard Cloud Commerce, or you can build tap to pay directly into your own mobile application, creating a true all-in-one experience.

In this article, we’ll look at how adding tap to pay can significantly boost your software’s value proposition and how software development kits (SDKs) make embedding it a fast, simple proposition.

The Benefit of Embedding Tap to Pay

Offering embedded payments is a huge part of creating an elevated software experience. But tap to pay takes things to the next level by maximizing convenience and minimizing costs for any business using your software through a mobile app.

Offer Your Users a Boost in Convenience and Savings

Tap to pay comes with two huge benefits for your merchants, convenience and savings.

Convenience: Tap to pay eliminates the need for dedicated payments hardware by turning the user’s smartphone into their payments device. That makes accepting payments far more convenient, especially for users who sell on the go, by removing the need to carry a bulky terminal or keep a plug-in card reader charged. It also saves users the hassle of learning, maintaining and troubleshooting separate hardware.

Savings: The second major benefit is cost. Skipping dedicated hardware means no upfront purchases, no pricey replacements, and no ongoing maintenance contracts. Since your users probably already have a smartphone, they can simply download your app and start selling — no extra hardware required.

Strengthen Your Value Proposition and Competitive Advantage

Adding tap to pay to your mobile app gives you an edge over competitors who are still forcing merchants into more traditional payment flows. Most of your competitors still rely on clunky workflows — asking field sellers to use a separate mobile payment pad or generic tap to pay app, then manually reconcile transactions later. By integrating payments directly into your software, you can offer a simpler, more streamlined experience. That makes your platform more valuable, helps you stand out and boosts both user retention and lifetime value.

Adding Tap to Pay to Your Mobile Application

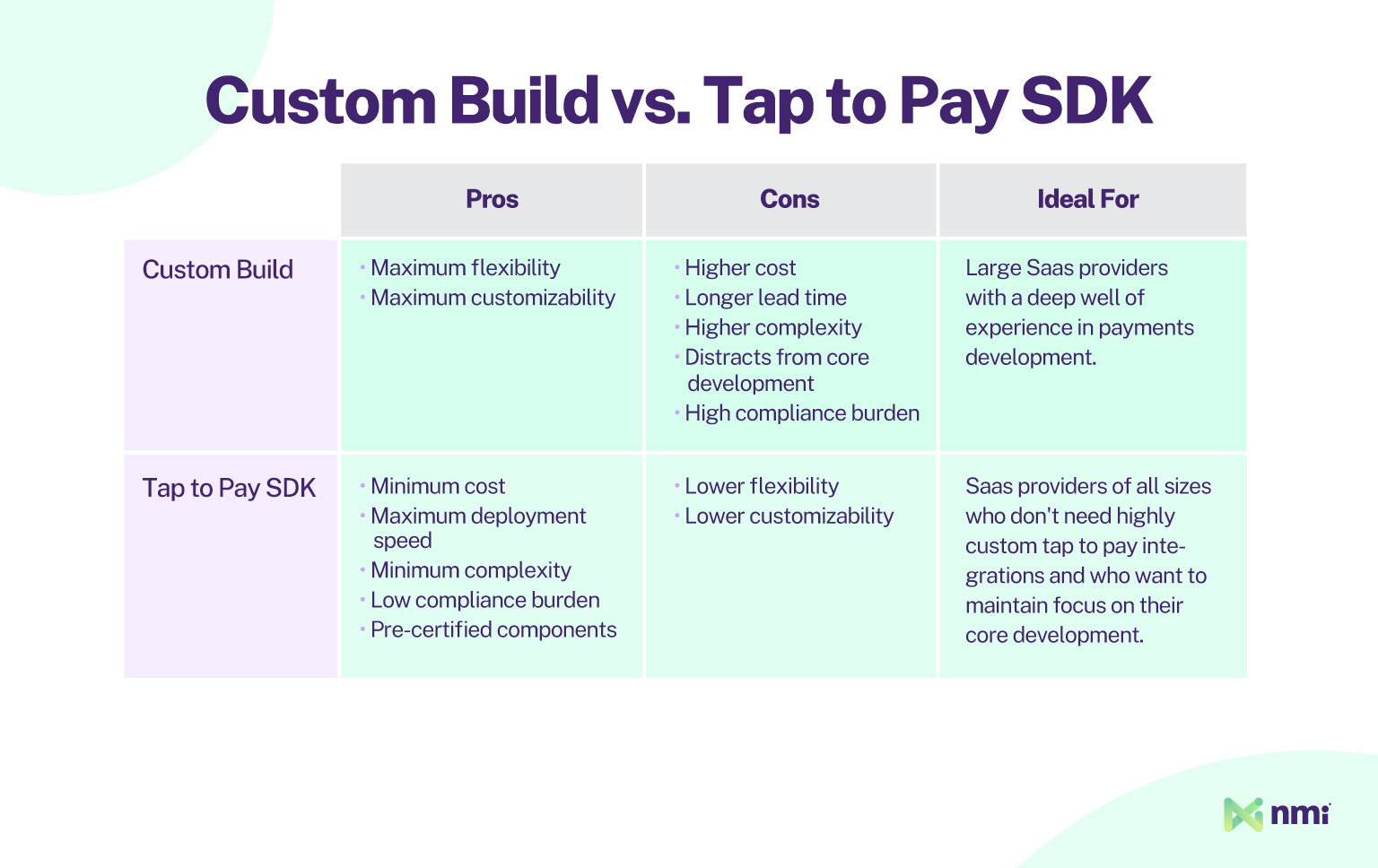

If you offer a mobile app and your users sell in the field, the benefits of tap to pay are clear. But, what’s the best way to give it to them? Your two primary choices are to custom build tap to pay functionality into your app or to use pre-built SDK components from a technology partner, like NMI. Which route you choose depends on a variety of factors, including your experience, your available resources, your need for customization and more.

Custom Tap to Pay Integrations

Building a custom tap to pay solution into your mobile app using application program interfaces (APIs) from Apple or Android allows you to take control of every aspect of your integration. That means maximum flexibility and customizability — but at a cost. By scratch-building, you are not only responsible for the costs and complexity of the development but also for ensuring your app is fully compliant and able to be certified. That means meeting the requirements of everything from Payment Card Industry Data Security Standard (PCI DSS) to Apple’s human interface guidelines.

Partner-Enabled Tap to Pay SDKs

If your platform doesn’t require a unique tap to pay integration, you can opt to build with an SDK from a technology partner. Using a tap to pay SDK gives you access to a library of pre-built modules and components, while still providing a certain level of flexibility in how you deploy the feature. It eliminates most of the cost, time and complexity of development, making it the easiest path to a secure, fully certified tap to pay solution for your mobile app.

Let NMI Take the Complexity Out of Tap to Pay

NMI Tap to Pay offers a frictionless, pre-certified tap to pay solution that can be easily added to mobile applications by using pre-built components and documentation. Our SDKs eliminate the cost, time and complexity of building and securing a tap to pay solution, and they provide SaaS developers with a way to improve the user experience and create seamless mobile payments.

To find out more about NMI Tap to Pay, visit the NMI Developer Portal or reach out to a member of our team today.