The recurring nature of subscription payments makes them more complex than one-time transactions. While subscriptions are convenient for consumers, they can be a headache for payment and software providers—especially if they don’t follow best practices.

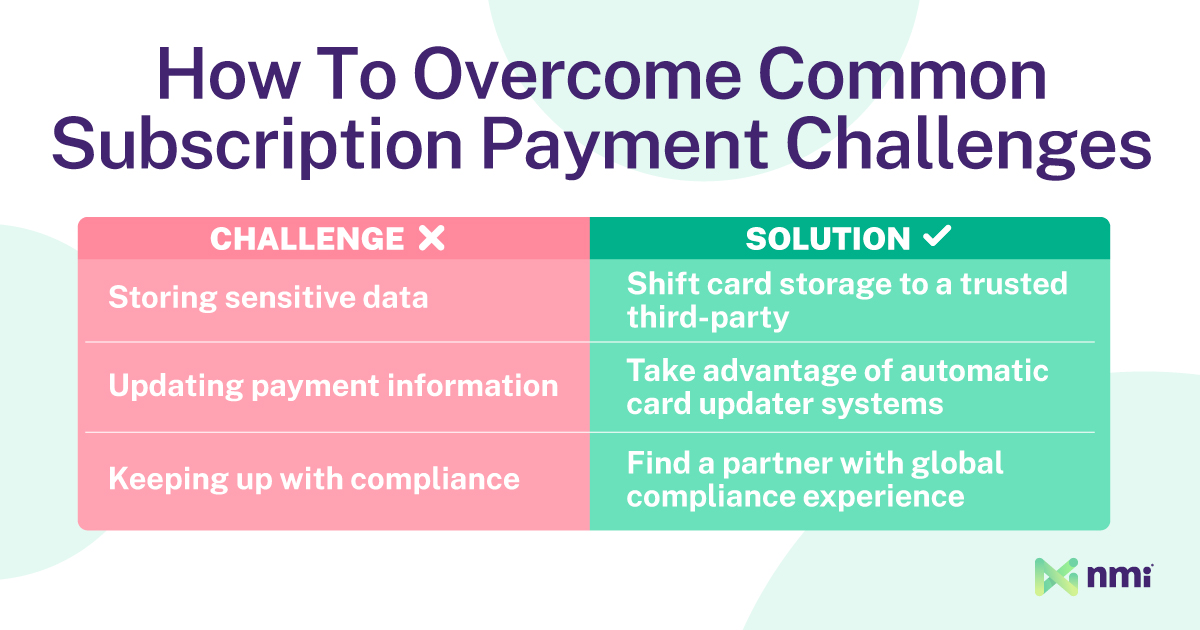

Common challenges include securing stored payment data, managing expiring credit cards and evolving with the regulatory environment.

Below, we break down the subscription payment challenges independent sales organizations (ISOs), payment facilitators (PayFacs) and independent software vendors (ISVs) face when adopting subscription payments and how to overcome them so you can turn this model into a winning strategy.

Customer Payment Data Security

The Challenge: Storing Sensitive Data

Subscriptions involve storing sensitive payment data for future billing. To the average consumer, putting a card on file for a subscription is standard. For the merchant, this is a huge responsibility.

Storing payment data makes merchants vulnerable to cyberattacks and data breaches—a huge risk that costs victims $4.45 million on average. To combat that risk, the Payment Card Industry Data Security Standard (PCI DSS) puts higher standards in place for card-storing merchants. Failure to meet those standards can result in additional liability and hefty fines.

The Solution: Shift Card Storage to a Trusted Third Party

Card data has to be stored to make subscriptions practical, but the merchant doesn’t have to be the one storing it (and neither do you). Secure, third-party card storage systems like NMI’s Customer Vault house sensitive payment data on a server owned by the payment provider rather than the merchant.

Instead of holding the card data, the merchant receives a token for each customer’s payment information. The tokens themselves do not contain payment information, so even if the merchant is hacked and tokens are stolen, criminals can’t use them to access the associated card data. That additional encryption, combined with the fact the card data is stored and secured offsite, insulates the merchant (and their payment provider) from the risks and costs associated with data breaches.

Payment Failures

The Challenge: Updating Payment Information

Subscription providers are also challenged with keeping payment information up to date. Many subscribers set and forget their payments—the passive nature of subscriptions is part of the appeal. However, credit cards expire, and an expired card can’t be automatically billed. That leaves merchants scrambling to alert subscribers with expiring cards.

Some customers use expiring cards to end old subscriptions. Others would happily continue paying but don’t realize their on-file payment method is about to expire. In either case, merchants risk losing revenue.

The Solution: Activate an Automatic Card Updater

The good news is that all the major card networks offer automatic updating services. With Visa Account Updater, Mastercard Automatic Billing Updater, American Express Card Refresher and others, subscription merchants won’t experience cancellations due to expired cards declining. These services aren’t available to merchants directly, but third parties, like payment processors, can sell to merchants.

For instance, NMI’s Automatic Card Updater is a processor-agnostic system that checks for changes to card numbers, expiration dates and CVVs each month and automatically makes any necessary changes. No action from the merchant or customer is required, making it the easiest way to keep subscriptions moving. This simultaneously maximizes revenue and improves the customer experience.

Regulatory Compliance

The Challenge: Keeping Up With Compliance

Subscriptions depend on recurring payments. However, this comes with additional rules and compliance requirements from global governments and card networks. Authorizing a recurring payment represents an extension of trust from the customer to the merchant or software vendor. Unfortunately, that trust is sometimes abused.

Recurring billing regulations exist to protect consumers from potentially abusive billing practices—especially ones that happen without the consumers’ knowledge. Merchants and software vendors accepting recurring payments must ensure they meet regulatory requirements surrounding how free trials convert into paid memberships, how terms are disclosed, how cancelations are processed and more—for every region they sell to.

The Solution: Centralize Recurring Billing With a World-Class Partner

The easiest way to ensure subscription payments abide by regulations is to process them through a payments partner with a global presence. This shifts some of the burden of keeping up with new regulations—like the proposed 2023 FTC rule on cancellations—from the merchant to the provider.

Subscription-payments-as-a-service insulates merchants from a complex regulatory environment similar to how third-party data storage insulates them from cybercrime risk.

How To Make Subscriptions Lucrative for Your Business

Now that you understand how to overcome common challenges, it’s time to get started. But where should you begin? Below, we’ve outlined a few steps to help you establish a solid foothold in the subscription market:

- Assess Your Business Needs: The first step is determining whether subscription payments will benefit your business. If you are an ISO or Payfac, do subscription payments make sense for your merchants? If you are a software vendor, will business users benefit from offering subscription payment options to their customers? If the answer is yes, the next step is to create a business plan outlining how your organization will approach subscription payments and the steps needed to enhance your infrastructure.

- Decide Which Subscription Model(s) Work Best: Next, decide which subscription model(s) will work best for your customers. Do you want to offer recurring flat rate payments? Tiered pricing? Or a blend? Once you have an answer, determine whether your tech stack can support subscription payments and what system changes you may need to make before adopting this payment model.

- Find a Reliable Payments Partner: Building the infrastructure to support subscription payments and meet evolving compliance regulations is a hassle. Instead, find a reliable payment provider that specializes in subscription payment processing. This partner should support various payment types, offer customizable billing cycles and provide world-class security. They should also provide APIs for easy implementation and work with your team to ensure your subscription payments work well for end-users.

Subscription payments can be complex—especially if you partner with multiple third-party vendors for payment processing, security, compliance and implementation.

Instead, the simplest way to make this model work for you is by partnering with a single, full-service provider.

At NMI, we offer a fully modular platform that equips payment providers with everything they need to provide elevated merchant services to their customers—including subscription enablement.

Our subscription-friendly payment gateway seamlessly integrates with over 200 processors and meets rigorous security standards, including PCI-DSS Level 1 (the highest level of PCI compliance). Our solution is also compatible with the most popular ecommerce sites and subscription platforms. With our marketplace of value-added services and in-depth reporting, you can make subscription payments a breeze for your customers.

With over two decades of experience in all aspects of digital payments, including subscription and recurring payment regulations, we’re here to help you succeed. To learn more about how NMI can help you provide your merchants with everything they need to thrive in the subscription economy, reach out to a member of our team.