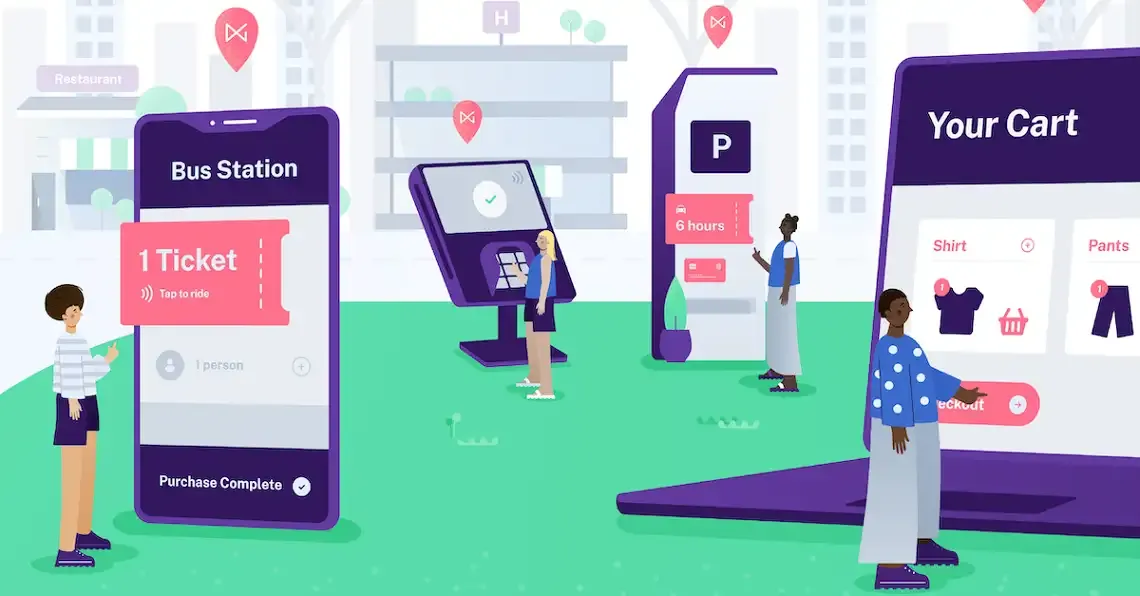

Slowly but surely, the worlds of payments and software have been merging. It’s a win-win for both sides.

Software companies enjoy a couple of primary benefits of payments integration:

-

More recurring revenue: By not monetizing payments, ISVs are leaving a considerable amount of recurring revenue on the table. In fact, for some software companies, payment revenue can eclipse monthly SaaS revenue.

-

Easier transition to omnichannel: Many software companies have had to pivot to accommodate merchants’ and customers’ ever-increasing interest in accepting payments across various channels. By selecting a payment partner with a complete stack of offerings, ISVs can gain omnichannel payment capabilities.

-

More data: Software companies have access to a wealth of customer data. By tapping into electronic payments, software companies can add payments data to the already bountiful volume of customer data, priceless for decision-making, new features and upsell opportunities.

On the other side, next-generation ISOs and other payment companies have identified several benefits of aligning with software companies:

-

Frictionless onboarding: Merchants can sign up for payments quickly through their software provider.

-

Increased exposure to merchants: Whether by partnering with a software company or acquiring the software outright, payment companies can reach merchants who would otherwise be unaware of their existence and services.

-

Reduced attrition rates: Software sales are stickier than payments. Merchants are often willing to change payment providers while chasing better rates but are hesitant to switch software providers since their entire business relies on the software.

-

Consistency: By adopting some software packages, merchants reveal a level of operational maturity and stability associated with a higher, more consistent processing volume.

-

Staged upsell opportunity: Aligning with a software company can provide highly lucrative upsell opportunities for payment companies. A merchant relationship can start with payments but grow into related products and services such as payroll, loans, invoicing and more. Additionally, upsell solicitations can be staged (required information is only requested as needed) to ease merchants into the process.

ISOs, ISVs and Acquisitions: What’s Next for this Fintech Trend?

When pursuing a payments integration, ISVs should seek to align themselves with a fintech partner like NMI who provides transparency, fast and simple API integration, full commerce enablement, dedicated support and the possibility of white labeling the payments piece of the solution.

ISOs and other payment providers may consider building their own software or, more realistically, acquiring a software company. This trend of software company acquisition has been occurring in the retail and restaurant verticals with considerable success for the payment companies involved. There’s no reason to think it can’t or won’t happen on a large scale across other niche markets – especially those with high ticket averages and recurring payments.

With so many benefits to both ISVs and fintech companies, it’s safe to assume that the lines between software and payments will continue to blur in the coming years. The only question is, will your company join in on the opportunity or miss out?

To learn more, reach out to a member of our team today.