The leftover Halloween candy is on sale and Christmas decorations are on every aisle, which can mean only one thing: The holiday shopping season is here again. Like every year, major sales days like Black Friday and Cyber Monday will be make-or-break events for massive retailers and small local businesses alike. But, this year, small merchants may have one factor in their favor: the increasing demand among young consumers for high-quality, in-person shopping experiences.

Are younger consumers shifting away from behemoths like Amazon? If so, that change in behavior could offer a significant opportunity for your merchants.

Let’s take a look at data that points to a shift in how and where Gen Z and Millennials prefer to do their holiday shopping. We’ll also look at three key things your merchants need to know to maximize their competitiveness and make the most of this emerging holiday opportunity.

A Shaky Prime Day and a Shift Toward IRL Shopping

The 2024 holiday season was not a good year for in-store sales growth. Last year, brick-and-mortar sales on Black Friday grew just 0.7% year-over-year (YoY), compared to over 14% for online shopping. But there’s reason to think that 2025 may look different. This holiday season, nailing in-store sales events could represent a renewed opportunity for your merchants to compete with the big platforms, especially within the increasingly important Gen Z demographic.

Prime Day Needed Two Extra Days to Thrive in 2025

According to Amazon, Prime Day 2025 was its most successful ever. But it was also the longest ever, at four days. The first two days did not go well, down 41% YoY on day one and 35% across the first half of the event. A strong finish saved the numbers, leading to nearly 5% growth over last year’s two-day sale and two days following. But it was tight.

Growth in Amazon Prime memberships also failed to materialize. Based on internal data reviewed by Reuters, in the three weeks leading up to this year’s extended sale, new Prime signups fell 2% below 2024’s mark, failing to meet Amazon’s internal expectations.

Young Shoppers Are Looking To Spend More Time In Stores

With a weaker membership drive and only 5% overall growth after a 100% increase in length, Prime Day 2025 may offer some insights into evolving consumer trends. First, it’s important to recognize that consumer hesitancy in tough economic times may be the main headline here. But the numbers also fall in line with another shift that’s currently underway: the migration of young consumers from the digital world back to the real world.

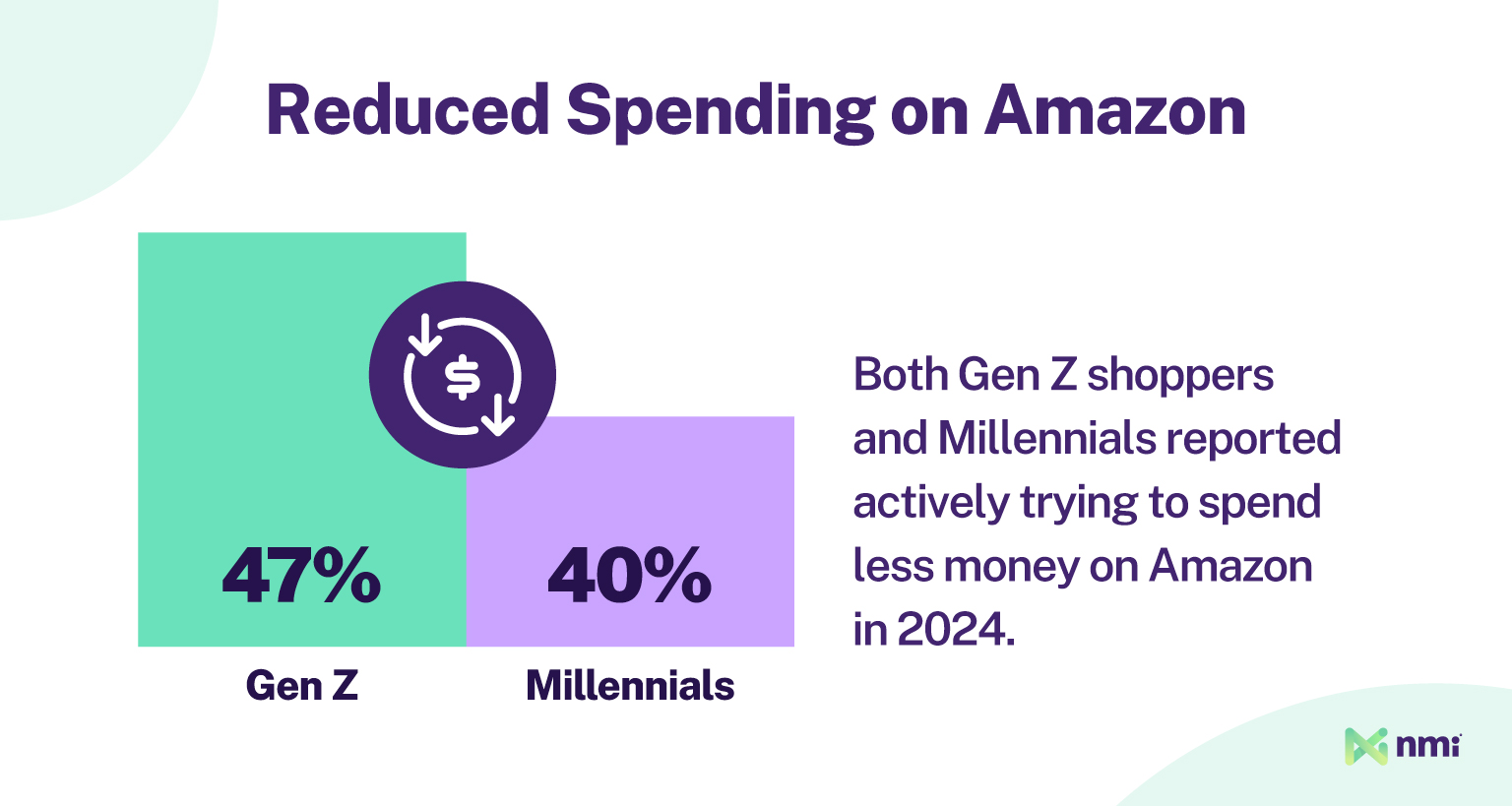

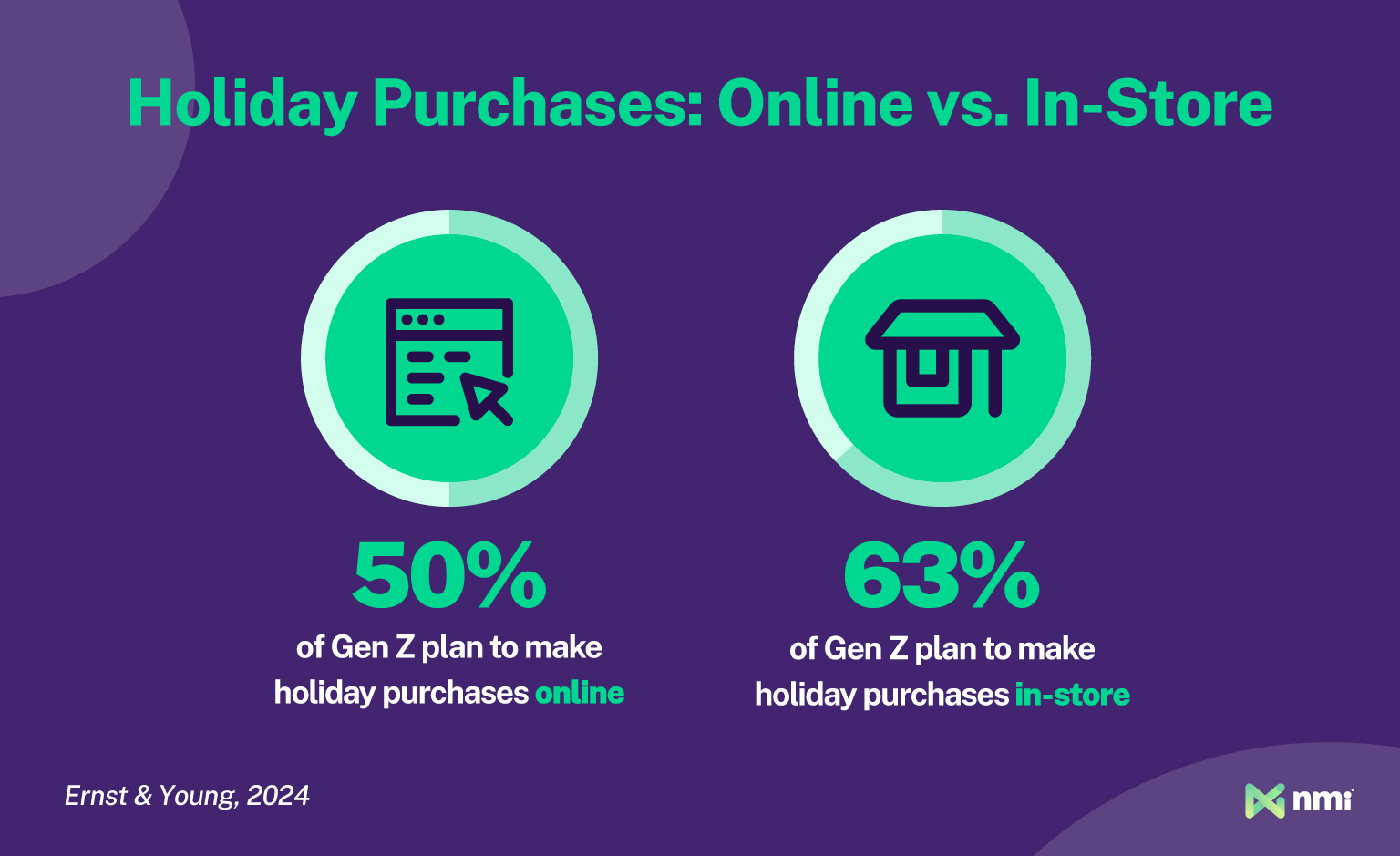

In 2024, 47% of Gen Z shoppers and 40% of Millennials reported actively trying to spend less money on Amazon. At the same time, Gen Z consumers are driving a resurgence in American malls, driven by a desire for more social shopping experiences and instant access to their purchases. And last year, Ernst & Young found that only half of Gen Z said they planned to make holiday purchases online, compared with almost two-thirds who planned to shop in-store.

In short, the youngest, most digitally native consumers are finding more opportunities to shop in-store.

What Your Merchants Need To Know To Excel This Holiday Season

If young consumers are leading a movement away from big online platforms and toward more mindful, experience-based in-store shopping, what does that mean for your merchants this holiday season?

Here are three key tips to help your merchants tap into the in-person opportunity and maximize their success this winter.

#1: Online Window Shopping Drives In-Store Sales

Years ago, retailers were worried about the growing phenomenon of “showrooming,” the practice of checking out products in a brick-and-mortar store and then buying them online, potentially from a competitor at a cheaper price. But as it turns out, today, people are far more likely to check out products online and buy them in stores. YouGov found that this kind of shopping, sometimes called “webrooming,” is practiced by 29% of Gen Z and 25% of other generations, compared with just 21% and 17% who still showroom.

What It Means for Your Merchants:

YouGov’s data shows that in-store browsing is still the number-one discovery channel for all consumers, but online discovery plays a big part in the success of in-store sales. That means it’s more important than ever that merchants offer seamless omnichannel sales so customers can discover and access deals through whichever channel they prefer.

When targeting young consumers with Black Friday and Cyber Monday sales, your merchant should go beyond just in-store and online sales by mixing in social commerce, as well. YouGov’s data shows that 64% of Gen Z consumers use social platforms for product research, so it’s a key channel for both getting the word out and making sales.

#2: Small Business Saturday Is a Great Opportunity To Make Local Connections

Small Business Saturday is a newer shopping holiday that falls on the Saturday after Thanksgiving and encourages shoppers to support the local, independent businesses in their communities. It’s a great opportunity to boost in-store holiday sales by highlighting the importance of community-focused commerce and offering young consumers the more social, experiential shopping they crave.

What It Means for Your Merchants:

Amex’s 2024 Shop Small Impact Study found that 90% of Gen Z and Millennials already find new local merchants to patronize just by walking around town. That’s an even higher number than the 80% who find businesses through social media. By extending hours and turning sales into community-focused events, your merchants can use Small Business Saturday to create novel, highly social shopping experiences for young customers looking for that in-person touch.

#3: Black Friday and Cyber Monday Sales Need To Be Frictionless — In Stores and Online

The 2025 season is an opportunity for small, independent merchants to capture holiday dollars that previously would’ve gone to big online platforms like Amazon. But while young consumers are increasingly looking for in-store experiences, their business still needs to be earned, and they will not put up with unnecessary friction. To steal sales from online behemoths, small merchants need to offer in-store shopping experiences that are as frictionless as possible, especially when it comes to checkout and payment.

What It Means for Your Merchants:

Merchants need to be ready for two things, increased volume and unique payment preferences.

Increased Volume: Increased foot traffic means busier checkouts, and long queues are a surefire way to undermine the holiday shopping experience. To ensure lines move quickly and customers can get in and out without a fuss, make sure your merchants have enough backup payment terminals and an offline-capable option should the worst occur and the WiFi goes down.

You may also want to recommend mobile solutions, like Tap to Pay, that allow your merchants’ staff to check out customers anywhere in the store using nothing but a phone or tablet. That turns the entire sales floor into a checkout lane, reducing congestion up front.

Picky Payments: Young consumers have different payment preferences compared to older generations. (Link the new survey piece here once it’s live.) To offer Millennial and Gen Z shoppers an experience that will draw them away from Amazon, your merchants need an expanded set of payment systems that include flexible contactless options. At the very least, that means digital wallet payments, either through a mobile phone or alternative devices like wearables, which over a third of Gen Zs already use.

Help Your Merchants Make 2025 Their Best Holiday Season Yet

With each passing year, the youngest consumers become a more important part of your merchants’ holiday mix, and meeting their needs is critical. In 2025, Black Friday, Small Business Saturday and Cyber Monday represent opportunities to carve holiday spending away from the big online platforms by meeting consumers’ building demand for more personal, social and immediately gratifying shopping experiences. NMI is the ideal partner to help you prepare your merchants to do just that.

NMI offers seamless omnichannel payments that make it easy for customers to shop and pay where, when and how they want. Every part of the NMI ecosystem is expertly orchestrated to minimize friction, make channel switching easy and ensure your merchants can offer the type of elevated experience Gen Z and Millennial consumers expect.

To find out more about how NMI can help you set your merchants up for holiday success, reach out to a member of our team today.