From grocery store checkouts and public parking lots to gas pumps, vending machines and buses, unattended payments are quickly becoming the norm in a variety of applications that don’t require human interaction. In every case, the ability to pay quickly with a tap takes a slow, inconvenient process and makes it fast and easy.

In 2021, the unattended payments market was worth roughly $40 billion USD. According to American Express, that number is set to hit $100 billion by 2025. The driving forces behind that rapid growth are clear: consumers and merchants love unattended payments.

Customers love the speed and convenience of the unattended option – only one in four prefers to checkout with a cashier. Businesses love it because it lowers operating costs, makes sales faster and improves traffic capacity.

Like digital payments as a whole, unattended payments represent the valuable (and somewhat rare) intersection where a merchant’s preferences and the preferences of its customers perfectly align. As a result, there is no question that unattended payments will continue to grow into the second half of the decade and beyond.

But, how can merchants best adopt this payment method to meet consumer expectations and unlock its benefits? And how can independent sales organizations (ISOs), independent software vendors (ISVs) and payment facilitators (PayFacs) take advantage of the opportunity to support that increasingly rapid adoption?

What are Unattended Payments?

Unattended payments are any checkout system that replaces a cashier with a self-service terminal or kiosk. Unattended solutions can be as simple as a contactless terminal on a vending machine or as complex as enabling tap payments on an entire metropolitan transit network. They can be blended with traditional checkouts to give customers more options or used store-wide. Amazon Go grocery stores, for instance, can operate with only three to ten employees.

Regardless of size or complexity, unattended commerce technology takes the place of cashiers. Customers can easily handle the checkout process on their own. The unattended digital payment process itself is the same as making a traditional card-present payment on a terminal. So, whether they’re using a physical card or a mobile solution like Apple Pay, customers already have the right payment habits well-established.

The question for merchants, then, is whether the rest of the checkout process is easy enough for unattended payments to decrease friction rather than increase it.

For instance, a one-step process like tapping onto a bus couldn’t be more straightforward. As a result, “open-loop” transit payments are exploding in popularity with riders and providers alike. On the other hand, purchasing a car is not something most consumers could or would do without human interaction, as evidenced by the faltering Carvana and its giant (and increasingly empty) car vending machines.

Why Do Customers Prefer Unattended Payments?

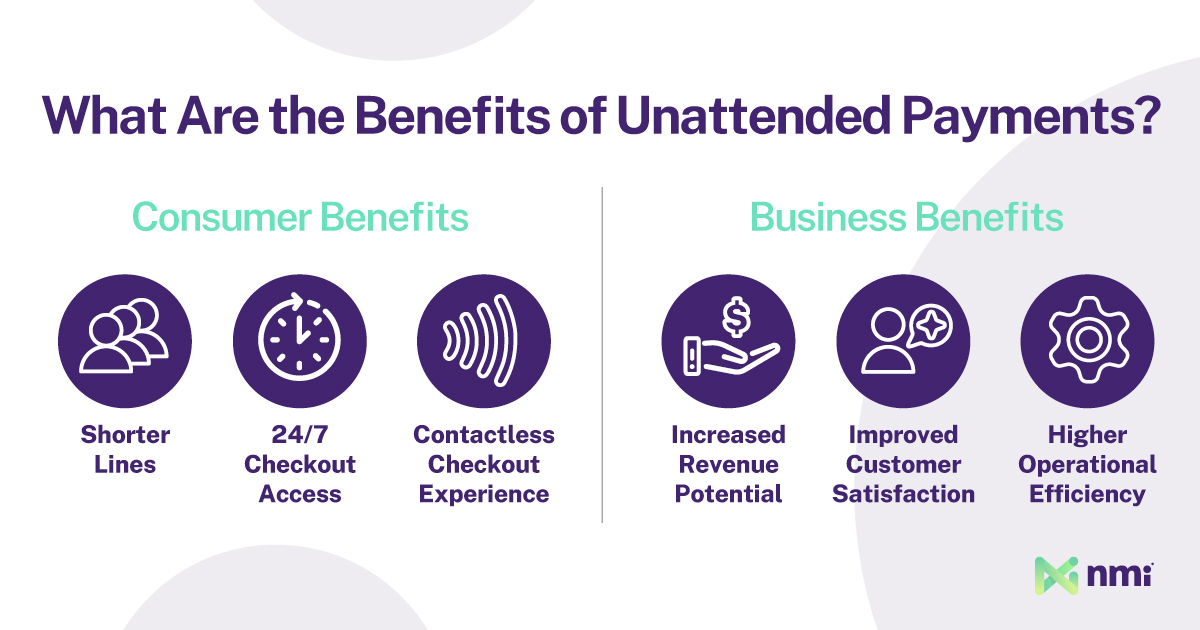

On the customer side, the benefits of unattended payments are all about speed and convenience. Just some of the upsides unattended systems offer over traditional checkouts include:

- Shorter Lines: Every shopper has experienced an understaffed checkout area and the long lines that come with it. Unattended solutions provide customers with an alternate option, enabling them to bypass the checkout line altogether. That speeds up the process for everyone involved and significantly improves the shopping experience, especially for customers just buying a few items.

- 24/7 Checkout Access: Unattended payments make it easy for customers to pay at any hour of the day, any time of the week. That’s particularly beneficial for consumers who work night shifts or odd hours and need to access things like parking and transit (or even snacks) at times when there is rarely someone there to help them.

- Contactless Checkout Experience: in the post-pandemic world, shoppers still prefer to minimize contact as much as possible. Unattended payments give customers control over their shopping experience and the flexibility to choose how much or how little interaction they have with employees.

How Can Businesses Benefit from Offering Unattended Payments?

Unattended payment systems are some of the most scalable, efficient and cost-effective ways to accept payments. As a result, they offer even more benefits to merchants than they do to consumers. Just some of those benefits include:

- Increased Revenue Potential: Unattended payments enable merchants to reach more customers, expand capacity and increase revenue potential. Removing the need for cashiers enables merchants to sell outside regular business hours (even 24/7) without the need to add staff. They also reduce the time a customer takes to complete a purchase. Timeliness is a key metric in businesses like restaurants, where getting customers in and out faster is a significant revenue driver.

- Improved Customer Satisfaction: Choice is a big part of the overall customer experience, and consumers appreciate the option to check themselves out. Whether getting out of a parking garage faster or skipping the line in a retail setting, customers who can depend on the fast, efficient payment experience of their choice are more likely to return. Over time, this reduces churn and increases customer lifetime value.

- Operational Efficiency: Unattended payment systems don’t require cashiers, meaning businesses can increase capacity while reducing labor costs. This makes unattended payments highly scalable. Unattended solutions require minimal training, scheduling and logistics. That means a new unattended checkout is ready to go as soon as it’s installed.

Offering merchants the ability to scale alongside demand quickly and cost-effectively makes unattended payments an ideal growth solution (and an excellent source of revenue for payment providers).

Where are the Opportunities in Unattended Payments?

Unattended payments are convenient and easily scalable, making them a prime candidate for wide-scale adoption. Today, several niches offer the most value to ISOs, ISVs and PayFacs selling unattended solutions. The most prominent include parking, vending, EV charging and self-serve retail.

Unattended Parking Payments

Unattended, self-service payment kiosks are commonplace in both above-ground and covered lots. Although finding parking lots still operating on manned toll-booth style entry and exit systems is difficult, they still exist – especially in markets slow to adopt modern payment technologies.

Because so many regions (and cities) have yet to update their parking solutions, new payment providers have plenty of opportunity to compete and carve out market share in the parking payments industry. The key is offering better service and support. Providers must also ensure a frictionless integration with operators’ existing unattended kiosk hardware to ensure minimal business interruption during a switchover to new processing services.

Unattended Vending Payments

There are almost 5 million vending machines in the United States. Consumers make the majority of their vending machine payments digitally, without cash. With over $10 billion in revenue in the U.S. alone, the vending industry represents a massive opportunity for payment providers looking to increase their unattended portfolio.

As with garages, most vending machines are already equipped with card readers, which limits the hardware sales opportunity. But with the market growing steadily every year, the transaction fee potential of vending is significant.

Unattended Electric Vehicle (EV) Charging

The EV charging station market is expected to hit nearly $20 billion by 2024. And unlike gas stations, which require large capital investments and highly specialized sites, providers can deploy EV chargers almost anywhere.

The vast network of EV charger locations dotting the United States includes traditional fuel stations, city streets, community centers, remote rest stops and more. The ability to put a commercial EV charger anywhere with a strong grid connection means that, as EVs proliferate, opportunities will abound for smaller merchants to seize market share.

Many charge point operators (CPOs) are also having the foresight to equip their electric vehicle charge points with contactless credit card readers rather than relying on mobile phone or account-based payments. The benefit for drivers is that they can simply tap their card and charge, rather than having to download an app and register before use, which can be frustrating and time-consuming.

For payment providers, now is the time to get a foothold to ensure a strong presence as more merchants enter the EV charging market.

Unattended Self-Service Retail

40% of grocery checkouts are now unattended, and many retail stores are moving towards contactless self-checkout options. The success of Amazon Go locations in cities like New York and the popularity of Uniqlo’s RFID retail technology has demonstrated the consumer desire for unattended retail solutions in traditional shopping environments.

With the speed and convenience unattended solutions bring to the market, this option will likely become the norm in various retail niches over the next decade. The inevitable popularity of unattended solutions in the space makes self-service retail an opportunity payment providers can’t afford to ignore.

How ISOs, ISVs and PayFacs Can Start Selling Unattended Payment Solutions

There has never been a better time for payment providers to gain a foothold in the unattended payments market. Unattended payments are a proven success; they represent significant opportunities with minimal risk.

However, unattended payments are still a “niche” solution. To compete effectively, providers must position themselves as experts with deep knowledge of complex regulatory and security factors, the newest technologies, the best processing options and the best support. Unfortunately, getting to that point can be complicated and time-consuming.

Instead of trying to break into the unattended market alone, working with an established partner will allow you to access everything you need to sell unattended payment solutions to merchants with fewer resources.

At NMI, we offer a full suite of unattended payment solutions, including processing and hardware for applications such as vending, kiosks, parking, self-serve retail, transportation and more.

With over 200+ processing partners, NMI ensures merchants have the widest choice of banks possible. We also offer simplified compliance with PCI P2P2 validated hardware, frictionless on-site integration and best-in-industry support, making the process of getting new merchants onboarded to your solution as easy as possible.

To learn more about how your company can partner with NMI to provide unattended solutions to your customers, reach out to a member of our team today.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.