A decade ago, selling internationally was the domain of massive retailers. Today, it’s just as likely to be your neighborhood boutique, or your newest merchant. Thanks to platforms like Shein, Temu and Shopify, global commerce has gone mainstream. But while the opportunity has exploded, so have the complexities.

Exchange rate fluctuations, consumer preferences, fraud threats and a patchwork of regulations can overwhelm even the most ambitious sellers. That’s where payments technology, and your role as a payments provider, make all the difference.

In this article, we’ll look at five ways you can tap into technology (and your payments partner) to help your merchants thrive in global markets, from dynamic currency conversion to fraud prevention systems that keep them ahead of the game.

1. Localize the Experience

Today, ecommerce is table stakes. In the United States, it’s one of the fastest-growing channels and has seen high adoption, with 97.1% of consumers expected to use ecommerce by 2029. International markets are also catching up, with China, Indonesia and the United Kingdom being some of the biggest adopters.

But, according to research from McKinsey, in countries around the world, anywhere from one-third to two-thirds of consumers still prefer shopping locally.

Localizing the online shopping experience is one of the most important steps merchants can take when selling internationally. They can’t just enable international shipping and expect to succeed. To maximize conversions, merchants need to create shopping experiences that feel as local as possible, even when they’re not. That can be done in several different ways, including:

- Local currencies: The first and most obvious customization is ensuring ecommerce sites and shopping carts dynamically update pricing to display the shopper’s native currency

- Language: Merchants need ecommerce systems and payment gateways that can adapt to a shopper’s location and automatically display the correct language

- Checkout flow: The flow and design of online checkouts can impact users differently in other regions. For example, in Japan, mobile commerce makes up 65% of all ecommerce. So, when selling to Japanese buyers, mobile-first optimization is far more important than it is for American shoppers

- Payment methods: Consumers in certain regions like to pay differently. While Visa and Mastercard might get the job done for the majority of U.S. shoppers, in Asian markets, offering digital wallet payments is a must. The more local or local-feeling payment options a merchant can offer, the better

2. Manage Currencies Intelligently

Currencies and foreign exchange are critical parts of selling internationally. The more countries your merchants sell in, the more options they need for currency management.

That starts with on-screen pricing. Auto-displaying local currencies and letting users manually select how their prices are shown are two key features your merchants need. But what about the currency after the payment is made?

Features like Dynamic Currency Conversion (DCC) allow payments to be settled in a merchant’s home currency, regardless of what currency they were made in. That offers a ton of benefits, including simplifying banking, accounting and reporting, and reducing fees.

Larger or more sophisticated merchants may also want to avoid foreign exchange (FX) fees altogether. That requires multi-currency merchant accounts that can settle transactions in the payer’s currency. So it’s a good idea to have processing partners who offer multi-currency accounts and a gateway that can integrate with them.

3. Clamp Down on Cross-Border Fraud

According to the European Banking Authority, cross-border payments suffer from fraud rates as much as 9 times higher than domestic payments. So, while selling internationally represents a huge opportunity, it is not without risks. To stay ahead of the bad guys, merchants expanding internationally need to ensure their fraud prevention systems are cutting-edge.

AI-Powered Fraud Prevention

Simple, rules-based fraud screeners are becoming obsolete in the era of artificial intelligence. AI-powered tools are especially important for cross-border sellers. Advanced anti-fraud systems like Kount use AI and machine learning to constantly refine their detection algorithms as they learn from each new scanned transaction. With access to billions of data points and the ability to self-improve, these AI-powered tools not only catch more bad transactions, but they also flag fewer false positives, maximizing approvals.

Payments Security Features

Another best practice is to maximize the number of payment security features your merchants can employ. Some of the protocols and tools available to safeguard transactions against fraudsters and bad actors include:

- 3D Secure 2.0 (3DS2)

- Strong Customer Authentication (SCA)

- Gateway tokenization

- Network tokenization

- Point-to-Point Encryption (P2PE)

- Card spinning detection

4. Understand (but Offload) Compliance Burdens

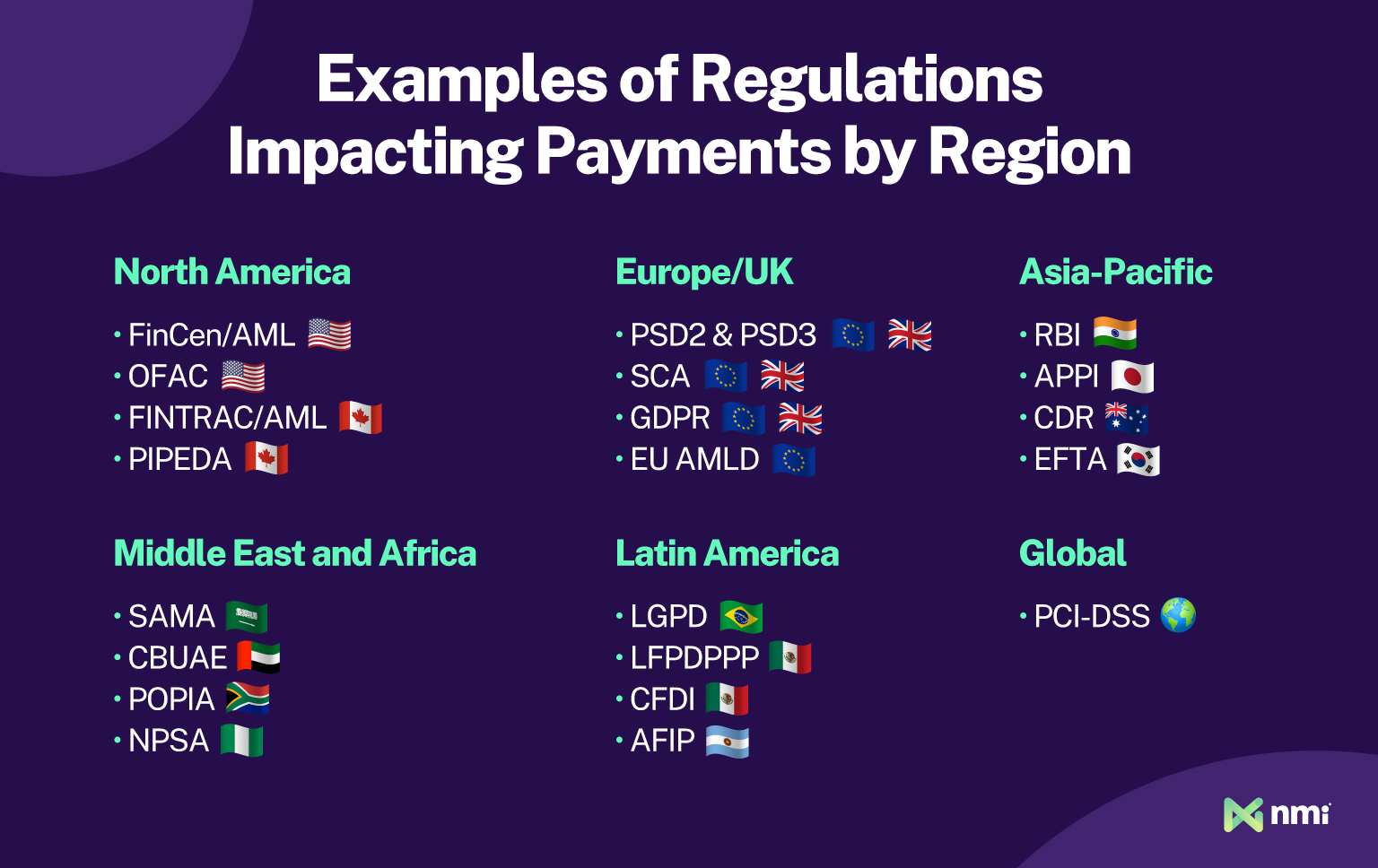

One of the most complex aspects of selling in global markets is navigating regional and national regulations. For example, selling in the U.S. carries a very different regulatory burden than selling in Europe. There is no way to avoid this complexity entirely, but merchants can offload as much of it as possible onto their technology and service partners.

Just some of the compliance issues that can be shed through technology and automation include:

Regional regulations: Payments is a highly regulated industry, and protection of consumers, their privacy and their sensitive card data is handled differently in different places. Many of these regulations have common requirements, and most can be dealt with through selecting pre-compliant payment systems and maximizing security features.

Automated tax compliance: The rules for when and how sales taxes must be collected vary from country to country. Managing taxes manually is completely impractical for merchants, but many of today’s payments systems offer automated tax compliance tools, like real-time tax calculation that automatically adjusts and applies taxes based on a buyer’s location.

5. Maximize Processor Connections

By nature, international payments are more complex than domestic ones. Sometimes one processor can handle all of a merchant’s needs, but often, global merchants need to work with multiple providers, including local or regional players that own certain international markets, to cover more ground. To make sure your merchants can always access the processing they need, you need processor-agnostic payments tech that integrates with as many providers as possible.

More processor integrations and better payments orchestration mean higher approval rates, lower fees and significantly reduced operational complexity. All are key competitive advantages when it comes to serving merchants that sell beyond their borders.

Help Your Merchants Expand Their Global Reach

The world is shrinking, and the globalized economy represents a huge opportunity for merchants of all types. But expanding internationally is a big challenge, and your merchants’ success depends on you offering the right processing options, payments technologies and guidance.

NMI is a one-stop payments acceptance platform that offers everything you need to help merchants sell abroad, including:

- An industry-leading payment gateway that supports over 100 currencies, multiple checkout languages, customized checkout flows, automated tax tables and more

- Seamless integration with over 150 payment processors around the globe, ensuring uninterrupted international sales

- Fully secure and compliant payment systems that meet Payment Card Industry (PCI) Level 1 standards and most of the world’s major payments and data protection regulations

- Advanced AI-powered fraud protection and cutting-edge security tools like network tokenization

- Dynamic Currency Conversion (DCC) for straightforward settlement of any international payment in the merchant’s home currency

To find out more about how NMI can put you in a better position to help your merchants succeed on a global scale, reach out to a member of our team today.