What if you could finance and pay for a purchase over time without a credit check or signing up for a personal loan? Buy Now, Pay Later (BNPL) lets you do just that. BNPL is a payment method that allows consumers to split large purchases into interest-free installments without prior credit approval. The first installment is due at checkout. Then the customer makes a payment, typically every two weeks or once a month, until their balance is paid off.

This payment method initially gained popularity on ecommerce sites, offering customers the option to split payments over time. As shoppers became more familiar with BNPL, adoption increased. However, with inflation at historic levels, fewer consumers are using BNPL to fund large, one-time purchases, and are instead relying on it to cover everyday expenses.

In January 2023, the U.K. Consumer Prices Index, including housing costs (CPIH), rose 8.8% to one of the highest levels since 1989. The same month, the U.S. reported a 6.4% annual inflation rate for the 12 months ending in January. Although inflation has dropped from its post-pandemic peak of 9.1%, rising costs continue to put pressure on consumers.

For many, buy now, pay later offers an alternative way to pay for rent, groceries, gas and other necessities without risking their credit health; it provides the extra breathing room needed to pay for everyday expenses. Unfortunately, having access to nearly endless credit with very little regulation has led to many consumers being unable to repay their debts. Because of this, governments in the U.K. and U.S. are considering implementing more stringent buy now, pay later regulations.

BNPL Regulations in the U.S. and U.K.

Buy now, pay later offers flexible financing with little to no interest. This has enabled shoppers to pay for larger purchases while helping merchants capture more sales. Unfortunately, while BNPL seems enticing at first glance, it comes with its own set of challenges, including scrutiny from government regulators.

U.S. Legislation

In September 2022, the Consumer Financial Protection Bureau (CFPB) issued a report on BNPL financing, citing data from the five most prominent BNPL providers in the U.S. Here are a few highlights:

- BNPL companies originated 180 million loans totaling more than $24 billion in 2021, nearly ten times the amount in 2019

- Approval rates increased from 69% in 2020 to 73% in 2021

- In 2020, 7.8% of consumers had at least one late fee. In 2021, this number rose to 10.5%

These numbers indicate that consumers are taking on more debt than they can afford. With such high adoption, the CFPB is concerned that BNPL companies do not provide appropriate buyer protection and disclosures, especially compared to other consumer finance models. For example, under the current buy now, pay later structure, buyers have minimal rights regarding dispute resolution and may be subjected to high fees if they cannot make their payments.

Regulators are also concerned that several BNPL lenders are shifting their business models to proprietary app usage. This would enable companies to collect (and potentially monetize) personal data – threatening consumer privacy and security. Because BNPL companies don’t have to share this data with credit reporting organizations, lenders may take on more risk than they realize if they approve a loan or new line of credit.

Although legislation is still many months (or years) away, the CFPB is working to identify new guidance to ensure BNPL lenders meet the same standards as credit card companies and receive appropriate oversight.

U.K. Legislation

In the U.K., the growing number of first-time BNPL users (4.1 million in 2022) has resulted in a 36% increase in complaints to the dispute settlement firm Financial Ombudsman Service (FOS). While the FOS has the legal authority to settle disputes between consumers and businesses, because BNPL is unregulated, the FOS is powerless to respond to these complaints.

To address this issue, the U.K. Financial Conduct Authority (FCA) announced that it is working on legislation to increase BNPL supervision. A proposal would come under Parliament’s consideration sometime in 2023. This announcement came shortly after the FCA published a study on the unsecured credit market, which concluded that BNPL represents potential harm to consumers.

What Will Buy Now, Pay Later Legislation Mean for Your Business?

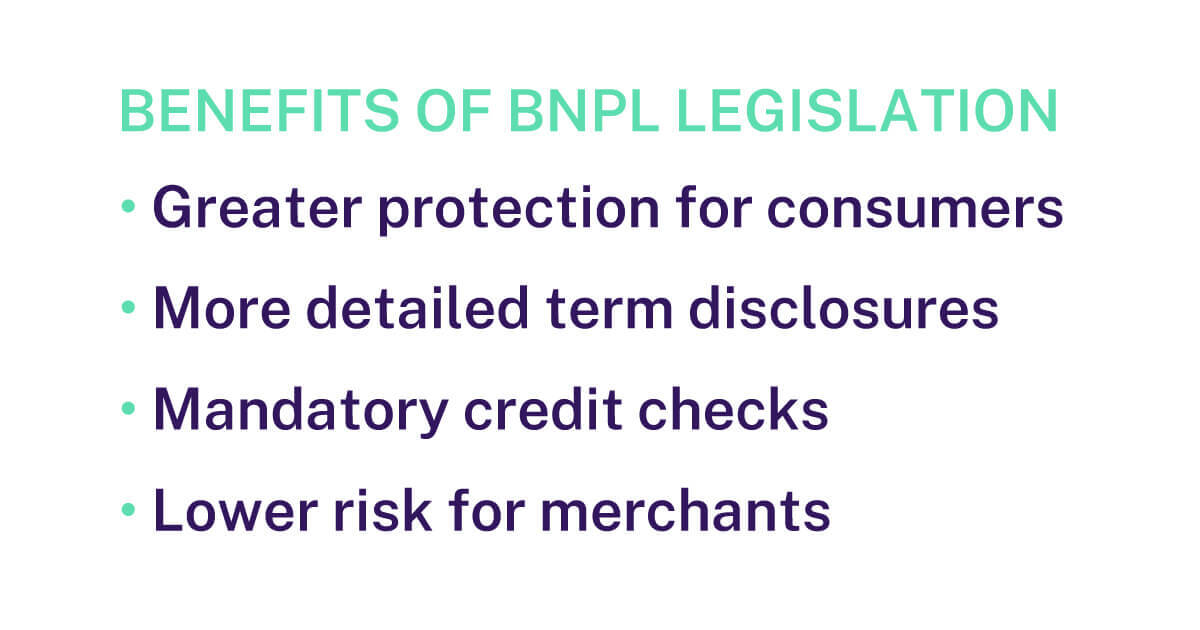

Buy now, pay later legislation will have its share of pros and cons. For instance, new regulations will provide consumers with more protection. While this represents a positive long-term change, merchants will likely see more consumer disputes.

On the other hand, laws will likely limit fee structures and require more detailed disclosures, so customers understand BNPL agreements better. Legislators hope this will lead to less confusion and fewer late payments. New regulations may also require BNPL companies to perform credit checks and share data with credit reporting organizations. This will lower the risks for merchants and their payment solution providers.

Beyond legislation, U.S. and U.K. merchants and their buy now, pay later app providers can mitigate some of these risks by taking advantage of advancements in open banking. Open banking offers third-party payment companies insight into consumers’ financial and credit histories. If done right, data sharing between payment facilitators will make it easier to determine whether consumers are eligible for BNPL credit.

The Future of Buy Now, Pay Later

Buy now, pay later apps allow consumers to pay for essential goods while avoiding interest charges and credit card debt. While several months (or years) away, new legislation will provide better protections for consumers, merchants and payment services providers such as ISOs, banks, credit agencies, merchant acquirers and even software developers.

To learn more, reach out to a member of our team today.