Residuals — the income on the processing fees earned by payment resellers — make the payments world go round, and managing them is a critical task for independent sales organizations (ISOs), payment facilitators (PayFacs) and other industry professionals. Traditionally, calculating and managing residuals was a grueling, time-consuming and resource-intensive process. But, automation and technology are now changing things for the better.

How you manage residuals affects everything — from agent relationships to your company’s long-term success. But if you’re like many payments companies, you may have found this process tough to optimize.

Aggregating reports from a dozen or more processors, reconciling data, calculating splits, and ensuring agents are paid correctly (and on time) is time-consuming. As your business grows, residuals management alone can cost you hundreds of hours a year. Even for larger teams, sorting through that much fragmented data can be a major headache.

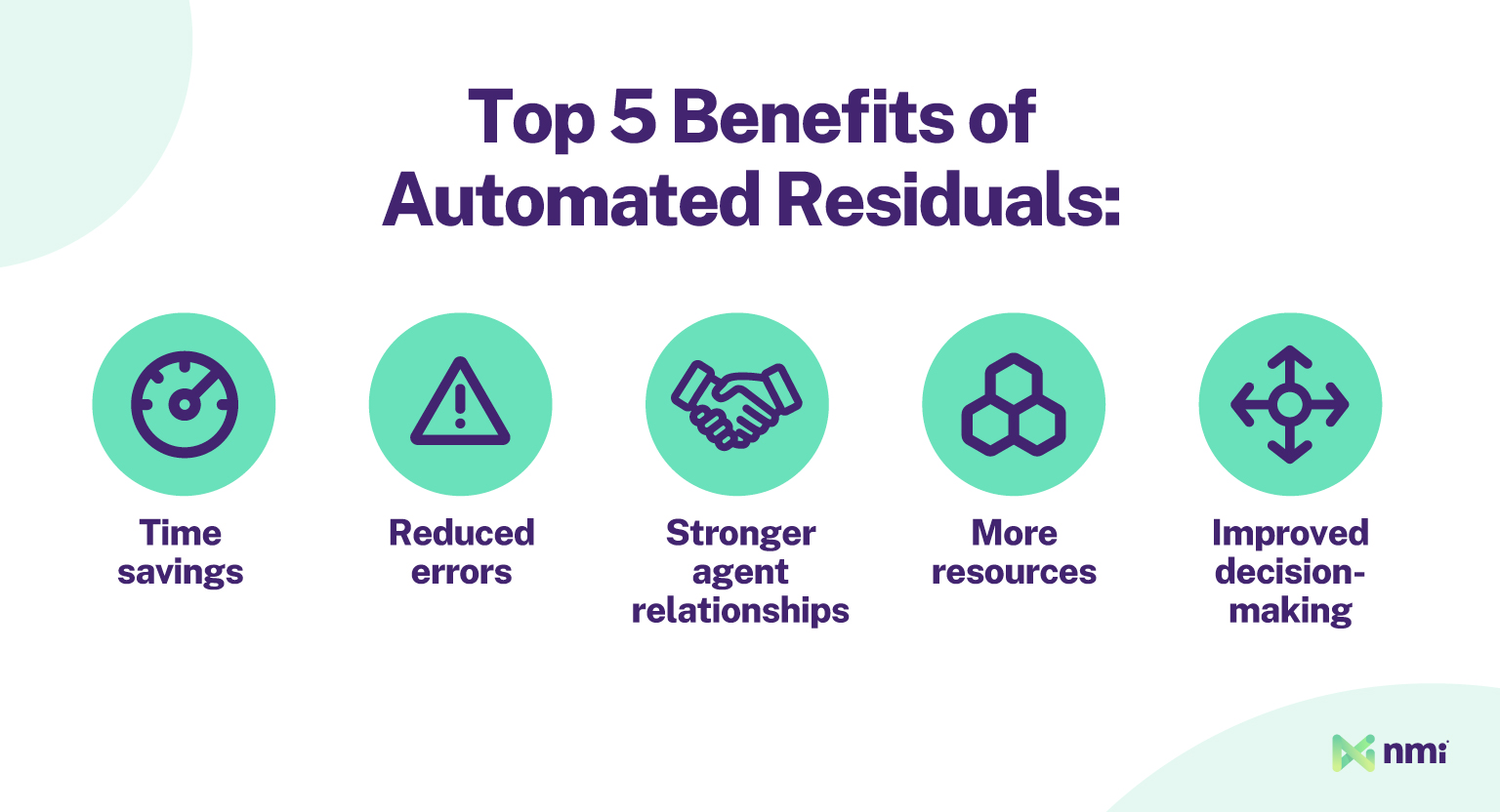

Automated residuals eliminate most, if not all, of that work and make the process frictionless and scalable. Let’s look at some of the main ways automated residuals can benefit you, including:

- Saving time by automatically centralizing your data

- Reducing errors and headaches associated with manual calculation

- Strengthening your relationship with agents through faster payouts

- Freeing up resources to help drive growth

- Improving decision-making through better business intelligence

Automatically Consolidating Processor Reports Is a Huge Time-Saver

If you’re like most payment professionals, you work with multiple processors in order to serve the widest possible client base. Each of those processors provides a residuals report, but there is little to no standardization across the industry. That means file formats, data details, naming conventions, table structures and layout all vary wildly, making life unnecessarily difficult.

To get your monthly data to a point where it’s usable for payout calculations and reporting, you have to spend hours trying to pull information from each report and bring it all together in a way that makes sense; a messy, frustrating and outdated process.

Automated residuals platforms solve this problem by taking the monthly reports from all your processors and automatically combining them into a single, centralized reporting dashboard. You can begin using your residuals data right away, instead of spending hours on preparation. Just upload the files and the data is consolidated in seconds.

Centralizing your residuals data in one place is a powerful way to drive efficiency. It’s also the foundation for other key benefits of automation like accurate calculations, streamlined reporting and fewer manual tasks.

Eliminating Manual Calculations Reduces Time, Errors, Headaches and Risk

Residuals are complex. You’re not just dealing with multiple payment processors — you’re also managing multiple agents and stakeholders tied to each merchant account, each with their own unique split. Figuring out who gets paid what can quickly become a nightmare, and there’s no room for error. When you’re handling dozens, hundreds, or even thousands of accounts, the downsides of manual calculations become impossible to ignore.

Manually calculating splits can take forever, and it opens the door to human error. When mistakes happen, someone ends up getting paid the wrong amount, which can hurt profitability and strain relationships. Errors also have to be corrected, creating even more rework and lost time.

With automated calculations, the stakeholder splits for each merchant account are programmed directly into the system. When you upload your residuals reports, the calculations are performed instantaneously and automatically, providing you with exact split data. The base split is applied, and, if an agent hits a bonus threshold or other complex parameters are met, it’s all taken care of. All you have to do is open the application and pull the report.

The accuracy and consistency of automated residual calculations also make compliance easier. If a processor performs an audit or if a merchant or agent challenges a payout, you can be certain your numbers were correct and easily pull the historical residuals data to prove it.

Faster Payouts Strengthen Agent Relationships

Your agents’ share of the residuals is what keeps their businesses running. And, like any small business, the faster they get paid, the healthier their cash flow is and the better they’re able to handle emergencies, plan for the future and pay their bills. That makes fast, reliable payout an extremely important part of maintaining a healthy relationship with your sales team.

Automated residuals speed up the split payout process. Because data is pulled in automatically and calculations are run instantly, you can finalize payout numbers days or even weeks earlier than you could with manual residuals processing. With certain platforms, you can even schedule ACH payouts directly through the system.

Automated residuals also make it possible to offer more flexible payout schedules. Rather than paying out once a month, you can pay your agents biweekly or weekly, as long as your processors provide you access to more frequent residuals reports.

The ability to pay agents more accurately, quickly and even more frequently is a significant recruiting advantage over competitors that still handle residuals the old way. In a space as competitive as payments, being able to attract and keep the best agents can be a major factor in your long-term success.

Automation Frees Up Resources for Growth

In smaller payment companies, senior management often calculate and manage residuals. But time spent wrangling CSV files and applying manual calculations is time not spent on the things you need your senior staff to be focused on — things like leading teams, setting strategy, developing tactics and driving growth.

Automating your residuals frees your management team from one of the most repetitive, inefficient and time-consuming tasks they currently deal with. That allows them to focus more time and effort on mission-critical tasks. Companies that reduce operational friction and make the most of their people are better positioned to grow — and keep growing.

Better Data Visibility Improves Forecasting and Decision-Making

With more of your management team’s time freed up, automated residuals can also help them make better decisions through improved data visibility. Automated residuals platforms offer the most accurate information on your profitability, your portfolio’s makeup and your merchants’ performance through easy-to-use reporting dashboards. That makes it fast and easy to pull reports and find the information you need to analyze trends, make forecasts and understand your business better.

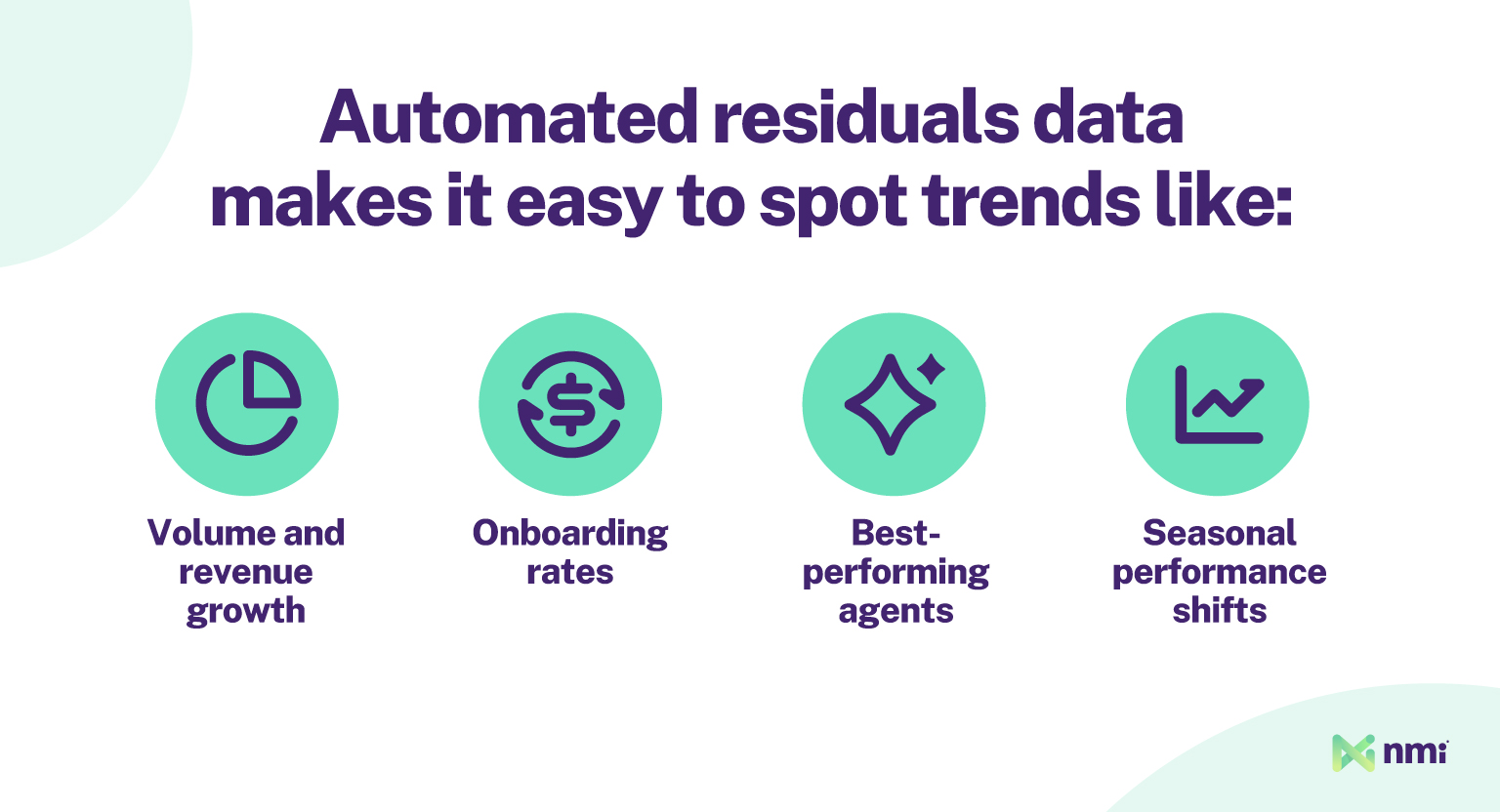

Automated residuals data makes it easier to spot patterns and trends like:

- How your volume and revenue are growing over time

- How onboarding rates translate into future earnings

- Which agents are driving the most volume and highest margins

- Seasonal shifts in your portfolio’s residual performance

Quick, easy access to deep insights helps your leadership team plan more effectively and spot opportunities for small improvements that drive meaningful growth over time.

Modernize the Way You Manage Residuals

Residuals are the lifeblood of payments, and managing them well is key to long-term success. But the old, manual ways of handling residuals are inefficient, time-consuming and costly.

Automation through a platform like NMI Merchant Central brings your residuals management to the cutting edge of payments technology, saving you time, money and headaches, and putting your company in a better position to grow and thrive in a rapidly changing industry.

Merchant Central offers a complete residuals management suite that eliminates manual processes, complexity and human error. Residuals from your processing partners are automatically combined, payouts are instantaneously calculated down to the penny and all the information you need is provided through the clearest, most intuitive reporting dashboard available.

To find out more about how NMI Merchant Central can turn residuals management from a necessary burden into a source of competitive advantage, reach out to a member of our team today.