The payments industry runs on more than technology and banking licenses — it runs on relationships. Behind every tap, swipe and “payment approved” notification is an entire network of partners working together to make transactions possible. At the center of that network are payment resellers: the connectors who bring enterprise-grade payment services to merchants of every size, from corner coffee shops to global ecommerce brands.

For payments companies, resellers are more than middlemen — they’re the growth engine that turns a handful of processors and acquirers into a network that spans millions of merchants worldwide. But the reseller model is complex, with multiple players, revenue structures and branding considerations in play. In this article, we’ll break it all down — from why the model matters to how resellers get paid — so you can see exactly how this vital part of the payments ecosystem works.

- Why the reseller model is so important in payments

- How frontline resellers connect to the wider payments ecosystem

- How resellers are paid

- How they stay front and center with their merchants while their partners work quietly behind the scenes

Why Payments Companies Depend on Resale Partners

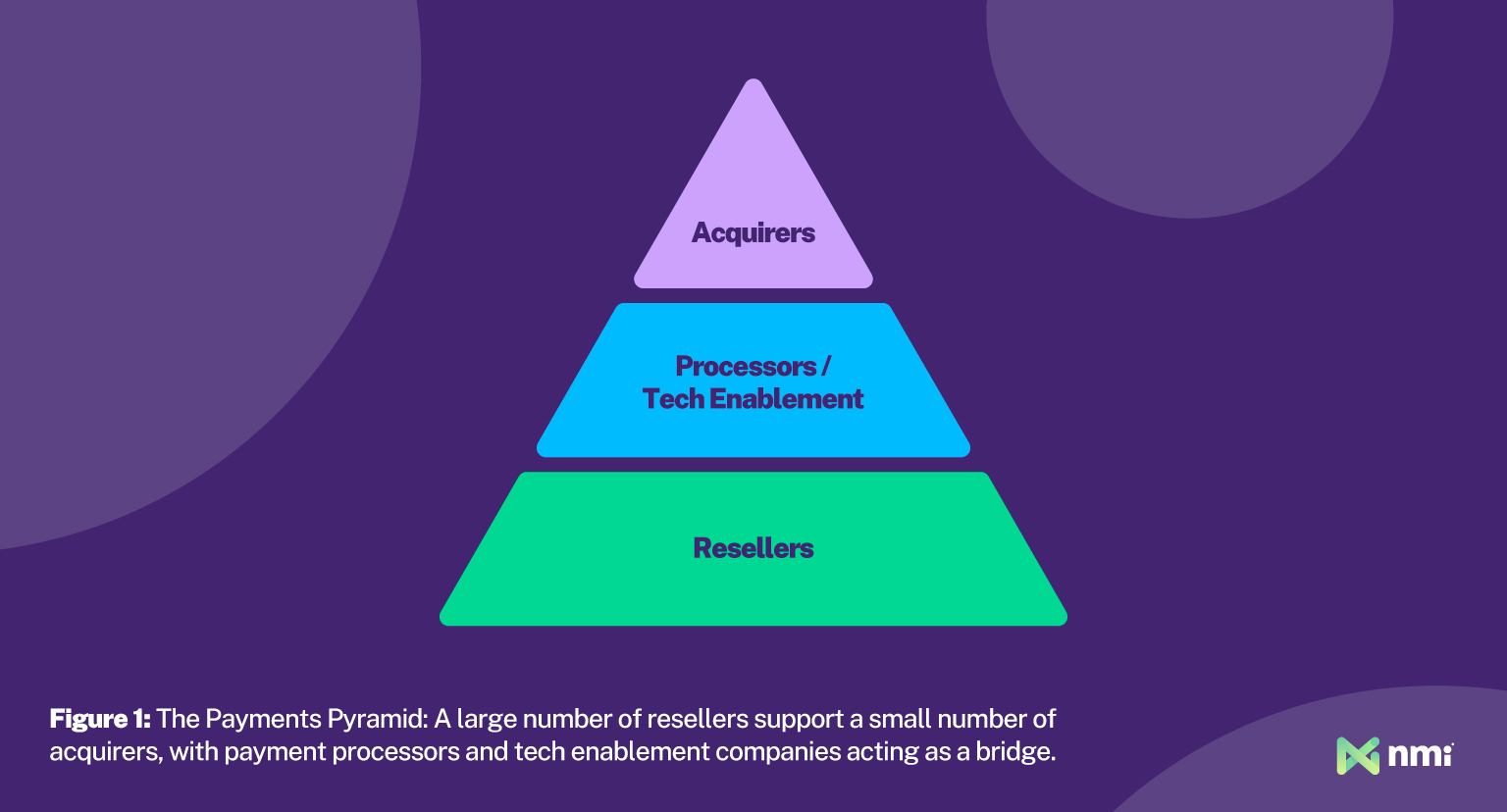

Resellers are an integral part of the payments ecosystem. According to Visa, there are over 130 million merchants accepting credit cards around the globe. If acquirers — the financial institutions that issue merchant accounts — had to compete for those merchants directly, they’d become bogged down. It just isn’t efficient for banks to spend resources signing, serving and supporting millions of merchants ranging in size from global retailers to micro-businesses and weekend hobbyists.

By contrast, there are 3,771 independent sales organizations (ISOs) and payment facilitators (PayFacs) in Visa’s Global Registry of Service Providers, and there are even more resellers than that when you include the many software companies now reselling embedded payments directly to their users. If you include the individual independent agents working on behalf of those resellers, the number skyrockets. And that’s where the big value in the reseller model lies.

By outsourcing sales, service and support tasks to thousands of smaller resellers, everyone in the payments chain wins:

- Big companies like acquirers and processors gain efficient market penetration and reach a far wider customer base than they could on their own, without getting bogged down in lengthy processes

- Resellers gain access to mature and secure payment products to sell without having to develop them on their own, and they earn a cut of the fees generated on every transaction for the lifetime of their merchants’ processing

- End merchants get the best of both worlds — the reliability and security of a big company’s products with the personal touch and dedicated service that only a small company can offer

In short, resellers make it possible for all the companies at every level of the payments pyramid to focus on doing what they do best. This results in improved service quality and higher profits at every level.

How Resellers Work With Companies Further up the Payments Pyramid

Before we look at the different ways resellers can partner with payment providers and serve merchants, let’s quickly recap what each of the major players at each level does:

- Acquirers: Banks that issue merchant accounts and take in the funds from credit card sales. Acquirers partner with processors and platforms, and some also work directly with resellers. They do not work directly with merchants

- Payment Processors: Companies that facilitate the technical and logistical aspects of transferring a card payment from a buyer’s account to a seller’s account. Resellers often partner with processors, who act as a middle layer between the reseller and the acquirer

- Gateway / Tech Enablement Providers: Companies that provide the merchant-side technology necessary to accept payments, including gateways and value-added services like anti-fraud tools and subscription management. Resellers need access to this tech to provide complete merchant solutions

- All-in-One Platforms: Large payments companies that serve as both payment processors and tech enablement providers, with one or more acquiring banks behind the scenes

- Resellers: Front-end sales companies that recruit, close and often support merchants on behalf of their processing and tech partners. This includes ISOs, PayFacs and SaaS (software-as-a-service) builders

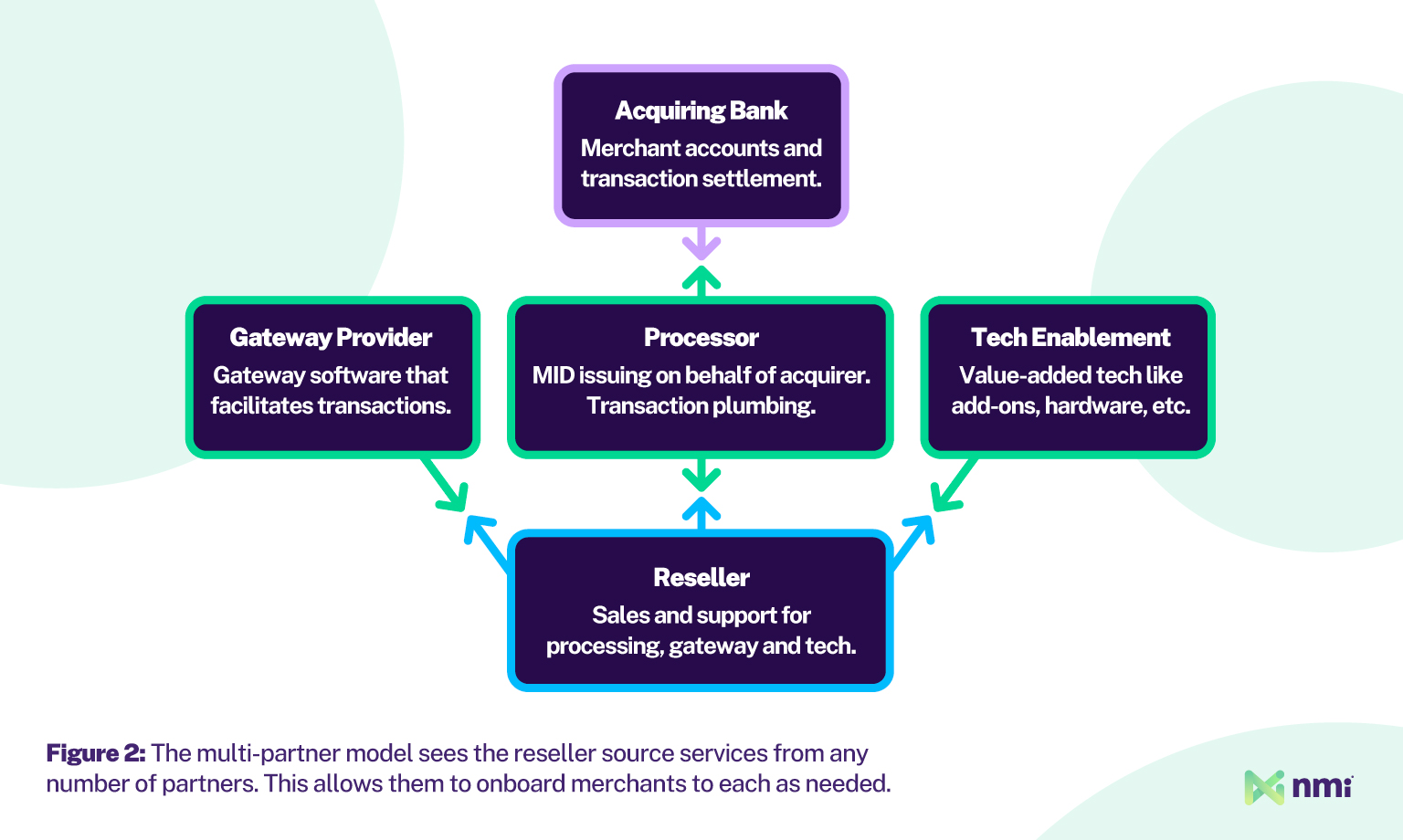

The Multi-Partner Reseller Model: Multiple Vendors to Power Each Aspect of Payments

In the multi-partner reseller model shown in Figure 2, the ISO or software provider works with different companies for processing, gateway and tech enablement. The reseller could work with a handful of different companies within each category, resulting in potentially dozens of partners.

Upside: The reseller can ensure it has diversified services, allowing it to tailor solutions to each merchant better. In particular, it’s common for resellers to work with multiple processors, ensuring merchants can be issued a merchant account and merchant ID (MID), even if they are high-risk or were initially rejected by another processor.

Downside: The more partners a reseller has to work with, the more complex their business becomes. Managing vendors, learning individual partner systems and navigating support takes more time. Since merchants have to be onboarded to each partner’s services individually, this slows down time-to-processing and potentially degrades the merchant experience.

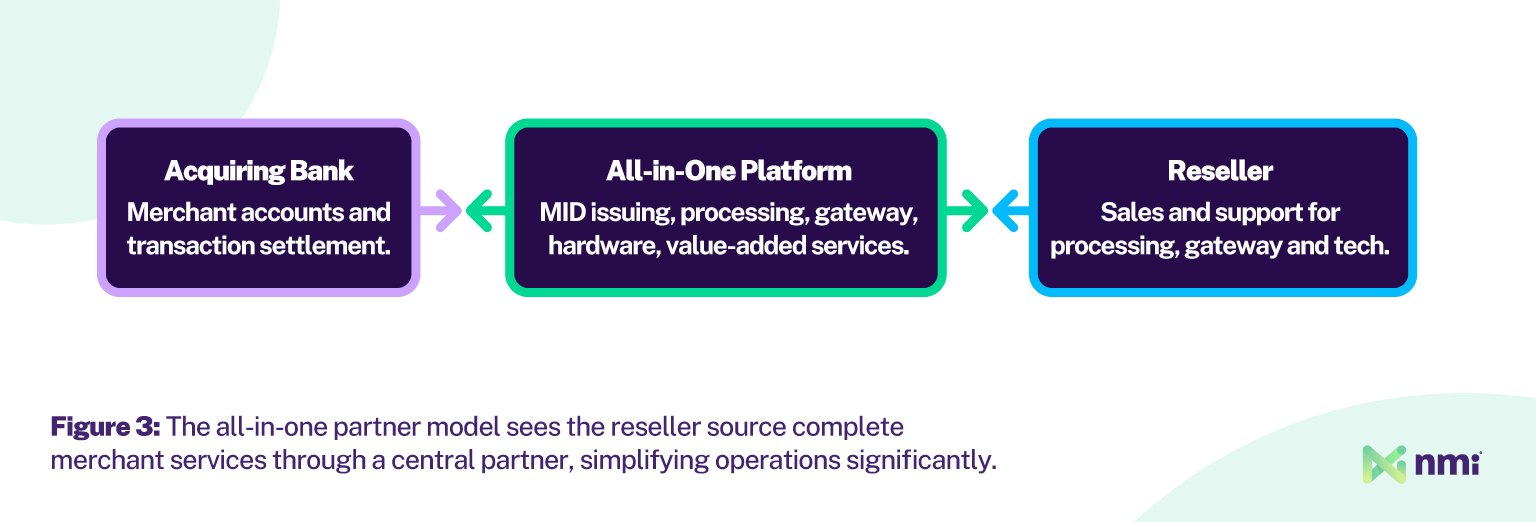

The All-in-One Reseller Model: Payment Processing, Gateway and Tech Enablement from a Single Partner

In the all-in-one reseller model shown in Figure 3, the reseller can access everything they need to offer comprehensive merchant services through a single, central payments platform. This is great for companies like SaaS platforms that want to monetize payments with as little complexity as possible. For traditional resellers, like ISOs, this model also offers simpler, more streamlined, cost-effective operations.

Upside: Onboarding merchants to all types of services takes much less time, and service delivery is more cohesive, improving the merchant experience. Navigating support is also easier, as resellers work with a single dedicated account manager and support team. Billing is simpler and partner relationships are deeper.

Downside: In the case of some platforms, the reseller is effectively locked out from outside services. For instance, a reseller who wants to use “bring-your-own processing” in addition to the all-in-one platform may not be able to. That could lock them into a more limited set of processing or tech enablement options. NMI solves this problem by providing a modular all-in-one platform that allows resellers to build their ideal solutions à la carte and plug in top processors on top of the built-in platform processing.

How Earnings Flow From Transactions and Value-Added Services

Resellers earn a slice of the fees — known in the industry as a residual — on every transaction processed by every merchant they sign, for the life of that contract. They also earn fees on add-ons they sell to merchants, including gateways, hardware, value-added services and more. But, the meat of a reseller’s earnings, and the part that makes their portfolio truly valuable, is the processing residuals.

Resellers can earn on transaction processing in two primary ways: by marking up wholesale pricing or through revenue sharing.

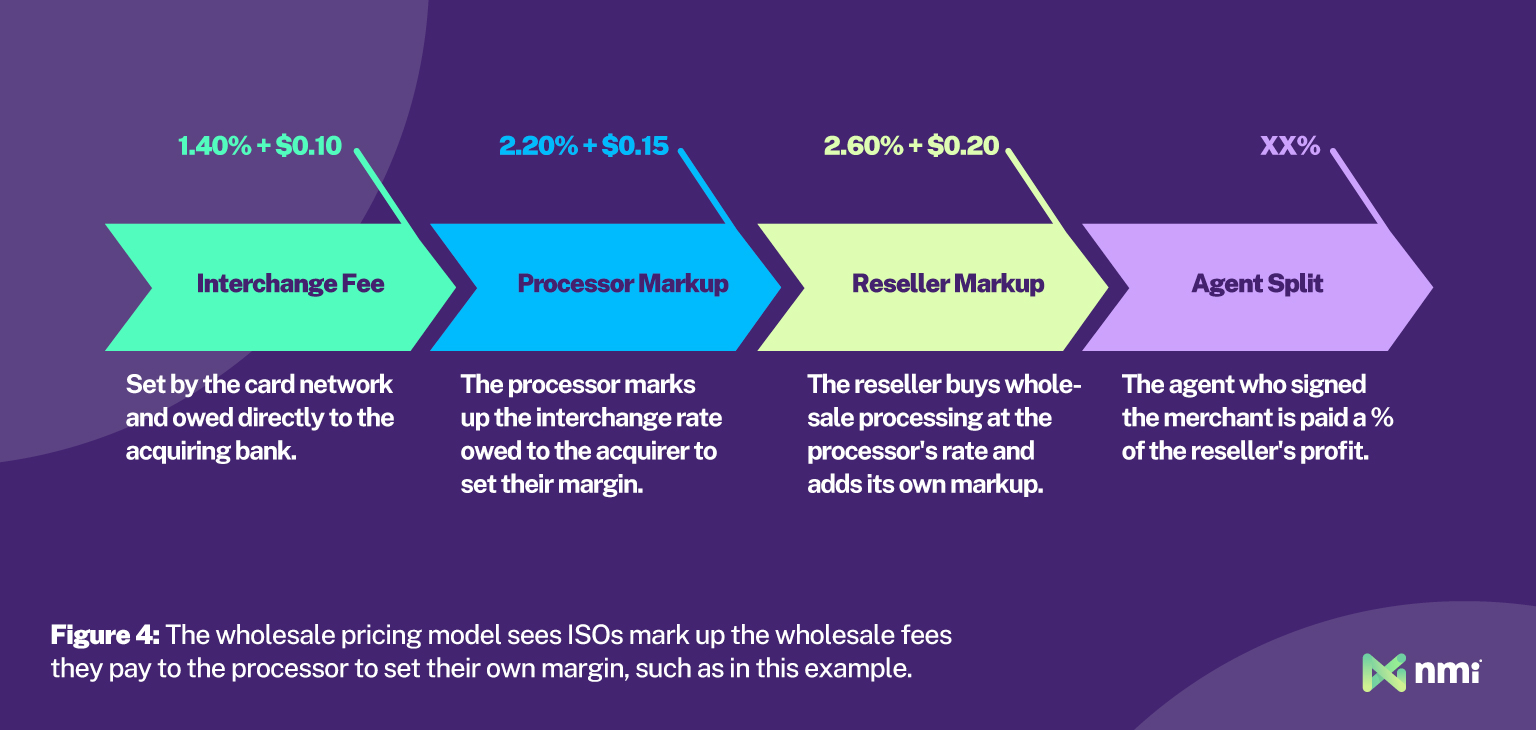

In the wholesale pricing model, the payment processor marks up the interchange rate, which is the minimum baseline transaction fee set by the card networks, and sells processing to the reseller at that wholesale rate. The reseller then adds its own markup, setting its own pricing and margin, and sells processing directly to merchants at that rate. Any independent agents involved in signing the merchant receive their own commission, known as a split.

Wholesale pricing (figure 4) is generally used by larger resellers, like wholesale ISOs and Super ISOs, that do very high volumes and benefit from having more control over their pricing. It offers higher margins but comes with major trade-offs, including increased complexity, increased risk and higher requirements from processors.

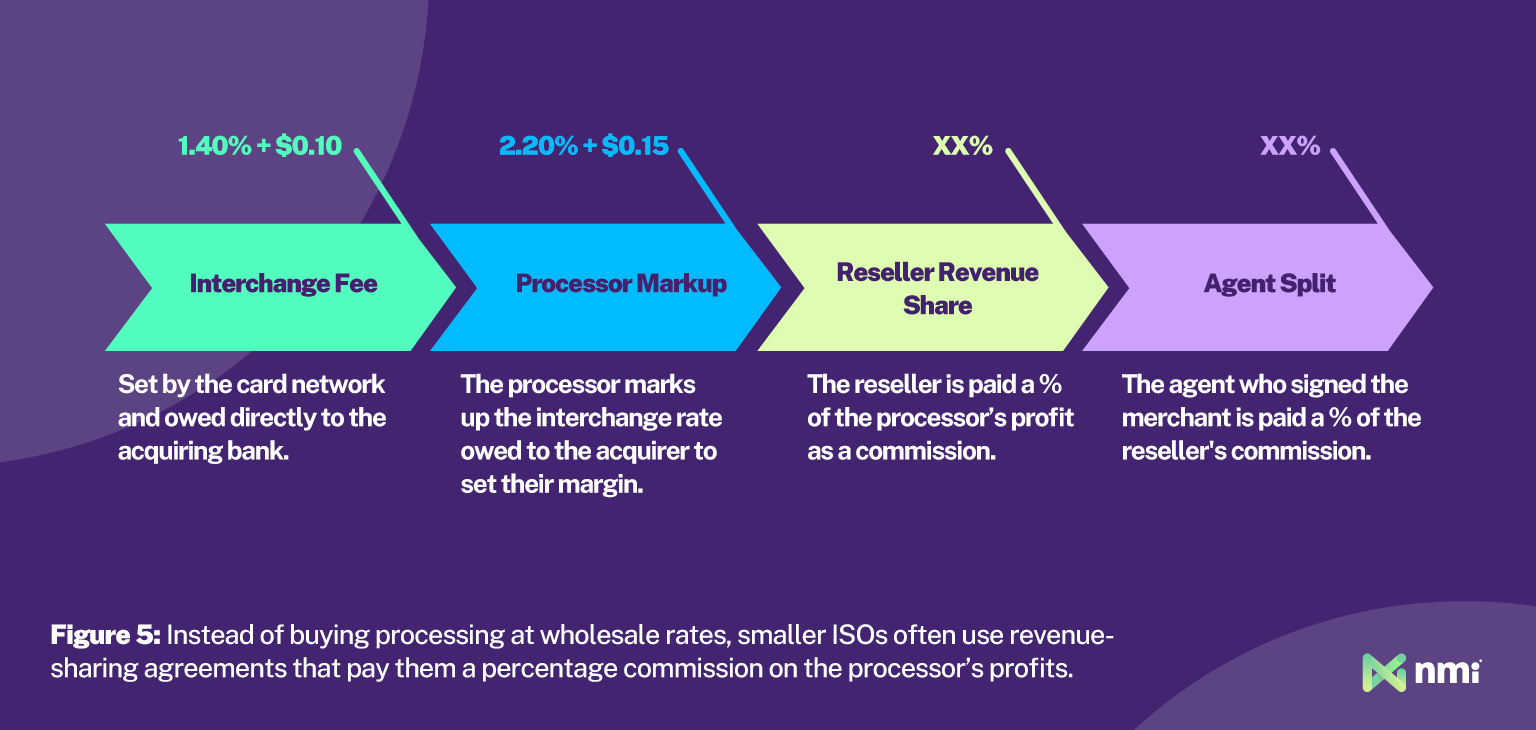

Revenue sharing is preferred by most smaller resellers for its simplicity. In the revenue sharing model, the reseller earns a commission on the profits of its upstream partner. In this model, the reseller often acts more like a pure referral partner. All of the risk, compliance burden and technical aspects belong to the upstream processor. Once again, if the reseller worked with any independent agents on the account, those agents are owed a split on the reseller’s residual.

In the revenue-sharing model, processors generally pay out residuals to resellers every month. However, in some cases, as technology makes tracking and managing residuals easier, resellers can access real-time tracking and weekly payouts.

How White Labeling Works and Who Owns the Branding Opportunity

One common question about reselling payments through a partner is who owns the branding. The reseller handles the frontline interactions with the merchant, but that doesn’t automatically mean it’s their brand that will be front and center. There are two big factors that resellers need to consider when it comes to branding: regulations and white labeling.

Regulation Factors: Technically speaking, to use their own branding, a reseller needs to be registered with the major card networks. The card networks have strict rules stating that unregistered resellers can only approach and serve merchants under the name of the registered reseller they’re working with. There is a loophole allowing unregistered companies that only collect and submit leads to use their own name and branding. But the second they provide a merchant with any kind of services, that loophole closes.

Availability of White Labeling: White labeling is the process of re-skinning a product with the seller’s name and branding. From reporting to gateways to value-added extensions, hardware, support and beyond, there is no shortage of branding opportunities for payment resellers. But capturing them requires white labeling.

When looking for a processing and technology partner, find someone who will white label as many aspects of their services as possible. Allowing merchants to see a reseller’s branding can strengthen relationships, foster trust and establish the reseller as a valuable partner and a key part of the merchant’s success.

Finding the Right Payments Partner

Navigating the reseller landscape means balancing opportunity with complexity. Whether you’re an ISO managing multiple processor relationships or a SaaS provider embedding payments for the first time, the right partner can make all the difference. A strong partner doesn’t just offer technology — they offer flexibility, transparency and the tools to scale your business while keeping your brand front and center.

As the reseller model continues to evolve (adding more players, more tech, and more ways to monetize) it’s more important than ever to choose a partner that can grow alongside you; one that doesn’t box you into rigid systems or force trade-offs between flexibility and simplicity.

That’s where NMI comes in.

We offer a complete, all-in-one payments platform that makes selling payments easier than ever before. Our partners gain one-stop access to:

- Direct MID issuing and merchant accounts

- 150+ processor connections for BYO-processing

- An industry-leading payment gateway

- A full suite of value-added services

- A wide variety of countertop and mobile payments hardware

- Tap to Pay smartphone payments

- Fast, simplified merchant onboarding

- Dedicated support and implementation managers

- No-code, low-code and fully custom integrations for embedded SaaS payments

- Self-serve flexibility

Because NMI is fully modular, partners can opt to use the entire platform or any combination of its components.

To learn how NMI can make your payments business easier, more modern and more profitable, reach out to a member of our team today.