What Are Interchange Rates?

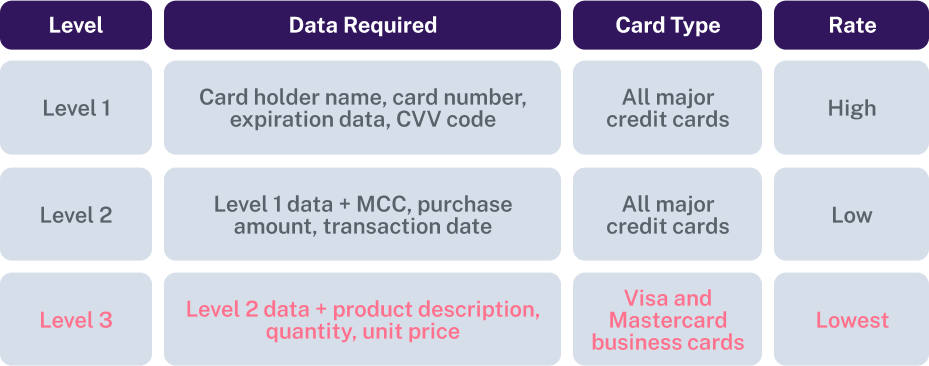

Level 1 , Level 2 and Level 3 interchange rates are different levels of data that merchants provide to credit card companies when processing a transaction. The more data a merchant gives, the lower the interchange rate will be.

Merchants who process a lot of business-to-business (B2B) or business-to-government (B2G) transactions can save money by using Level 3 interchange rates. This is because Level 3 data provides more information about the transaction, which helps credit card companies assess the fraud risk.

Cost Savings

By including detailed transaction information through Level III Advantage, businesses can qualify for lower interchange rates and reduce their processing expenses. This translates to increased profitability and improved bottom line.

Risk Mitigation

Level III Advantage empowers merchants to mitigate risks associated with credit card transactions. By complying with Level 2 and Level 3 data submission requirements, businesses enhance transaction security and reduce exposure to potential losses.

Competitive Advantage

Level III Advantage enables businesses to outperform competitors by securing optimized interchange rates. This competitive edge allows merchants to offer better pricing to customers, attract new business partners and meet the requirements of corporate buyers.

Automated Data Optimization for Lower Interchange Rates

No need to be a strictly B2B or B2G merchant to use Level III Advantage. If a Merchant does not qualify for Level 3, they would automatically transact at Level 2 interchange rates.

Personalize and Save Informational Data Templates

Set your own rules and save your templates to be used for other transactions.

Stop Being Overcharged

Cut Costs on Credit Card Processing Fees with Bin Lookup for Company Cards. Our gateway platform optimizes data fields set by benchmarking NMI data and your own merchant data from transactions. This allows us to provide instant access to Level 2 and Level 3 savings.

Improve the Customer Experience

Level III Advantage helps businesses improve the customer experience by providing customers with accurate, near real-time transaction insights. Better data helps build customer trust and loyalty.

Interchange Rates FAQ

Interchange rates are set by credit card companies such as Mastercard and Visa. These card companies typically publish updated interchange rates in April and October.

Visa and Mastercard each have unique data demands to qualify for Level 2 and Level 3 rates. With NMI, we automatically optimize this data so merchants can qualify for higher savings on each transaction.

B2B and B2G merchants have “tiers” or “levels,” referred to as Annual Account Spend. It’s a way of categorizing cards based on how much your customers spend each year. Remember, the more they spend on a business card, the higher the rates will be.

Drive Revenue and Reduce Attrition With NMI’s Value-Added Services

DISCOVER MORE MARKETPLACE APPSKount® Advanced Fraud Prevention

Kount utilizes a global database and AI-driven comprehensive fraud screening toolset to provide real-time risk analysis and fraud assessment for ecommerce and card-not-present transactions.

Learn More

Automatic Card Updater

Ensures uninterrupted payments for merchants by keeping data stored in the Customer Vault up to date via automatic updates to account information from issuers.

Learn More

Customer Vault

Maintain a unique token value that enables merchants to repeat transactions without having to store or re-collect payment data — a must for merchants with recurring revenue models.

Learn More

iProcess Mobile Applications

Lets merchants accept EMV card payments on a phone or tablet with our turnkey mobile applications for Apple and Android devices.

Learn More

Payer Authentication 2.0

Reduce your fraud risk and increase customer confidence with security protocols developed by Visa & MasterCard that allow consumers to shop online more securely.

Learn More

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.