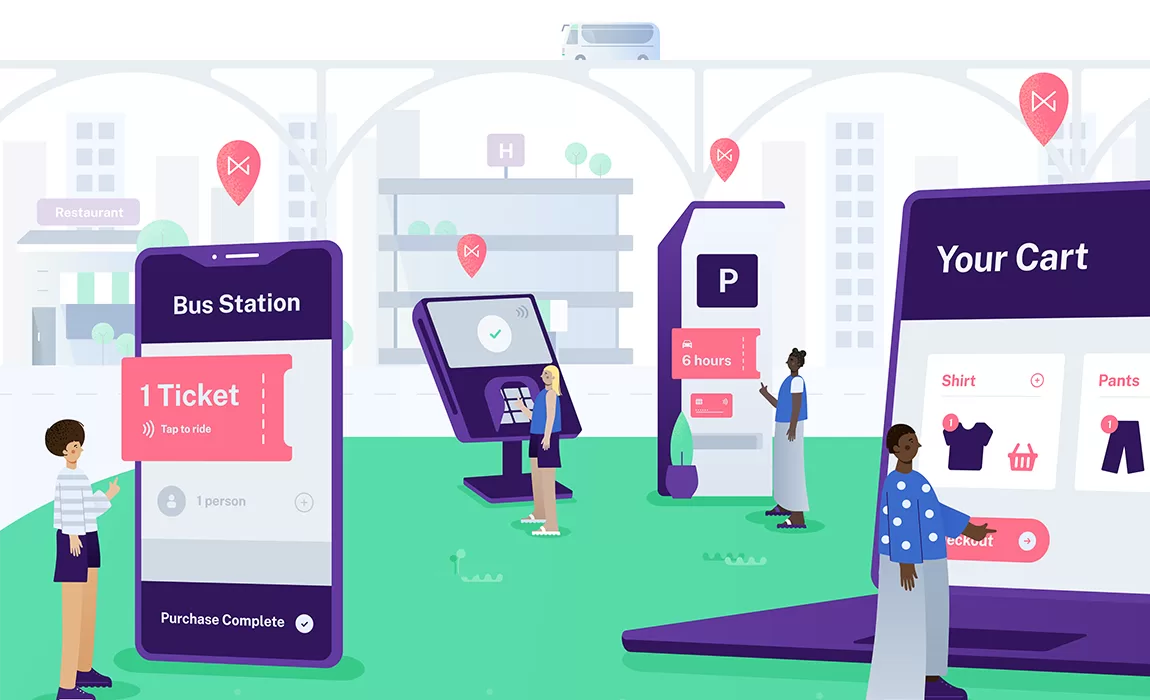

Payment innovations are driven by the need to provide consumers the most seamless payments experience possible. From buy now, pay later (BNPL) to biometrics and contactless, the payments landscape is constantly evolving — and it can be difficult for merchants, technology providers and financial institutions to know which tools resonate most with consumers.

To take the pulse of consumer payment preferences and experiences, NMI surveyed 1,000 U.S. consumers in October 2022. We asked consumers what they really value in their payment experiences and analyzed the latest payment tools and methods. We also asked consumers about their willingness to try new payment innovations, and the results were clear: A majority of consumers are willing — and eager — to try emerging payment technologies.

Over two-thirds (69%) of consumers say they’re excited to try new payment technologies or capabilities with their current payments tool (e.g., tap-to-pay capability with a credit card)

But consumers are discerning, and they need critical education and guidance from trusted payments authorities before they’ll consider adopting new payment methods. Read on for the key findings from our Payments Innovation Pulse Report — and our top takeaways for businesses looking to stay competitive, gain market share and exceed customer expectations in a variable payments terrain.

Consumers value speed and convenience in their payments tools — and they’re eager to try new technologies

Convenience and speed are the primary drivers behind consumer payment preferences. The majority of consumers (84%) cite convenience as the No. 1 reason why they use their preferred payment methods, and just under half (49%) use these methods because they’re the fastest.

Top 5: Drivers of consumer payment preferences

-

These payment methods are the most convenient for me: 84%

-

These payment methods are the fastest of the choices available to me: 49%

-

I understand these payment methods best of the choices available to me: 37%

-

These payment methods are the safest from a fraud/theft standpoint: 20%

-

These payment methods are the safest from a health/cleanliness standpoint: 17%

Furthermore, over two-thirds (69%) of consumers agree that they’re “always excited to try out new payment technologies or capabilities.” Younger consumers are even more likely to report eagerness: 83% of consumers ages 18-24 and 87% of consumers ages 25-40 agree or strongly agree.

Though consumers are enthusiastic about payment innovations, their transition to regularly using new technology is ongoing. While speed and convenience are overwhelmingly the most important factors in driving payment preferences, around a third of respondents (37%) also say they use their chosen payment methods because they understand them best of the choices available.

The takeaway: In 2022, speed and convenience largely dictate consumer payment preferences. Younger consumers in particular are eager to try new offerings that offer these benefits — and demand will only increase as familiarity with new payment technology grows. Merchants and payment technology partners must meet consumer enthusiasm with technology that enables frictionless, end-to-end payment experiences.

Many consumers have tried payment innovations and contactless is experiencing the most growth

To gauge use cases and familiarity with new payment technologies, we analyzed consumer experiences with three payment innovations: contactless payments, BNPL and biometric payments.

Contactless payment usage is on a continued rise in the U.S.. In a 2020 poll by NMI, only 22% of consumers said contactless credit/debit cards or mobile payments were their preferred in-store payment method. But this year, more than two-thirds (69%) of consumers said they have made in-person purchases using contactless payment technology in the past six months, and only 5% of consumers aren’t familiar with it. The numbers are even stronger for younger consumers. Respondents ages 18-24 and 25-40 are the most likely to use contactless payments, at 79% and 82%, respectively.

BNPL also has a high level of consumer familiarity, but a lower rate of adoption than contactless. Almost all respondents (96%) have heard of the financing option, yet only 54% of consumers have made a purchase using it. Among the 46% of consumers who haven’t used BNPL, almost half (44%) say it’s because they don’t feel the need to pay for purchases in installments. This is the No. 1 reason for not using BNPL. The No. 2 reason (14%) is that they’re worried about going into too much debt.

Compared to BNPL and contactless, biometric payments has the lowest rate of consumer usage. Despite the vast majority of consumers (91%) reporting familiarity with biometric payment technology, only 36% of consumers have used it to make a purchase. However, there’s still significant potential for growth — whether it’s by convincing consumers of biometric’s benefits or raising awareness among those who haven’t heard of the technology. Among those respondents who said they were unfamiliar with biometric payments, nearly half (47%) say they’d likely use the technology if a business offered it.

The takeaway: Consumers’ excitement to try new payment technologies is driving significant growth for options like contactless. But when it comes to other, newer technologies, some consumers may not know what they’re missing in terms of speed, convenience, security and other benefits of advanced payments solutions. To ensure speedy adoption of these new technologies, their value must be clarified by trusted payment authorities. But who do consumers look to for this type of information?

Comprehensive consumer education and guidance is key to payments adoption

Financial institutions and card issuers play a critical role in new payment technology adoption. Just under half (46%) of consumers find out about new payment technologies or capabilities with their current payments tool from their bank or financial institution. A significant chunk (38%) learn about new technologies or capabilities from their credit or debit card issuer, and 36% learn about them through word of mouth. Social media also plays a significant role.

Top 5: How consumers typically find out about new payment technologies or new capabilities with their current payments tool (e.g., tap-to-pay capability with a credit card)

-

From my bank or financial institution: 46%

-

From my credit/debit card issuer: 38%

-

Word of mouth: 36%

-

Social media: 35%

-

From retailers or merchants: 30%

Further, two-thirds (66%) of consumers want their financial institution or card issuer to inform them about new payment technologies or capabilities with their current payment tools. In the same vein, nearly half (46%) of consumers point to educational materials provided by their financial institution as the No. 1 driver that would convince them to try new payment technologies or capabilities. Social media (34%), user testimonials and peer recommendations are also significant contributors (tied at 32%).

The takeaway: Consumers are eager to try payment innovations, but they’re also discerning. They look to trusted payment authorities — namely banks, financial institutions and card issuers — to lead the way in the integration of new payments tools. These organizations hold the key to driving new technology adoption and influencing consumer payments sentiment. Consistently upleveling payment experiences with innovative technologies is also key to retaining customers — and goes a long way toward remaining competitive in a crowded payments marketplace.

Consumers expect seamless payment journeys. Are you prepared to deliver?

Contact us today to learn more.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.