Embedded lending is changing the way small businesses access working capital by making it faster, easier and cheaper to apply for loans. It’s also creating new opportunities for frontline payments companies like software-as-a-service (SaaS) platforms and independent sales organizations (ISOs) to provide a high-value service while opening up a new, low-to-no-risk source of revenue.

By integrating third-party embedded lending services into your offerings, you gain the ability to provide your customers with small business loans that are fully underwritten and managed by your partners behind the scenes. That enables you to earn fees on lending, and it makes you more valuable to your small business customers by meeting one of their most dire needs — easier access to affordable capital.

In this three-part series, we’ll take an in-depth look at the embedded lending opportunity and what it means for your business and your customers. In this first installment, we’ll take a foundational look at embedded lending, including what embedded lending is, how embedded lending works, why the market so desperately needs it and how it’s reshaping the ways loans are issued and repaid.

What Is Embedded Lending?

Embedded lending is the integration of lending services directly into non-financial systems like marketplaces, business software or ecommerce platforms. It allows small businesses to access loans quickly and easily through the platforms and accounts they already use. It’s also part of the greater embedded finance ecosystem that includes embedded payments, embedded insurance and embedded banking, making it an ideal solution for software-based payment services.

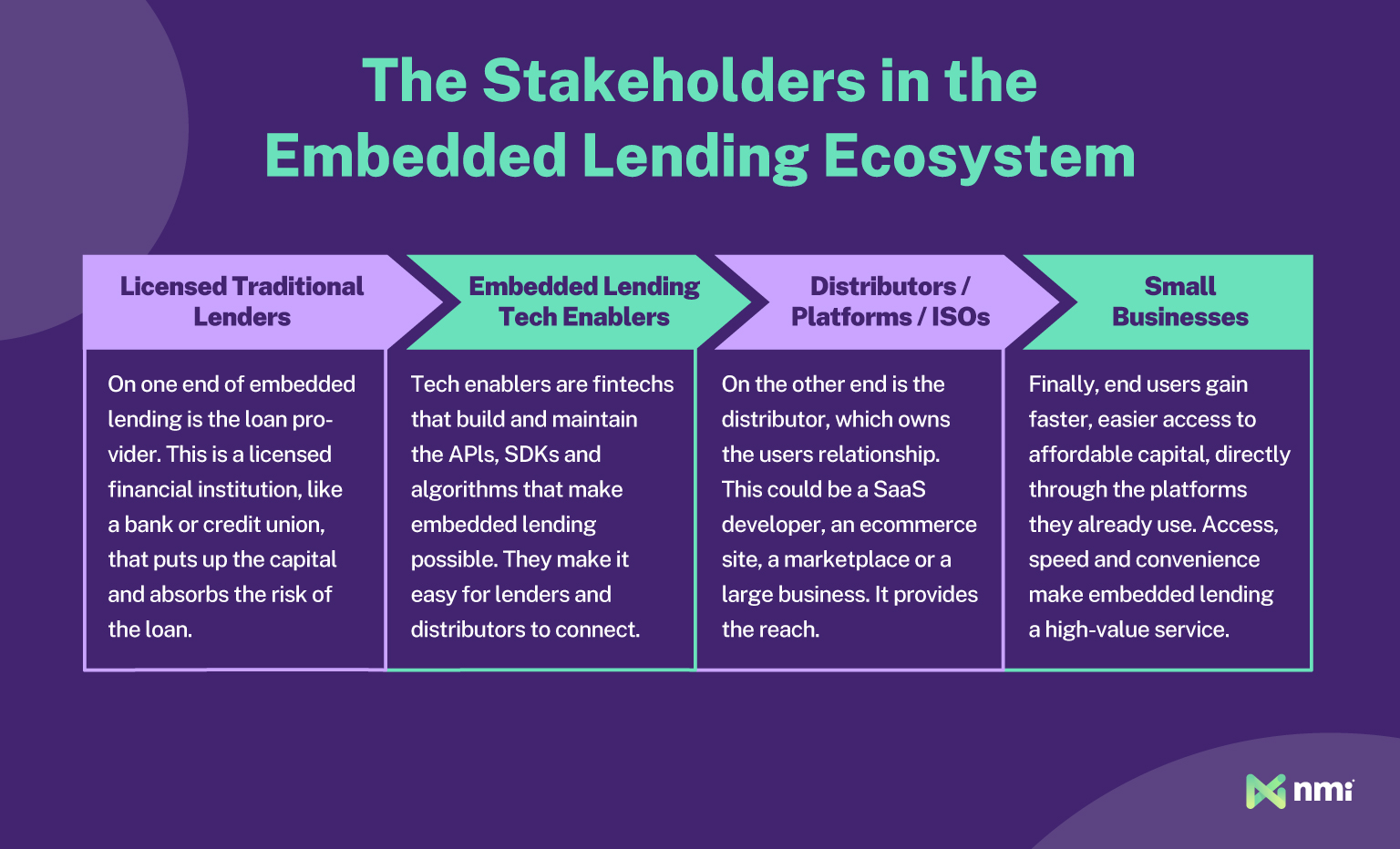

The goal of embedded lending is to allow small businesses and merchants to bypass the old, bank-centric application process and apply for loans right when they need them. It accomplishes that goal by bringing together traditional lenders — such as banks that have regulatory licenses and plenty of capital but short reach — and frontline platforms that have built-in user bases in need of short-term loans.

With embedded lending, small businesses don’t have to go to a bank to apply for a loan. Instead, they just log in to their regular business management platform. From there, they can either access a pre-approved loan waiting in their account, or quickly apply, receive a decision, and access their funds, without ever leaving their platform account.

Embedded B2B Lending Is Taking Off

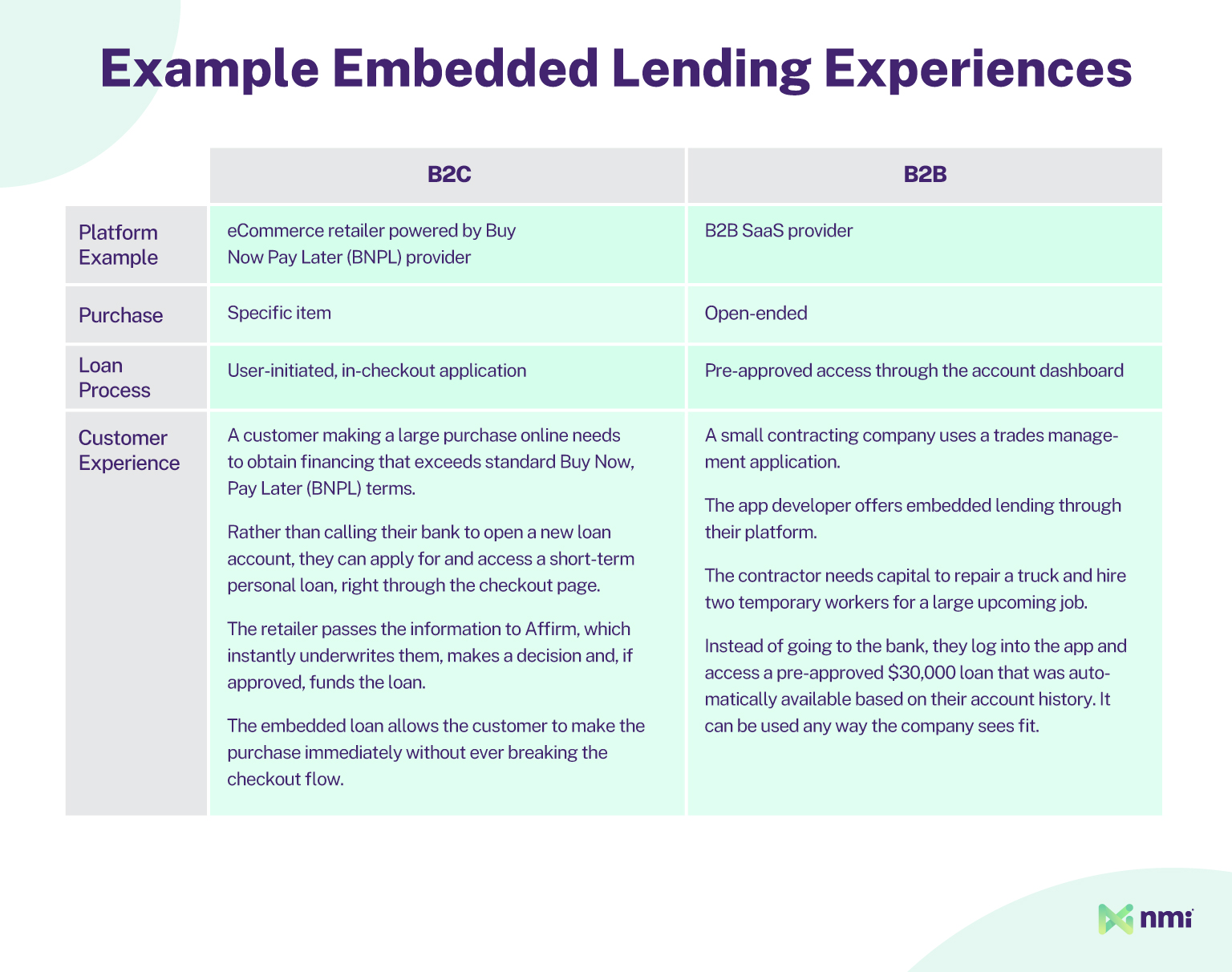

Embedded lending started in the business-to-consumer (B2C) world, where things like point-of-sale (POS) financing in retail stores and dealer-provided car loans have been around for many years. But today, the focus is quickly shifting to business-to-business (B2B) opportunities, as service providers look for ways to extend short-term loans to their small and medium-sized business (SMB) customers.

SMBs need capital for numerous reasons, including dealing with emergencies, preparing for busy seasons, strategic expansions and much more. But, until recently, they only had two options to access funds:

- Apply through a traditional lender like a bank, which is high friction and often unsuccessful

- Tap into easy access but high-interest sources, like their business credit cards or, worse, payday loan providers

With embedded lending, SMBs can get the best of both worlds — fast, easy access to working capital, often in as little as a few minutes, with reasonable interest rates, all directly through the software platforms they use on a daily basis.

The Challenges of Embedded Lending

What Makes Embedded Lending Critical to the Future of Payments and Finance?

Access to capital is an existential struggle for many SMBs. First, with the economy in a period of high uncertainty, banks are tightening their lending standards across the board. According to the San Francisco Fed, businesses of all sizes now face lending friction reminiscent of the 2008 financial crisis and the COVID-19 pandemic.

On top of that, banks view SMBs as informationally opaque. Every SMB is different, and recordkeeping varies wildly from one to another. That elevates perceived risk and makes it hard for banks to categorize, underwrite and serve small businesses.

The Vast Majority of SMBs Need Better Access to Capital

According to research from Goldman Sachs, 81% of small business owners who applied for a business loan or line of credit had a hard time accessing affordable capital. Overall, 77% of all small business owners have concerns about capital access.

The consequences of being walled off from loans are serious. Goldman found that, among the SMBs that found accessing capital difficult:

- 49% were forced to halt a planned expansion

- 41% were limited in taking on new business

- 27% canceled strategic investments

- 22% had to lay off employees

Small Businesses Who Can Get Loans Often Can’t Afford Them

Even when SMBs succeed in getting approved for a loan, the cost of capital often makes it a moot point. Just over half of respondents told Goldman Sachs that they were unable to afford a loan at current interest rates. That creates a potential catch-22 where a business owner may not be able to afford to keep operating without a loan, but they also can’t afford to make loan payments due to high interest rates.

Why Embedded Lending Is a Better Way for SMBs to Access Capital

The current way SMBs access capital is clearly unacceptable. Especially since 99.9% of all businesses in the United States are small businesses, and account for almost half of all job creation. Unfortunately, traditional lending channels aren’t equipped to improve things. But thanks to some of its unique characteristics, embedded lending can.

Embedded Lending Is Frictionless

Embedded lending moves the lending process directly to the point of need and makes loan access fast and easy. If an application is necessary, small businesses can complete the process through their regular business software and have a decision and access to funds — often within minutes.

In some cases, businesses can be pre-approved based on their in-platform data, without any application, pushing affordable loan offers directly to their account dashboards. That creates an open loan option resembling a working capital line of credit that a small business can access instantly if and when they need it.

Embedded Lending Is Data-Driven

Embedded lending taps into one of the superpowers shared by all types of embedded finance — deep data. By leveraging real-time and historical data from the platforms they’re integrated with, embedded lending systems can perform deep, algorithm-driven analyses on information that wouldn’t be available through traditional channels.

That can include everything from payment processing and accounting data to operational patterns and more. All that user-specific information can be analyzed to get a truer picture of a small business’ creditworthiness, leading to lower risk, more access and better interest rates.

Embedded Lending Is Highly Scalable

As a front-end distributor, adding embedded lending to your offerings is as easy as partnering with a good tech enablement provider. The banking and infrastructure aspects are all taken care of behind the scenes, and embedded lending services are designed specifically for simple, low- or no-code integration. That means embedded lending services can be quickly and easily rolled out to small businesses, and loan offers can be calculated and pushed out automatically with no additional load on your team.

On the lender side, embedded lending greatly reduces the cost of reaching customers. Your platform provides the reach, and the bank provides the loans. This low-friction, low-cost, easy-to-integrate model can be scaled exceptionally quickly on both sides of the equation, making it possible to get loans into the hands of SMBs easier than ever before.

Embedded Lending Minimizes Risk

Embedded lending reduces risk for everyone involved. As a frontline provider, there is effectively no risk because you take on no responsibility for underwriting. For your customers accessing loans, the risk of default is lowered because the loan terms are short — often under a year — and repayment can be automated as a percentage of monthly revenue. The banks providing the loans take on almost all the risk, but they can mitigate it through access to better data and deeper business insights from the customer data you provide.

The Embedded Lending Opportunity for Payment Providers

It’s clear that traditional lending channels are failing SMBs, and newer, better ways to facilitate small business loans are needed. Embedded lending solves that problem by creating frictionless, fast and effective connections between business owners who need affordable capital and lenders looking to serve them, with you in the middle. By providing access to your customer base and the data they generate, you become a critical part of the embedded lending ecosystem, and the benefits of that can be significant.

In parts two and three of this series, we’ll cover some of the most commonly asked questions and focus on the embedded lending opportunity for frontline merchant services providers, including how embedded lending opens up new revenue channels and what it means for your ability to compete in a market that increasingly demands one-stop service.