A year ago, we made our predictions for 2025 in From Frictionless to Future-Ready: 2025 Executive Trends & Predictions. Now, it’s time to take a look back at how some of those predictions panned out.

How did we do? Some predictions, like the spread of biometric payments, turned out to be slightly ahead of their time. Others did a good job of describing key industry trends that emerged throughout the year, while a few didn’t quite land where we expected them to.

Let’s dig into some of the 2025 predictions that hit the mark, like the rise of digital wallets and SoftPOS systems, and the ones that took big steps forward, like the growing momentum behind decentralized finance (DeFi) as regulations started to ease.

Prediction: Digital Wallet Adoption Reaches Critical Mass, Especially Among Generation Z

In our 2025 report, we predicted that digital wallets would emerge as a top payment choice for American consumers, closing the gap between U.S. and international markets. We predicted that growth would be driven primarily by Gen Z, who would use digital wallets for the majority of their transactions.

What Actually Happened in 2025

The latest data from Visa shows that one in five U.S. shoppers now prefer paying with a digital wallet over any other method. When you drill down to Gen Z, that number jumps to 36%, which now puts preference for digital wallets above credit cards (34%) with this increasingly important demographic. This shift marks a major milestone for the industry, as next-generation contactless technology has now surpassed physical cards for the first time ever.

According to the Diffusion of Innovations Theory, when a technology reaches 20–40% adoption, it hits critical mass — the point where momentum from existing users and network effects drives continued growth on its own. Visa’s data suggests digital wallets have already cleared that threshold with innovators and early adopters. Among Gen Z, they’re well on their way to mainstream use.

As of November 2025, Juniper Research estimates there are currently 4.4 billion digital wallet users around the globe, and by 2030, over 75% of the world population will be using the technology to pay.

Prediction: SoftPOS / Tap to Pay Will Displace Physical Terminals

Multiple members of our executive leadership team predicted that tap to pay and wider software point-of-sale (SoftPOS) systems would begin displacing traditional payment terminals in 2025, thanks to cost and convenience advantages.

What Actually Happened in 2025

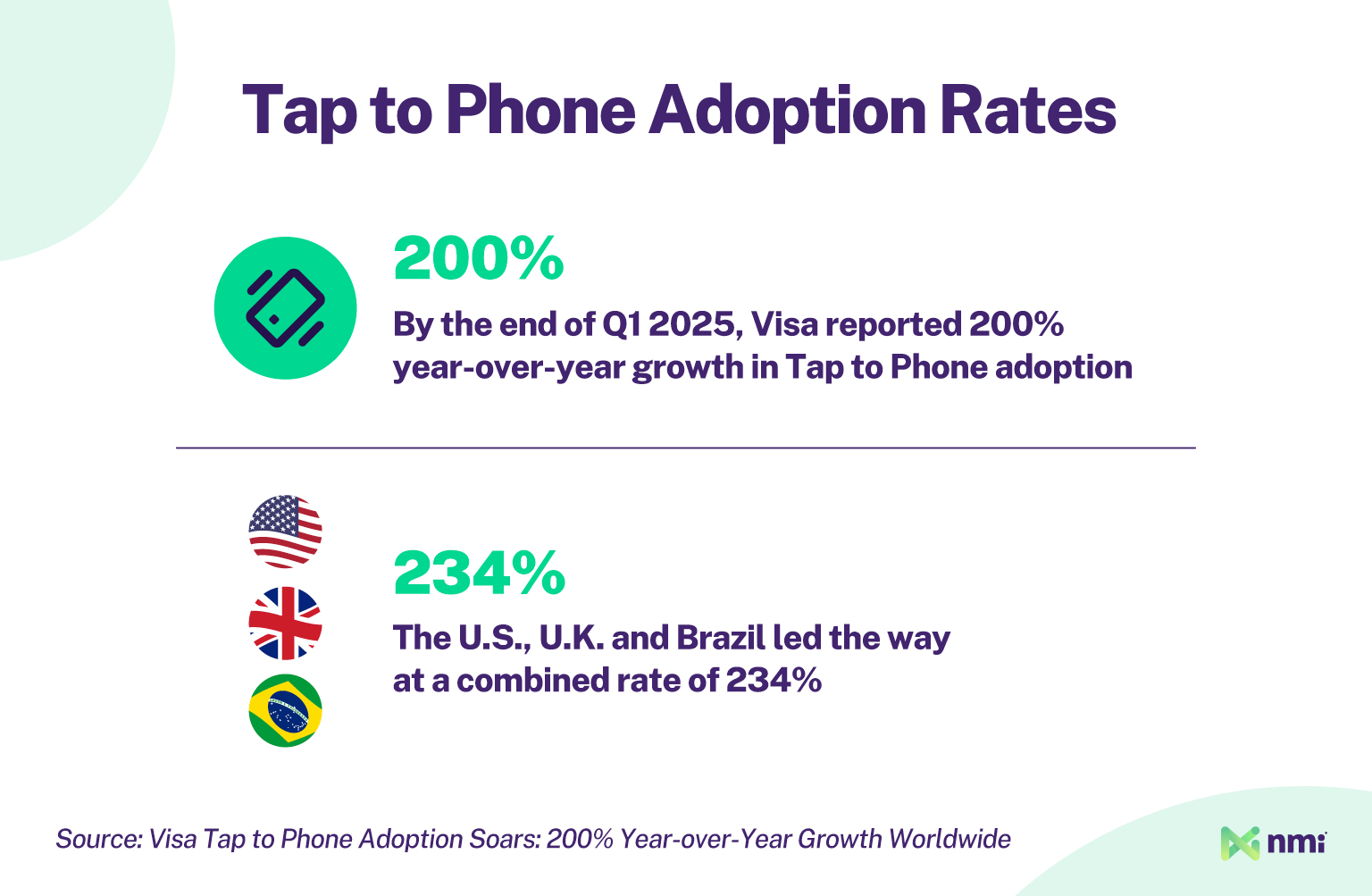

By the end of Q1 2025, Visa reported 200% year-over-year growth in Tap to Phone adoption, with the U.S., U.K. and Brazil leading the way at a combined rate of 234%. Unsurprisingly, this strong growth was driven by small and medium-sized businesses (SMBs), with new SMBs representing over 30% of SoftPOS sellers.

This shows a clear shift towards fully software-based payments systems among small merchants, especially newer ones. These companies just starting out are attracted by the low cost and simplicity of taking physical payments on devices they already own, along with the familiar user experience offered by smartphones. The growth of adoption in 2025 aligns with the technology’s strong projected growth between now and 2030, which Grand View Research estimates will reach 23.1% CAGR.

Prediction: Differentiation Will Become Survival in Embedded Payments and Finance

One big prediction for 2025 was that embedded payments and finance would become so widespread that they would no longer represent a significant competitive advantage on their own, meaning that software-as-a-service (SaaS) providers would need to find ways to differentiate their embedded offerings in advance of a wave of new competition.

What Actually Happened in 2025

In an October 2025 report from PYMNTS and Green Dot, research showed that 99.8% of the medium and large companies surveyed offered at least one type of embedded finance product. That’s an astounding number that demonstrates just how widespread this market has become. When looking at embedded payments, 73.1% of SaaS companies surveyed had adopted the technology, second only to financial tech (fintech) and banking-as-a-service, which come in at an only slightly higher 74.5%.

It’s worth noting that PYMNTS only surveyed medium and large firms, with 97% of respondents generating $10 million or more in annual revenue. Still, the findings confirm what many expected: competition in embedded payments exploded. Because of that, by Q4 2025, including embedded payments in a SaaS offering was no longer a standout feature — it was quickly becoming the norm.

Prediction: Regulators Help Usher In a New Generation of Mainstream DeFi Solutions

Maybe the boldest of all our executive predictions was that 2025 would be the year DeFi would finally break into the mainstream. Specifically, DeFi would proliferate thanks to a number of converging factors, including maturing tech, a friendlier regulatory environment and a surge of interest from traditional financial institutions.

What Actually Happened in 2025

While DeFi remained niche, the groundwork for its mainstream expansion was absolutely set. On July 18th, 2025, the GENIUS Act was signed into law in the United States, creating a regulatory framework to allow financial institutions and state governments to adopt, issue and manage stablecoins as part of the mainstream financial system.

In 2025, we also saw major financial institutions soften their views on the crypto space as a whole. Despite CEO Jamie Dimon’s longstanding skepticism, in November of 2025, J.P. Morgan released the JPMD token on Base, an Ethereum Layer 2 blockchain. In doing so, they became the first bank to issue a USD deposit token on a public blockchain.

While JPMD is a big step, its limited availability to JP Morgan clients means it is not decentralized. But adoption of blockchain solutions, deposit tokens and stablecoins by major financial institutions is a critical step toward introducing businesses and consumers to blockchain-based finance, and that will ultimately be what pushes DeFi to the next level.

A Look Ahead in 2026

From digital wallet proliferation to SoftPOS adoption to embedded payments competition and beyond, a lot of our predictions for 2025 panned out. If you haven’t already, make sure to check out From Frictionless to Future-Ready: 2025 Executive Trends & Predictions for more great insights.

Now, at the start of 2026, we’ve looked into our crystal balls again to predict what the payments space might see in the year ahead. Some key areas we’re focusing on include the impacts (and consequences) of agentic payments, a resetting of industry-wide expectations for AI, contactless payments emerging in non-traditional environments, the rise of network tokenization as a critical foundation for future growth and more.

To learn more about how NMI is enabling our partners to stay at the forefront of payments innovation, reach out to a member of our team.