How do you build a set of payment offerings that are cost-effective, perfectly matched to your target merchants, cutting-edge in a market that never stops evolving, and will scale with your business and capabilities?

The answer is modularity.

Modular embedded payments are the future of merchant services because they enable independent sales organizations (ISOs) and software-as-a-service (SaaS) platforms to offer more effective, targeted and flexible payment solutions. That represents a significant operational and competitive advantage at a time when both margins and competition for merchants have never been tighter.

In this article, we’ll dive into modular payments and explain:

- What are modular payments

- How they differ from the rigid payment platforms so many companies get tied into

- Why modular payments are key to supercharging growth

- What to look for in a partner

What Is a Modular Payments Platform?

A modular payments platform is an all-in-one system that doesn’t force you into the “all” part. Instead, it provides a complete end-to-end menu of payment products and allows you to choose which ones to integrate into your business and how. The goal is to provide you with the components, the expertise and the support to create an ideal payments solution based on your unique needs.

This also means having a variety of integration options, including no-code, low-code, and full control application program interface (API). More options means you can select the component you need and decide how you want to use it based on your particular use case, development resources and technical expertise.

Think of it like the most iconic modular product of all: LEGO. Far from being locked into a set design, LEGOs allow you to sift through the bin looking for the exact pieces you need to realize your vision. You can snap on new extensions, remove pieces you don’t need and move entire sections from one place to another, allowing you to create something unique.

Modular payments allow companies like SaaS providers and ISOs assemble ideal combinations of payment products based on dozens of factors, including:

- End-customer needs

- Existing tech stacks

- Internal capabilities

- Strategic planning

- Risk and compliance

- Cost and resource considerations

- Time-to-market requirements

- Shifting market forces

- Unexpected growth

- Competitor offerings

This flexibility and control are critical to success in the ultra-competitive payments space, where few companies have identical needs. With so much rapid change, the needs of tomorrow are rarely the needs of today.

Building a Payments Solution, Brick by Brick:

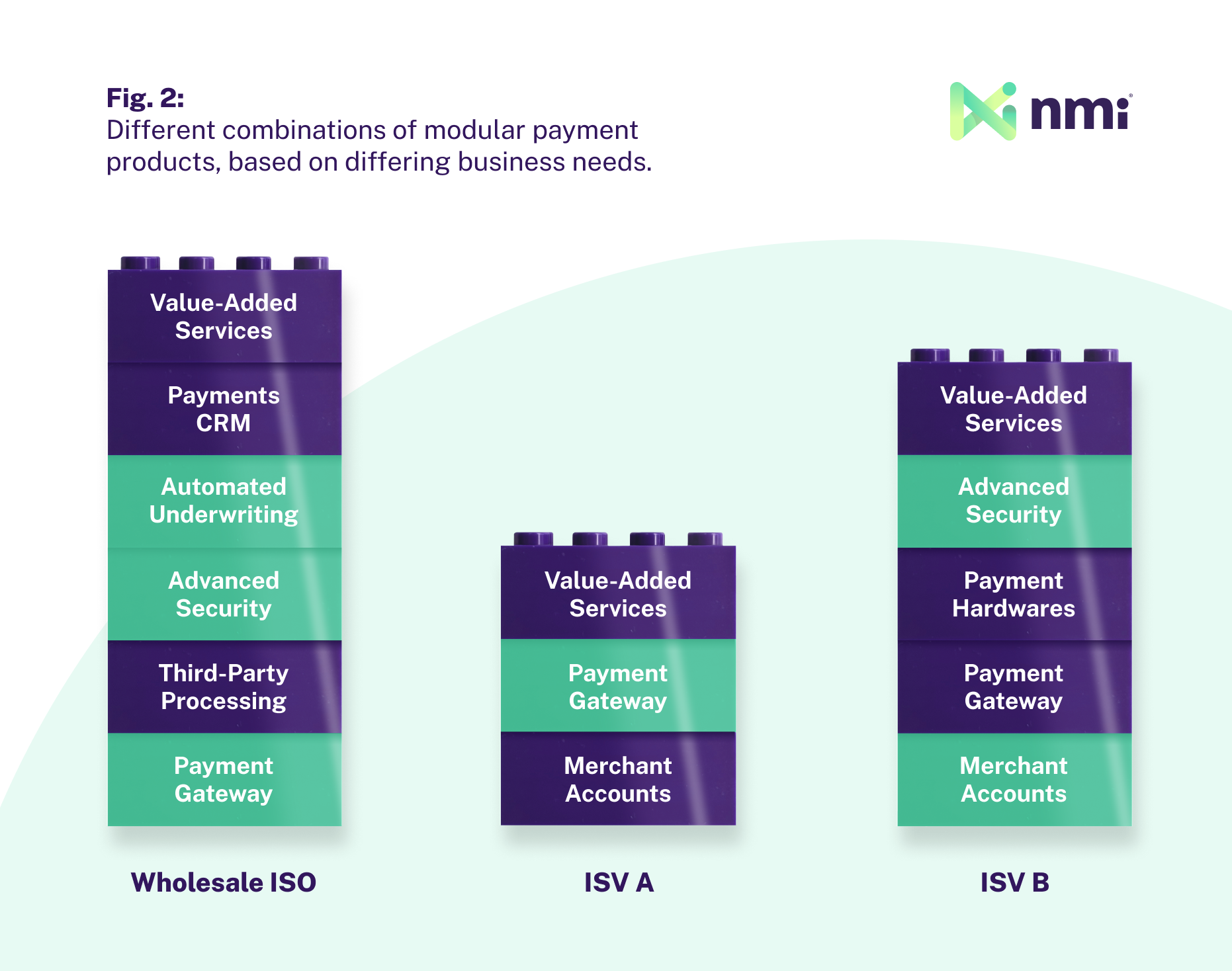

Consider three different businesses — a wholesale ISO; a start-up software company, dipping its toe into serving ecommerce sellers; and a mature software platform with some internal payments experience, serving users that sell both online and in-person.

Each has a different set of needs, but, without modularity, they’d all be stuck with the same rigid payments stack as they grew and needs changed.

That might mean the wholesale ISO misses out on key services, the start-up software company pays for a long list of features it doesn’t use, and the mature one is stuck with a solution that can’t scale or take advantage of its growing internal payments capabilities.

Modularity fixes all of these problems. It allows each business to get the exact solution it needs, today and in the future. For example, as software company A grows, it can easily add additional bricks. If software company B gains even deeper payments experience and opts to start building some things internally, it can remove the bricks it doesn’t need anymore, shedding costs. No company is stuck and scaling up or down is simple.

Unfortunately, modularity is not the norm when it comes to payment platforms. The industry’s biggest players typically lock their partners into rigid tech stacks. And, in an attempt to serve the widest possible set of customers with one set of services, the solutions within those platforms are highly generic, completely inflexible, unnecessarily sprawling and very expensive.

How Modularity Powers Flexible Growth

Modular payments are ideal for growth because they excel in three critical areas: scalability, cost-effectiveness and responsiveness to market trends.

Modular Payments Enable You to Scale Without Disruption

One of the most important benefits of modular payments is the ability to scale painlessly. Adding and subtracting products and services as your needs change is frictionless, and you can easily blend no-code, low-code and fully custom integrations in any way your growth requires.

By comparison, rigid platforms are frictionless at the beginning, but the consequences of being locked in add up fast. As your business evolves, any non-basic need that may arise, like high-risk processing, can be exceptionally difficult to manage. And, if you ever need any kind of customization, you may be faced with the disruption of switching providers. This process, also known as “rip and replace,” is painful and costly, often resulting in a negative experience for the merchant customer as well. The journey that seemed easiest at step one quickly becomes the far more difficult path as you scale.

Modular Payments Are More Cost-Effective

Modular payment systems are the most cost-effective option because they only require you to pay for the tools you need. For example, if you don’t sell subscriptions, why would you pay for subscription billing tools? Yet, part of the reason big platforms are so expensive is that these types of tools are priced in for everyone.

Modular payments allow you to build the stack that best serves your needs and your budget. Not only do you control which tools you pay for, but you can also easily bring your own processing, helping minimize transaction fees. NMI integrates with over 200 top payment processors, giving ISOs and SaaS builders the power to shop around and negotiate the best possible rates.

Modular Payments Enable Nimble Market Responses

Digital payments are evolving at breakneck speed, and new technologies and rails are constantly reshaping how customers want to pay. Staying competitive means staying relevant to merchants, and that requires you to adapt quickly as the market changes. Modular payments provide that agility.

With modular payments, you can quickly add new tech to your offering as your partner rolls it out, choosing where and when to integrate it. And, if your partner doesn’t offer something you need right away, you have the option to build it yourself or integrate a third-party solution using tools like API connections. You can get cutting-edge products to market faster and boost customer retention by meeting your merchants’ evolving needs.

Choosing a Partner to Power Your Modular Payments

Unlocking the power of a modular payments stack means finding a partner to provide you with the right bucket of bricks and the support to combine them effectively. Some key qualities to look for include:

- A wide breadth of services: The more products and services available, the more choice you have and the better you can serve your merchants. Choose a partner that offers the widest possible set of solutions and who can support you as you scale into the future

- Strong security and compliance: Securing payments and keeping systems compliant are complex tasks best left to experts. You need a partner with the most advanced security and the in-house expertise to keep you on track with compliance

- A developer-friendly environment: No-code/low-code, full control APIs, software development kits (SDKs), self-serve tools and sandbox environments all help ensure easy scaling and room for future growth. With a variety of integration options, you have more flexibility and control over what you add to your tech stack and when, even if you want to use low-code for one feature and build out another with APIs

- A partner-first mindset: Your modular payments platform isn’t just a vendor. They’re your support system and a critical player in your success. Look for a provider that offers the dedicated, world-class support you’d expect from a true partner

- A proven track record of innovation: One of the biggest benefits of going modular is the ability to bolt on new pieces as payments and tech evolve. Find a partner who never stops rolling out new features to help keep you on the cutting edge

NMI Makes It Easy To Design Tailored Payment Solutions That Scale

NMI’s modular payments platform offers a tailor-fit solution to meet the needs of every front-line provider — ISOs, SaaS platforms, owner-operators and enterprise-level alike.

As an NMI partner, you can choose exactly how you combine our turnkey products or integrate them with your own custom systems. This ensures an ideal solution for your business, your merchants and your budget. You are in control, and your payment systems adjust to you, not the other way around.

To find out more about our full line of modular payment processing and merchant services solutions, reach out to a member of our team today.