The merchants of the future are here, and they need payments.

Entrepreneurial activity in the U.S. is booming, driven largely by young generations of business owners. While Millennials and Gen Zers have long shaped consumer trends, it’s now just as important to understand their preferences as it is those of merchants. For many companies, that will require a major mindset shift, especially since these digital natives won’t settle for the outdated payments solutions their parents used.

Let’s look at this critical demographic shift in American entrepreneurship and how it resets the bar for many areas of payments, including:

- Technology

- The merchant experience

- Sales channels

- Support

Entrepreneurship Is Skyrocketing in the United States

According to Global Entrepreneurship Monitor’s (GEM) 2024-25 report, entrepreneurial activity in the US is at a 26-year high. America’s Total Entrepreneurial Activity (TEA) is at 19%, indicating that nearly one-in-five working-age adults are currently in the process of starting a business or running one that is less than three years old.

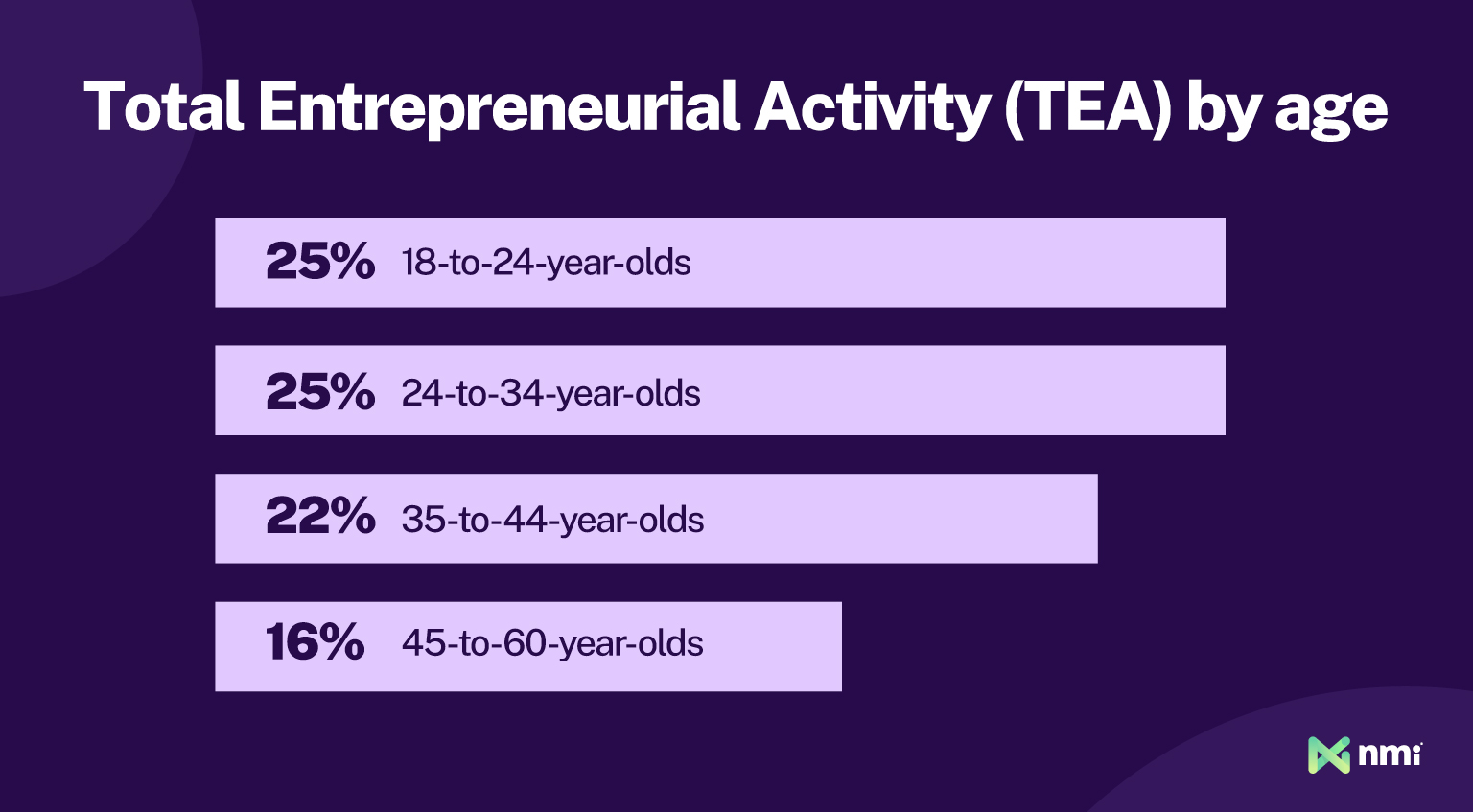

That’s great for America as a whole, but what really jumps out in GEM’s data is that Millennials and Gen Zers are driving entrepreneurial growth in a way we haven’t seen before:

- From 2024-25, 18-to-24-year-olds and 24-to-34-year-olds have put up the highest TEA, at 25% each

- Older Millennials, aged 35 to 44, came in just behind, at 22%

- Gen X lags behind both at 16%

Over the years, 25-to-44-year-olds have consistently led GEM’s TEA tracking. But, since 2023, 18-to-24-year-olds have begun topping the charts. By comparison, GEM’s 2004-05 report shows only a 15.8% TEA for America’s youngest adults, marking a nearly 60% increase in entrepreneurial activity among these demographics in the last 20 years.

The trend toward younger entrepreneurs outpacing their mid-career counterparts can be put down to a number of factors, including the now ubiquitous gig economy and social-media-driven side-hustle culture. However, GEM reported that 66% of entrepreneurs cited job scarcity as a motivator, which could drive even more entrepreneurial activity in the years to come as Gen Z stares down a particularly difficult job market.

What a Surge of Young Entrepreneurs Means for Payments Providers

The data shows that new business owners are trending younger. But what does that mean for the payments space?

In the short term, it means payment companies will need to rapidly adjust to the expectations of younger demographics to capture market share. In the long run, it means staying at the cutting edge of payments technology will become a strategic imperative for providers. In either case, playing it safe or arriving late on tech could become a competitive death sentence.

Tech: The Cutting Edge Matters When There Is No Status Quo

We already know that Gen Z and Millennials have a more tech-forward relationship with payments than older generations. As business owners, these generations will expect access to the same, increasingly diverse payment systems they prefer to use as consumers. That means the pressure on payments companies to adopt a wider set of next-gen offerings is only going to grow.

For instance, an older business owner may be perfectly happy with traditional terminals and a basic gateway, because that’s all they’ve used for years (or even decades). But, with young entrepreneurs, especially Gen Z, that “comfortable status quo” doesn’t exist. And, because they’re true digital natives, they’re not afraid to try new technologies; in fact, they’re actively looking for the next thing.

Experience: Price Isn’t Everything

Money matters to young entrepreneurs, but it’s just one part of the equation. According to research from Deloitte, these individuals place just as much value on meaning and well-being. That tracks with what we know about younger demographics as consumers: They’re famously experience-driven. For payment companies, this means that earning the business of young entrepreneurs requires competing on the quality of the merchant experience.

Young merchants are looking for tech-centric payments experiences that mirror the speed and low friction of the apps and platforms they use elsewhere in their lives. And we’ve already seen how successful some large payment platforms have been in offering exactly that.

Experience-focused offerings like instant sign-up, plug-and-play components and simplified payouts have made self-serve platforms dominant forces in the market, even though they come with higher transaction fees. That’s a sign of things to come, and payments companies of all types need to find ways to offer a more platform-like experience that makes payments an invisible part of business.

Channels: There Is No Choice but To Be Everywhere

For younger demographics, there is no border between online and offline. Gen Z and Millennials are more than twice as likely as baby boomers to engage with omnichannel commerce, moving between website research, influencer and brand posts on apps like TikTok, and in-store shopping. Omnichannel is the baseline expectation for these generations, and young entrepreneurs want the ability to sell across all channels, as well.

For payments companies, just offering in-store and online payment options is no longer good enough. To meet the expectations of young business owners, it’s crucial to offer seamlessly orchestrated omnichannel payments that blur the lines between offline, online and social. That requires payments companies to not only offer a more diverse menu of services and technologies, but also to integrate and package them in turnkey omnichannel solutions that merchants can plug in and use right out of the box.

Support: Self-Serve or No-Serve

When it comes to customer service and support, Gen Z and Millennials prefer to help themselves. According to Gartner, 38% say they’d give up on a customer service issue if they couldn’t solve it through self-serve channels. More than half (55%) said it would cause them to use a service less, and 52% said it’d drive them to look elsewhere.

Payments is a complex space where technical issues are inevitable and good support is critical. But young business owners don’t want to be forced into an interaction with a support specialist.

That creates two challenges for payment companies. The first is developing easily accessible and effective self-help services, like merchant account management portals, strong knowledge bases and AI-assisted support copilots. The second is developing service offerings that are simple and bulletproof enough to lend themselves well to self-serve management and troubleshooting.

Creating Payments Solutions Tailored to Gen Z and Millennial Entrepreneurs

There has never been a time when more Americans were going into business for themselves. And, unlike past entrepreneurial booms, today, the youngest demographics are responsible for the highest growth.

A consequence of that accelerating shift is that the payments industry has less time to adapt than previously thought. Younger Millennials and Gen Z were once thought of as the payment processing customers of tomorrow. But, as it turns out, they’re already on the scene in a big way, and their unique expectations need to be met now.

So, with no time to spare, how can payments companies improve their technology and reduce friction to compete for a demanding generation of young entrepreneurs? The easiest way is leveraging partnerships with cutting-edge payments technology providers, like NMI.

NMI’s payments ecosystem gives our partners turnkey access to everything they need to offer complete, one-stop payments. Just some of the things that make NMI an ideal choice for serving the next generation of young business owners include:

- Modern Payments Tech: A full suite of next-gen payments systems, including extensive digital wallet integration, mobile tap-to-pay, AI-powered fraud prevention and more

- Frictionless Merchant Experiences: Fast sign-up, easy integrations, low fees, simplified security and compliance, prompt payouts and more

- Self-Serve Management: NMI’s self-serve merchant portal enables business owners to take unparalleled control over their payments experience

- Full Omnichannel Orchestration: NMI seamlessly blends in-store, online, social, mobile and unattended payments, enabling sales to happen anytime, anywhere

- Complete Modularity: Merchants can pick and choose which parts of the NMI ecosystem to use, offering custom-tailored solutions and the personalization Gen Z and Millennials demand

NMI can help you position yourself to serve a new generation of young, tech-savvy entrepreneurs. For more information, reach out to a member of our team today.