Text-to-Pay Mobile Payments

Faster and Simpler

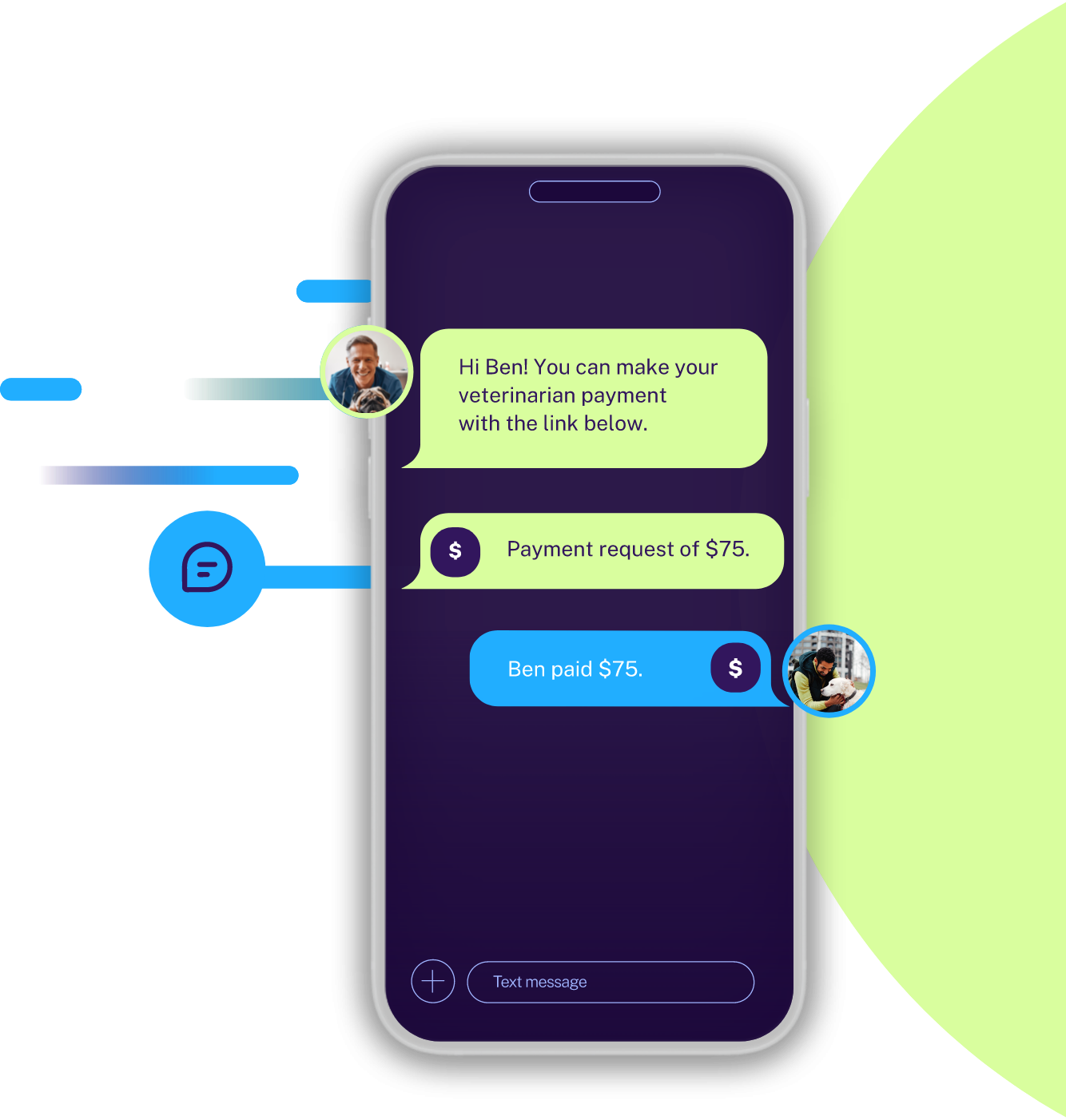

Payments Via Text Message

Nearly all of your merchants’ customers carry smartphones in their pockets. That means they are nearly always accessible and text messaging is a familiar, low-barrier communication channel. By integrating payment capabilities into texting, a whole new world of possibilities opens up for seamless customer interactions.

Our conversational Text-to-Pay commerce platform delivers speed, convenience, simplicity, and security for both merchants and their customers—enabling seamless payments, card captures, and quick approvals.

It’s a simple solution that elegantly solves

multiple, complex payments issues, such as:

Invoices sent via email have a

low, slow open rateEmail is not PCI-DSS compliant, so it poses

greater security risksMerchants struggle to contact

customers and receive payments

quickly

The Business Power of Text Messaging

Putting the Phones to Work

for Your Merchants

Your Gateway Experience

With our Text-to-Pay integration, merchants can initiate conversations, send invoices, receive payments, and issue receipts—all via text messages with their customers.

Your Merchant’s Experience

Today’s customers expect fast, simple, and secure payment experiences from their mobile devices. Our Text-to-Pay integration provides a convenient way for customers to pay bills or invoices from their mobile phones, through the text messages they receive from your merchants.

Data Security & PCI

Compliance

Text-to-Pay offers the highest level of Payment Card Industry Data Security Standard (PCI-DSS) compliance to keep customer data secure. The integration manages customer data, saving preferred payment methods and adding speed and security to any text-to-pay request. The app stores the merchant’s client’s payment information with Level One PCI security. Additionally, it manages compliance and regulatory requirements such as Nacha, TCPA, HIPAA, GDPR and CCPA.

How It Works

Text-to-Pay is the latest offering in NMI’s growing, diverse marketplace of value-added apps. Watch our product features highlight video to see everything it makes possible with your payments and what you can do with it.

Elegantly Solve Multiple,

Complex Payment Issues with a Text

ISO and Software

Vendor Benefits

- Increases speed-to-payment

- Creates a frictionless payment experience

- Eliminates PCI and data security risks

- Improves internal operations

- Keeps customer data safe

- Enables another payment channel

for your merchants with virtually no integration, no new apps and no new passwords

Merchant Benefits

- Opens another channel of payments for you

- Reaches customers wherever they are — no new apps or passwords

- Makes payments easy, speedy and efficient

- Empowers you to retain control of your whole payments process

- Keeps customer data safe