In our last consumer survey, we looked at some of the payment trends shaping how people shop and pay in 2025. Now, we’re digging into how people feel about embedded software payments — one of the industry’s fastest-growing areas today.

We talked to 1,000 U.S. consumers to learn how often they use in-app payments, where they’d like to see more of them, what kinds of experiences influence their decisions and much more. We found that consumers (especially younger ones) are enthusiastic about mobile app payments. In fact, 64% of Gen Z and Millennials say the availability of in-app payments directly influences where they shop, making this a critical consideration for Software-as-a-Service (SaaS) providers building consumer-facing apps.

In this article, we’ll break down what today’s consumers really want from in-app payment experiences and why these trends matter. Here’s a quick look at some of our findings:

- In-app payments have gone mainstream: young consumers still lead the charge, but most adults now use and trust them

- Consumers expect embedded payments: they want to use them for far more than just food delivery, rides, or retail, but across all their everyday activities

- Personalized offers and loyalty rewards are key: consumers increasingly value discounts and incentives tailored directly to them

- Biometric authentication is now the way to pay: most consumers are now comfortable using biometrics to make mobile app payments faster and more secure

In-App Payments Are a Regular Part of Consumers’ Lives

In-app payments are no longer “new.” In fact, half of all respondents said they now make in-app payments at least once per week. That indicates that we’re now well into the middle stages of the technology adoption life cycle.

With that being said, young, tech-forward consumers are still the most likely to demand in-app payments.

- 32% of Gen Z and 29% of Millennial respondents said they make in-app payments at least once per day

- An astounding 70% of Gen Z make an in-app payment on a weekly basis

- 64% of both Gen Z and Millennials said they’re likely to choose a business that offers in-app payments over a similar one that doesn’t

- 65% of Gen Z and 67% of Millennial respondents expect to use in-app payments even more in the coming year

- 67% of both Gen Z and Millennials said they’d pay for everything through an app if they had the option

The Takeaway

End customers now expect in-app payment options. The younger a user base skews, the more likely it is that the option will be a significant differentiator. As time passes, today’s “young consumer” will increasingly become the average consumer. For SaaS companies serving businesses, that means two things:

- As young consumers become more influential drivers of the economy, businesses will need in-app payments in order to stay relevant to their evolving customer base

- With the number of business owners under 40 at a 20-year high and exploding interest in micro-entrepreneurship among Gen Z, mobile app payments capabilities will be a base expectation of the young founders and executives seeking software solutions

Consumers Want Embedded Payments Everywhere

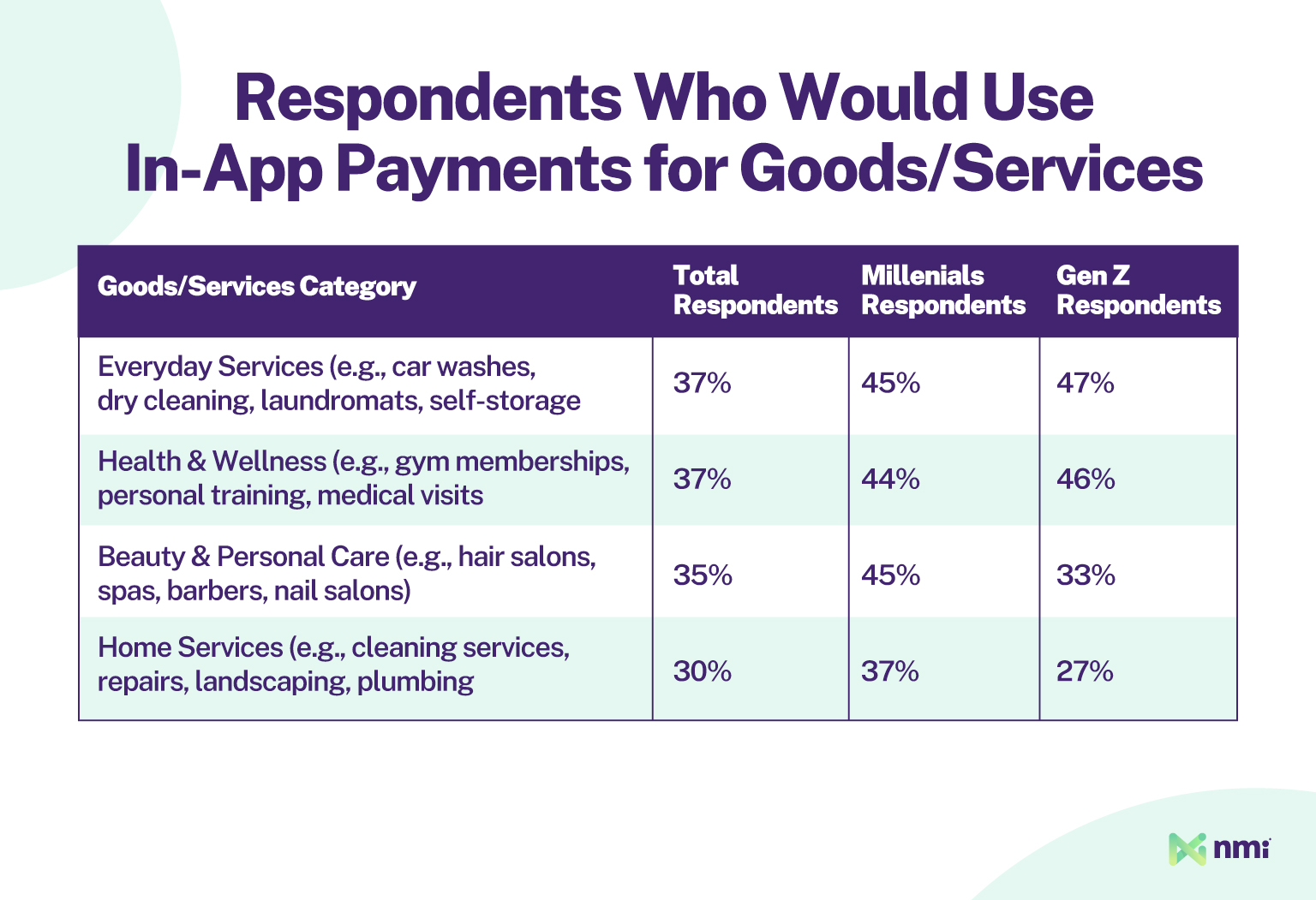

App-based embedded payments are already well established in categories like food delivery, ridesharing and ecommerce. But our research shows that consumers are looking for embedded app payments all across their daily lives, including everyday services, health and wellness, beauty and personal care and home services.

We asked our participants which goods/services they wanted to pay for through an app. Here’s an overview of their responses:

The Takeaway

The market for embedded payments is broader than many expect. For SaaS platforms serving business-to-consumer (B2C) businesses, there’s a strong chance that end customers not only want to accept embedded payments, but increasingly expect them — regardless of industry. In the future, even SaaS companies that have thrived without embedded payments will need to make them a priority to meet rising demand and stay competitive.

Consumers Across the Board Prefer Personalized Embedded Payment Experiences

Personalization is a big part of next-gen payments, especially with AI tools making hyper-personalization more cost-effective than ever before. While personalization is often cited as a driving factor for Gen Z users, our research found that the desire for personalized discounts and rewards is actually universal across demographics.

Nearly three-quarters (72%) of all respondents said they would find an app that “automatically suggests rewards and discounts based on your purchasing habits” appealing. That average includes:

- 82% of Gen Z

- 85% of Millennials

- 74% of Gen X

- 50% of baby boomers

The Takeaway

The preference for personalization among strong majorities of Gen X, Millennial and Gen Z respondents shows that, as time passes, personalization in software payments will become more important. For SaaS providers, this represents one additional layer of complexity that will need to be addressed in order to offer a complete, competitive payments experience.

Ultimately, this will have an impact on the build vs. buy decision, making it more attractive for SaaS companies to engage all-in-one solutions that can offer integrated personalization, rewards and loyalty features straight out of the box.

Consumers Are Ready for Biometric Mobile App Payments

Some in-app payments enable consumers to make more secure purchases by taking advantage of the biometric features built into their devices, an important benefit in a world of rising fraud. American consumers are still just beginning to warm up to more advanced biometric payments, like the new palm scanners in some retailers’ checkout lanes. But our research shows that the biometric authentication in phones, like thumbprint scanners and facial recognition tools, is already seeing wider adoption.

- 64% of all respondents said they were comfortable using biometric authentication to complete mobile app purchases, including 66% of Gen X, 75% of Millennials and 80% of Gen Z

- Most Millennial (50%) and Gen Z (53%) respondents said they’re very comfortable making biometrically authenticated in-app payments

The Takeaway

Biometric authentication through digital wallets matches the speed of a one-click or tap payment with unparalleled fraud prevention for both in-store and online purchases. For SaaS companies, building embedded payments into apps provides access to that additional layer of fraud screening, which protects everyone in the payments chain.

The ability to mitigate fraud at the source, fight illegitimate chargebacks and protect revenue are all major benefits that can only be unlocked through embedded in-app payments, making them a win-win for everyone.

Getting Started With Embedded App Payments

NMI Payments offers one-stop access to everything you need to unlock the frictionless, secure payment capabilities your users and their customers demand. From no-code and low-code snippets that make integration fast and simple to fully custom, application program interface (API) driven options, NMI enables you to take as much or as little control as you choose.

Embedded payments go far beyond just integrating gateways and checkouts. WE offer a complete solution to help you unlock more value from your software, including:

- Payments monetization: When your users get their payment processing services through your platform, you earn a commission on every transaction they process

- Omnichannel scope: Whether your users sell only through your app or on the web, in-store and in the field, NMI enables you to serve all their needs and open up diverse new revenue channels

- Modularity: NMI Payments is fully modular, allowing you to take only what you need and add with ease as you grow. That makes NMI the most flexible, cost-effective and scalable option on the market

- White labeling: NMI puts your brand forward by white labeling our solutions as your own. When your users sign up for payments or interact with your systems, it’ll be your business they see, not ours

To find out more about how you can quickly and easily add embedded payments to your app, reach out to a member of our team.