Value-added services are vital to any independent sales organization (ISO) or independent software vendor (ISV) that manages merchant accounts. They allow you to deliver new features, tailor solutions to specific customer needs and build stronger, stickier merchant relationships. Value-added services also enable businesses to unlock more profits by increasing monthly recurring revenue with subscription-based software-as-a-service (SaaS) solutions.

However, while value-added services are essential to long-term growth, it can be difficult to determine which services to offer – and even more challenging to deploy them to all your customers. Thankfully, Mass Enablement allows businesses to overcome these challenges. But what is Mass Enablement, and how do you use it to enhance your merchant management?

What is Mass Enablement?

Mass Enablement allows you to offer a wide selection of value-added services to individuals or groups of merchants with the touch of a button. With Mass Enablement you can browse value-added services from a portal and choose which to offer your customers as easily as selecting apps from an app store.

Once you’ve decided which services to offer, your customers can try them during a risk-free trial. Offering free trials is an excellent way to let your customers experience new services first-hand before making a financial commitment. Afterward, merchants can choose whether to keep paying for the service or decline it.

Mass Enablement makes it easy to showcase value-added services, raise awareness around your business’ unique offerings and transition customers to a subscription service model.

Which Value-Added Services Can You Offer?

Mass Enablement for payments focuses on services that increase efficiency and security. With Mass Enablement from NMI, you can offer clients various value-added services designed to enhance customer experiences at the point of sale. They include:

Automatic Card Updater

This service automatically updates card data stored for recurring billing or online payments. It uses information from card issuers to ensure payment information is always up to date. With this service, merchants can minimize the number of declined transactions that result from outdated payment data, and consumers can enjoy a more streamlined shopping experience.

Customer Vault

Merchants can use NMI’s Customer Vault to store unique data tokens that enable repeat transactions. With tokenization and off-site data storage, merchants won’t need to house payment data on servers or worry about security. In addition, customers won’t need to reenter their information at checkout. This service allows merchants to meet consumer expectations for convenient, personalized service.

Kount® Advanced Fraud Protection

NMI’s partnership with Kount equips merchants with industry-leading fraud protection. This service gives merchants access to a global risk database, merchant-determined risk thresholds and AI-powered fraud screenings to provide real-time analysis and fraud assessments for card-not-present transactions.

Enhanced Data (Level II/III) Processing

B2B and B2G merchants can reduce payment fees with Level II and III processing. This service provides the enhanced data necessary to process qualified card-not-present transactions at a high level.

Fraud Protection (iSpyFraud)

NMI’s proprietary fraud-prevention solution is a rules-based tool that enables the merchants you manage to screen transactions for suspicious activity, identify threats and reduce losses from fraud.

Electronic Invoicing

Help your clients replace paper invoicing with a sustainable electronic option. This service enables them to create an electronic invoice, email it to customers and accept payments online. Because it’s faster and less labor-intensive than traditional processes, your team will have more time to focus on customers.

Encrypted Devices

Encrypted Devices are crucial to maintaining security. With this, merchants can easily choose between Swipe POS software, Customer-Present Cloud or custom apps for advanced payment data encryption.

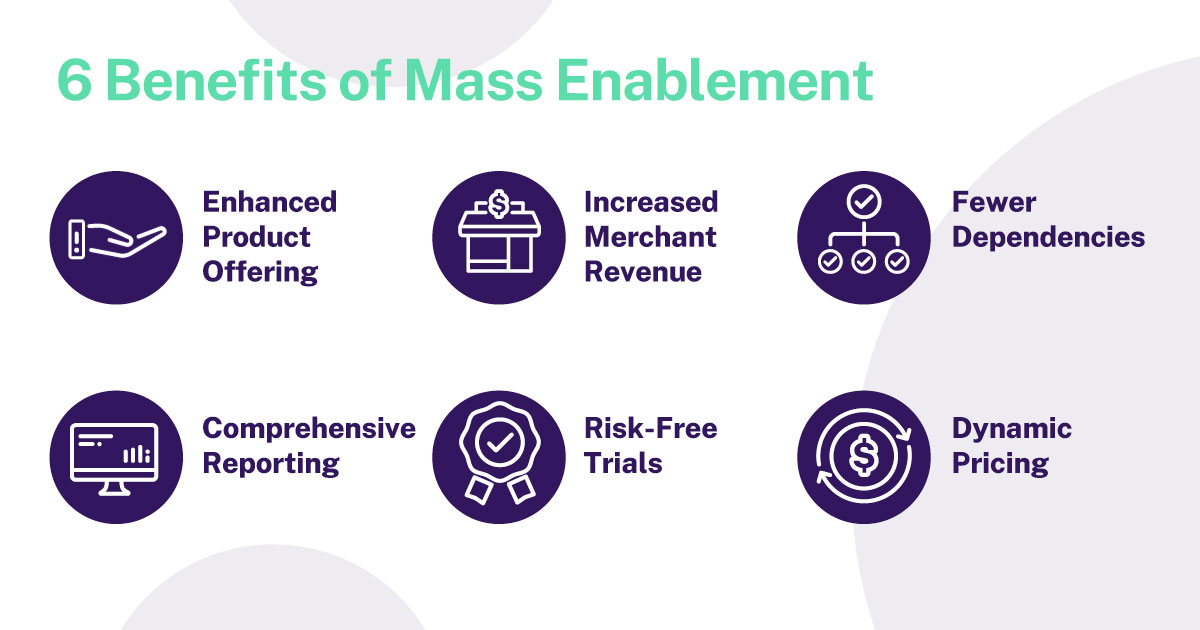

The Top 6 Benefits of Mass Enablement

Offering value-added services from a payments partner frees you from the headache of researching solutions independently, establishing new partnerships or manually programming features to work alongside your tech stack. Although other payments companies may offer access to one-off value-added services, Mass Enablement allows you to incorporate unique offerings into your long-term strategy while improving merchant management.

With Mass Enablement, ISOs and ISVs can:

- Enhance Product Offerings

By integrating with your payments partner’s platform, you can offer your clients a wide range of services (and the flexibility to try them risk-free). Mass Enablement allows you to differentiate your business from other ISOs and ISVs by offering unique solutions that meet your clients’ needs. Over time, this will improve merchant loyalty and reduce churn. - Increase Revenue for Your Business and Merchants

With Mass Enablement, you can deliver value-added services through a SaaS model. This provides more opportunities to build recurring revenue and allows the merchants you manage to see a higher return on investment (ROI) from services like advanced fraud prevention, electronic invoicing and automatic card updaters. - Decrease Dependency on Your Partner’s Team

Mass Enablement is designed to give you autonomy; you can access the suite of available services from your portal and offer them to your clients without needing support from your payments partner. Decreased dependency will make your business more flexible and less prone to disruption. - Generate Comprehensive Reporting

Mass Enablement makes merchant management easy for ISOs and ISVs with the ability to generate comprehensive reports in near real-time. This feature provides visibility into which services you have enabled for each account and which merchants may need more support. - Offer Risk-Free Trials

You can build long-term customer confidence and buy-in by enabling free trials for merchants or groups of merchants. At the end of the trial, seamlessly convert merchants and begin charging for services. - Set Pricing

You control pricing for value-added services. Mass Enablement allows you to set pricing dynamically, so you can maximize margins while offering competitively-priced solutions.

Bring Value to the Masses

Keeping up with demand for new features (and staying one step ahead of fraudsters) is becoming more of a challenge for ISOs and ISVs who manage merchant accounts. With Mass Enablement, you can expand your offering with just a few clicks and let your clients try services risk-free. It’s a win-win for everyone – solution providers and their customers.

Contact a member of our team to learn more about Mass Enablement from NMI and how it can help you effortlessly expand the number of solutions available to your merchants.