The payments space is moving toward elevated convenience, and that includes payments hardware. At the forefront of that shift are mobile solutions that untether payments from the front counter, enabling merchants to sell on the go.

Until recently, merchants looking to go mobile had two binary choices: a wireless version of a traditional payments terminal or a system that turned their smart devices into payments hardware. While both have a lot of great uses, new tap to pay options are bridging the gap between hardware and smart devices, offering the feel and convenience of a smartphone with the professionalism and single-purpose design of a traditional terminal.

The Problem: Comfort vs. Cost

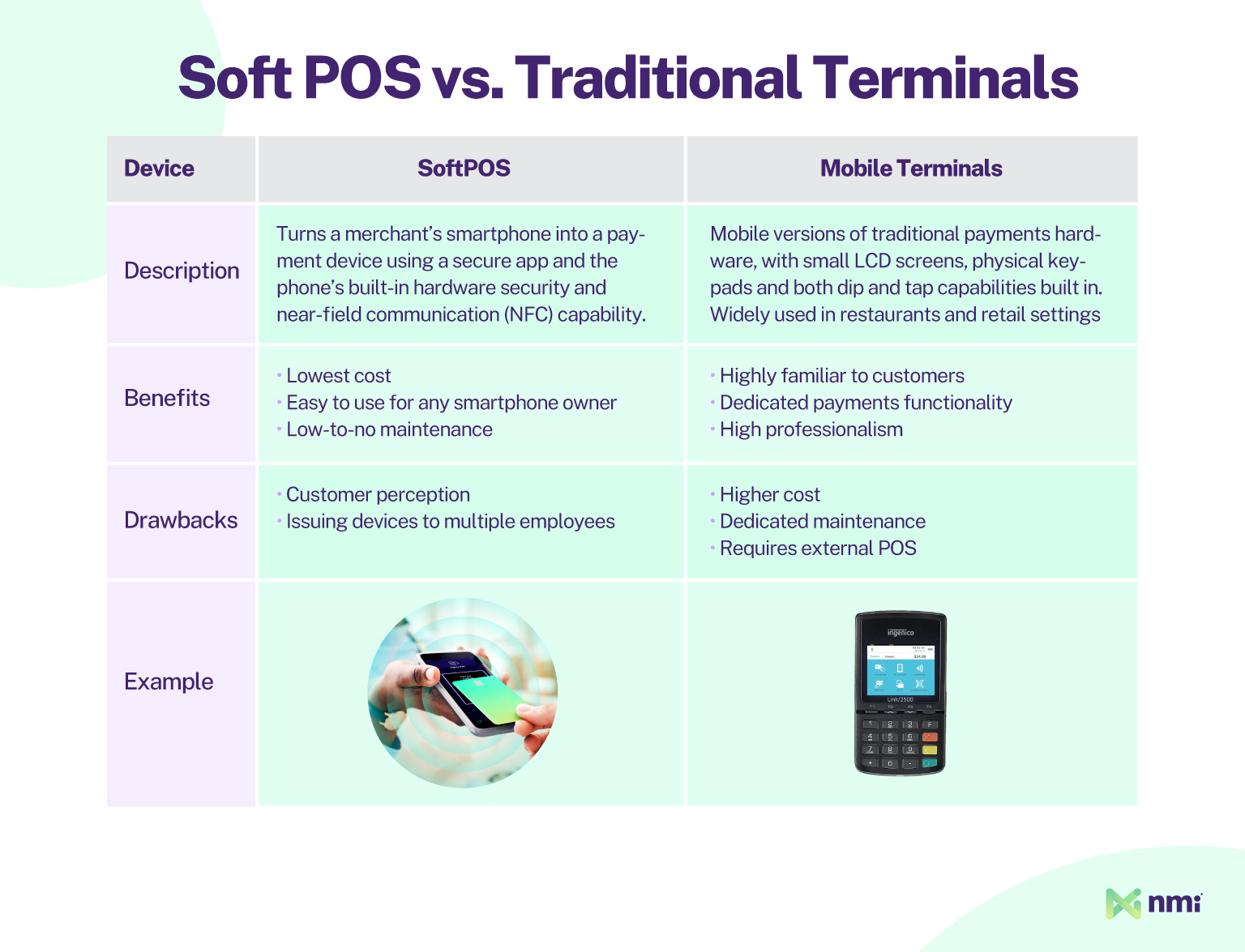

Traditional mobile terminals look and feel like standard card payment pads. They have small screens, physical keypads and, in some cases, built-in receipt printers. But, because they’re not physically tethered to a countertop point of sale (POS) system, they can be used on the move. That provides a lot of convenience, but there are two major drawbacks: Standard mobile terminals are expensive, and they’re not easy to troubleshoot or maintain, which can hurt the user experience (UX).

Software point of sale POS (SoftPOS) systems, also called tap to pay, are a newer option that solves the cost and UX problems by turning a merchant’s smartphone into a payment device. SoftPOS enables tap payments using nothing but a secure app and a phone’s built-in near-field communication capabilities. As long as a merchant has a charge and a signal, they can sell anywhere. And as long as they already have an available smartphone, there is no hardware cost to absorb. That makes SoftPOS the most flexible and affordable hardware option currently available.

But the very thing that makes SoftPOS great can also be a weakness — the phone. In a world where payment security is so important, tapping a payment to a seller’s smartphone can leave some customers feeling uneasy. It just isn’t what they’re used to, and it may not feel as safe as a standard terminal (even though it is).

Likewise, merchants themselves may have issues using phones for payments. In stores with multiple checkouts, moving to SoftPOS means issuing each cashier a phone to use for their shift or asking them to install a SoftPOS app on their personal device.

Both traditional mobile terminals and SoftPOS systems are ideal for certain businesses. But the gap between them forces some merchants to compromise between two options they don’t love: high-cost, higher-friction dedicated mobile hardware, or a smartphone-based solution that they or their customers may not be totally comfortable with.

The Solution: Tap to Pay, Reinvented

To serve the needs of merchants looking for something in the middle, new hybrid tap to pay systems are emerging. They combine the feel, ease-of-use and low cost of pure SoftPOS systems with the professional look, customer familiarity and dedicated use case of traditional mobile terminals.

Dedicated tap to pay devices are built on smartphone architecture, with full touch screens and user-friendly Android operating systems. But, they have several additional features that differentiate them from phone hardware and make them better suited to payments, including:

- Redesigned External Bodies: Commercial-feeling outer casings signal to users that they’re interacting with a payment device, while maintaining the small, convenient form factor of a phone

- Built-In Barcode Scanning: Professional barcode scan engines enable fast checkout, while a standard rear-facing camera enables QR code scanning

- Swappable Batteries: Unlike most of today’s smartphones, easily swappable batteries ensure there’s minimal downtime during business hours

Combining the Best Features of Existing Options

Tap to pay devices combine the best of both worlds in several key ways, including:

Single-Device Selling: Dedicated tap to pay devices are fully self-contained SoftPOS systems, requiring no tethering to a second device and no connection to an external POS.

Low Cost: Merchants only have to buy the pad, with no additional hardware or software required. That makes dedicated tap to pay devices the second most affordable option next to pure SoftPOS.

Familiar Operation: Full-sized touch screens and Android-based operating systems make dedicated tap to pay devices simple to use, configure and troubleshoot. Anyone comfortable with a smartphone will feel at home with SoftPOS.

High Trust: Dedicated tap to pay devices offer merchants and customers the convenience of unrestrained mobile payments while maintaining the professional feel, high trust and positive customer perception of traditional terminals.

Dedicated Use: Designed purely for payments, dedicated tap to pay devices maximize performance and minimize distraction. No personal apps, no push notifications, no unnecessary drains on system resources. Just fast, frictionless mobile payments.

Smartphone-Like Convenience in a Dedicated Payment System

NMI and Landi have partnered to offer the M20SE mobile terminal, a next-generation tap to pay device designed to meet the unique needs of modern merchants.

The Landi M20SE enables merchants to minimize costs, remove friction from payments, sell anywhere and improve the customer experience. It includes a 6.5” touchscreen, Android 13 OS, extensive network connectivity, a built-in barcode scanner, a pre-installed SoftPOS system with a streamlined user experience and much more.

To find out more about the M20SE and how to offer it to your merchants, reach out to a member of our team today.