Payments is a technology-driven industry, and data sits at the heart of every advancement. One new source of data that stands to shake things up is open banking, an open-data framework that lets customers share their financial information with third parties to improve their services.

Unsurprisingly, this new level of access to consumer data is already making an impact across the payments ecosystem. It’s driving everything from new rails like pay-by-bank to improved orchestration and value-added services. At the same time, it introduces strategic challenges for traditional revenue models. Many use cases of open banking, such as identity verification, are already in high demand, while others are still years away from mainstream adoption. Regardless, open banking is gaining traction every year, and it’s time to start thinking about it.

So, to better understand this new technology, let’s explore the fundamentals of open banking, its growing influence on the payments space, the structural barriers that may affect its adoption, and the strategic opportunities available to organizations that can adapt effectively.

What Is Open Banking?

Open banking is a technology and regulatory framework that allows third-party service providers to access a customer’s banking data, as long as the customer gives explicit permission. Data is accessed through application program interfaces (API) provided by banks. Then, third-party financial technologies (fintechs) connect to these to build value-added services that can leverage customer data to reduce friction, simplify services or improve customization.

The ultimate goals of open banking are to provide users with more control over their data and to create more open, frictionless, secure and cost-effective financial services, such as:

- Account Aggregation & Personal Finance Management: With open banking, consumers can see all of their bank accounts, cards, loans and investments in one app, with budgeting and spending insights built in

- Lending: Real-time income, credit scoring and affordability checks enable financial institutions to offer faster and more reliable loan approvals

- Subscription & Bill Management: Open banking allows users to view, control and even cancel recurring payments directly, without having to sign into the third-party provider’s platform

- Data & Analytics: Companies using open banking can gain better insights into their business spending and financial health with cashflow dashboards and automated reconciliation

- Security: Users can control who can or cannot access their data, while real-time verification reduces fraud

- Pay-by-Bank: Consumers can connect their bank accounts to payment solutions (such as digital wallets) to pay directly by bank

- Onboarding: Behind the scenes, the wealth of data provided by open banking makes it faster and easier for payments providers to onboard and underwrite merchants

Open banking also offers several other benefits, including more reliable recurring payments and instantaneous, real-time balance verifications that reduce bounces from insufficient funds. In the near future, open banking may also enable instant account-to-account (A2A) refunds.

As we mentioned before, one notable benefit is the addition of a pay-by-bank option to online and mobile checkout. With pay-by-bank, a customer connects their account to a digital wallet or online checkout through a third party. That makes A2A payments as simple as paying by card. A2A payments settle instantaneously, carry no interest and cost far less to process than card payments do. That makes them an attractive option for both consumers and merchants.

All this provides users with a new, low-friction payment option that improves checkouts and recurring payments. But as open banking and pay-by-bank gain traction, they could potentially steal market share away from traditional card payments, which are already fending off a number of other emerging rails, like native digital wallet payments, peer-to-peer apps, stablecoins and buy now, pay later (BNPL) options.

Open Banking Is Still Very Early in the Adoption Cycle

The U.K. is one of the most advanced markets in terms of regulation and adoption. There, 20% of consumers and small businesses currently use open banking. On one hand, that’s a significant milestone. But it also demonstrates just how much room there is for growth in comparison to card payments. In the U.S., adoption rates are much lower, at just 11% of adults.

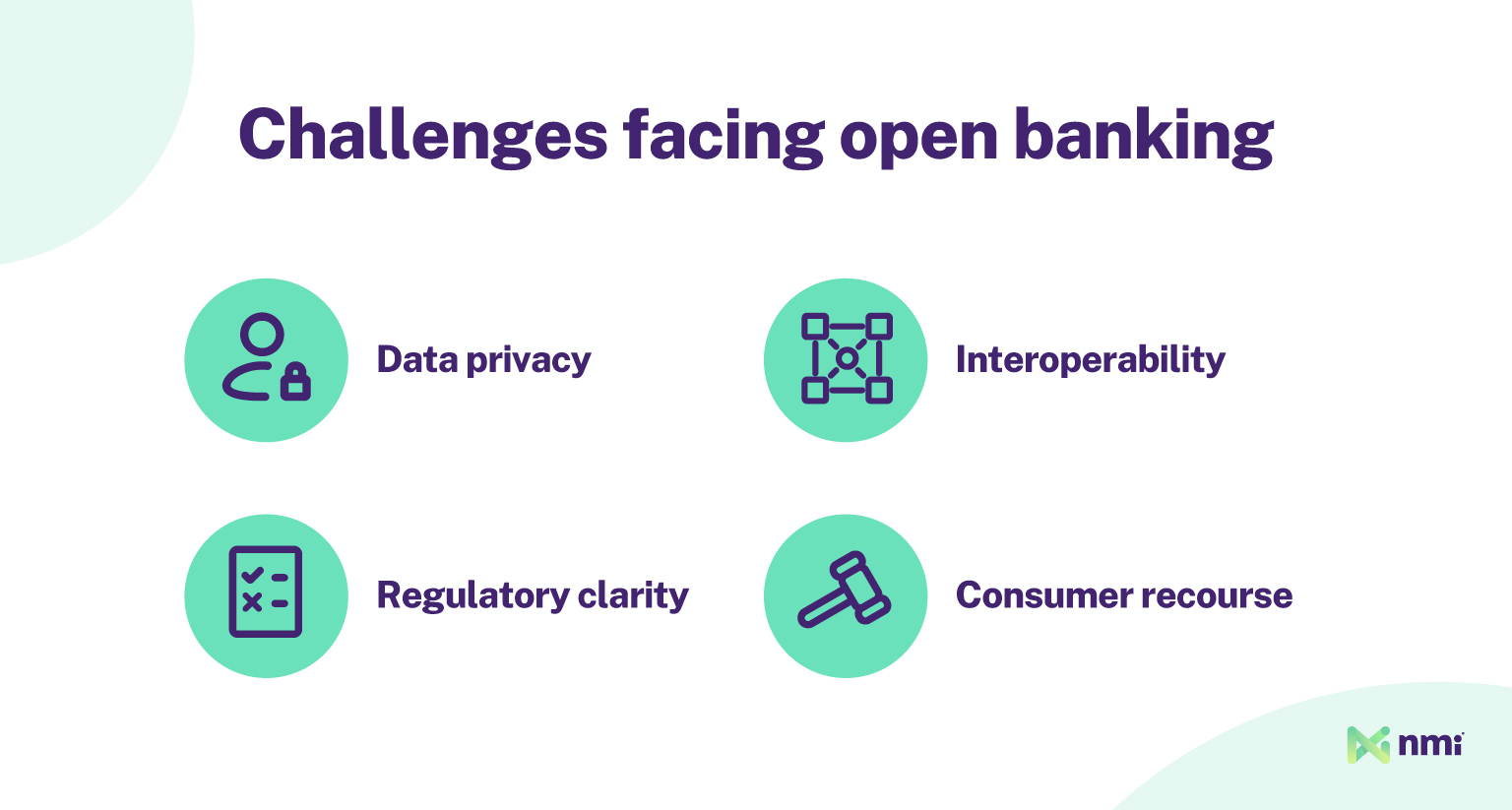

And, while open banking is growing, some key challenges could temper how enthusiastically both consumers and fintech companies embrace it, including data privacy issues, poor interoperability and regulatory uncertainty.

Data Privacy: Banking data is highly sensitive, and the amount of information about a consumer that’s available far exceeds what’s included in a standard credit card transaction. As it stands, less than half of Americans trust a bank or credit union to provide open banking payments. Even highly trusted third parties, like Amazon and Visa, can’t crack the 25% mark. To speed up adoption, banks and open-banking providers will need to convince users that their data is not only safe from attackers but also from internal misuse.

Interoperability: Regulation in the European and U.K. markets is in the process of standardizing APIs on the bank side. But API fragmentation and lack of interoperability are still problems in the implementation layer. In other regions, like the U.S. and Asia-Pacific, API standardization is immature or non-existent. That makes it harder for third parties to develop solutions, which slows down consumer awareness and adoption. Wide-scale interoperability and concrete API standardization will be necessary before open banking can become mainstream.

Regulatory Clarity: Open banking regulation varies wildly by country and region. The U.K. and EU have by far the most mature regulatory framework under Payment Service Directive 2 (PSD2). But the successors to PSD2 are already under development and will likely introduce several new rules around API standardization, consumer data protection and more.

In the U.S., the Consumer Financial Protection Bureau’s 1033 rule, which was meant to advance open banking, is currently in limbo in the midst of legal challenges, leaving the market without any open banking regulations. That said, Stripe has recently agreed to pay JP Morgan Chase for access to their bank data APIs, which could set a precedent for other banks and 3rd party fintechs under the current U.S. administration. The new compliance burden on open bank payments will be a challenge for the industry, so clarity and stability are badly needed.

Consumer Recourse: While refund mechanisms are being improved, A2A transfers lack a forced reversal mechanism like credit card charge-backs. That means consumers opting for pay-by-bank currently have no real recourse in cases where a merchant fails to meet their obligations or fraud is committed. Developing and regulating a mechanism to fill that gap is critical to bolstering consumer trust in open banking.

What the Rise of Open Banking Means for Payment Providers

For payments companies, open banking represents both a challenge and an opportunity. Low-cost A2A payments could challenge credit card dominance and put downward pressure on fees. However, there are also significant opportunities for payments leaders to develop third-party solutions and put open-banking data to work for themselves and their users.

Opportunity: Pay-by-Bank Integration

As open banking grows, more consumers will come to expect pay-by-bank to be available in mobile and online checkouts. Payments companies have an opportunity to build and integrate these solutions as a competitive differentiator, grabbing market share early on before open banking becomes mainstream. This opportunity extends to frontline service providers like software providers and independent sales organizations (ISOs), which can use pay-by-bank features provided by their partners to stand out and streamline otherwise tedious workflows like onboarding and underwriting.

Challenge: Pressure on Current Revenue Models

A2A payments offer extremely low fees, often under 1% in the U.K. and EU. They’re also often flat fees, making them very attractive for higher ticket sales. As open banking gains adoption, it may motivate merchants to disincentivize credit card use, putting new pressure on interchange rates, especially in the U.S. market, which has some of the world’s highest swipe fees.

Opportunity: Increased Margin on Low-Cost Processing

While pressure on swipe fees may strain payments companies that don’t adapt, it also represents an opportunity for the ones that do. The base cost of A2A transactions is so low that fintechs and payments providers building value-added layers have a chance to unlock higher margins on transactions while still offering merchants 40% to 85% lower end fees compared to credit card swipes. Payments companies can also use lower fees as an opportunity for improved orchestration, allowing transactions to automatically be routed to the lowest-cost option, boosting value to merchants even further.

Challenge: Costs of Data Access

In the U.S., a legal battle is underway to determine whether or not banks can charge for access to open banking data. In the meantime, banking giant JPMorgan is already rolling out fees, and payments-related data is hit the hardest. If things go the banks’ way, fintechs and payments companies could face steep costs for open-banking access.

Opportunity: Solving Fragmentation for SaaS Applications

Embedded software payments are where the industry is heading, and software-as-a-service (SaaS) providers will want pay-by-bank options. But open-banking API fragmentation can be a nightmare for developers, especially in the U.S. market. Payments enablers can provide significant value to SaaS companies by taking on that headache and offering unified, turnkey pay-by-bank services that can be embedded in software without having to navigate potentially dozens of individual APIs.

It’s Time to Start Thinking About Open Banking

Wide-scale, mainstream open banking is years away, especially in the United States. But payments companies should start planning for it now. Once it rolls out at scale, it could have major impacts on how the industry works and the way customers pay.

For frontline payment providers, the best way to stay ahead of major changes in the payments space is to partner with a payments technology enabler that never stops innovating — like NMI. To learn more about open banking and how it can improve processes like onboarding and underwriting, reach out to a member of our team today.