The payments industry is undergoing a transformation – one driven by changing consumer preferences and fintech innovators armed with next-generation payment features.

Innovative software developers and payments specialists have disrupted the way traditional payments companies operate. New technological advancements and customer-centric solutions have become paramount in this ever-evolving landscape.

Now, independent sales organizations (ISOs), independent software vendors (ISVs), payment facilitators (PayFacs) and merchant acquirers must adapt or risk losing relevance in an increasingly competitive and saturated market.

It’s no longer enough to offer simple payment acceptance. Instead, companies that want to compete and scale must find a full commerce enablement (FCE) solution that goes beyond payment processing to enhance payment facilitation and internal efforts while creating points of differentiation.

What Is Full Commerce Enablement?

Full commerce enablement goes beyond basic payment processing. It encompasses a comprehensive suite of solutions that span the entire merchant journey, from onboarding and underwriting to flexible payment acceptance and risk monitoring.

A full commerce enablement platform provides everything ISOs and software developers need to deliver an exceptional merchant experience. It allows businesses to own more of the value chain by leveraging their industry expertise while providing stronger customer relationships and the ability to deploy a diverse set of commerce solutions – resulting in revenue growth and higher margins.

With full commerce enablement, your business can transcend the limitations of turnkey payment platforms and offer merchants valuable services beyond standard payment acceptance. Because full commerce enablement partners are always innovating, you can provide customers with leading-edge payment solutions and value-added services without having to do everything yourself. This will allow you to expand your offerings while unlocking new recurring revenue streams.

In addition to customer-facing improvements, a robust full commerce enablement platform will make managing internal operations easier. It does this by simplifying (and automating) administrative tasks such as merchant management, data entry, underwriting, risk assessments and onboarding.

The best partner will do the heavy lifting for you, so you can focus on what you do best – providing an exceptional customer journey.

Full commerce enablement is designed to enhance every aspect of your business – from providing a more valuable merchant experience to boosting the productivity and efficiency of your team. It’s the perfect recipe for growth.

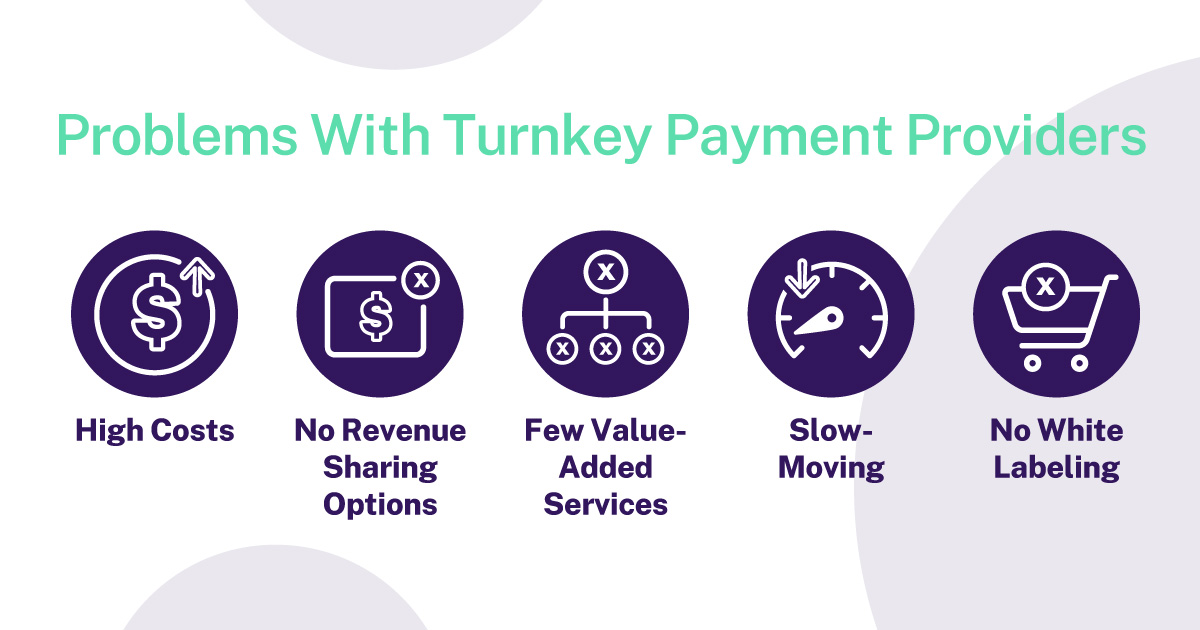

Problems With Turnkey Payment Providers

Traditional “turnkey” payment providers like Stripe and Square come up short when compared to full commerce enablement partners. Their payment solutions are limiting and difficult to scale, and they don’t provide the breadth of features required for businesses to meet merchant expectations and thrive.

Other issues ISOs, PayFacs and software developers may face when partnering with a turnkey provider include:

High Costs: Turnkey payments providers are more expensive for merchants and frequently increase costs. For businesses offering payment acceptance, they offer little to no flexibility to renegotiate terms, making it difficult to grow revenue and scale

- Revenue Share: Turnkey providers don’t typically offer payment integration partners equitable revenue share or give them control over pricing

- Value-Added Solutions: Most turnkey providers don’t offer value-added services beyond standard payment acceptance – leaving your team to fill in the gaps

- Slow-Moving: Many turnkey providers are slow to deploy new functionality and don’t deliver the competitive differentiation or flexibility required for growth

- White Labeling: Most turnkey providers don’t let customers use their own branding on their payment solutions, making it difficult to create a seamless customer experience under one brand

Limitless Growth – The Benefits of Full Commerce Enablement

A truly versatile full commerce enablement solution will offer merchants a more robust, secure way to accept payments – enhancing your business’ payment solutions and internal efficiency.

Enriched Payment Solutions

A full commerce enablement partner will constantly be innovating on your behalf, so merchants can offer the payment options that their customers demand without your team having to spend countless hours on research and development.

These solutions allow merchants to accept a variety of payments, including:

- Mobile payments

- Contactless payments

- Point-of-sale

- eCommerce payments

- In-app payments

Emerging payment solutions such as text to pay, tap to pay and buy now, pay later (BNPL)

Flexible payment options empower merchants to cater to their customers’ diverse needs, boosting customer satisfaction and loyalty. Over time, this reduces transaction processing time and improves cash flow.

The best solutions also offer built-in risk management and fraud prevention. These robust security measures (which include AI-powered fraud detection and tokenized data storage) help merchants avoid unnecessary risk and instill trust and confidence in their customers.

By partnering with a full commerce enablement partner, you can offer merchants access to valuable features, such as automatic card updates, digital invoicing and level II and III processing. With a suite of value-added services to choose from, your merchants can lean on you for everything they need to be successful, and you can unlock new recurring revenue streams.

Internal Enhancements

Behind the scenes, full commerce enablement makes it easier for ISOs, PayFacs and software providers to reduce costs and perform necessary workflows, including:

Administrative Tasks:

Full commerce enablement can automate various manual tasks to reduce the time (and effort) required to manage your business.

Merchant Management:

With merchant-level insights and automated workflows, your team can easily handle onboarding, merchant account setup and ongoing management.

Data Entry:

This solution streamlines data entry by removing the human element. It harmonizes integrated systems, ensures seamless data synchronization and reduces the risk of mistakes.

Onboarding:

Full commerce enablement allows you to reduce friction and get merchants onto your platform quickly and seamlessly.

Underwriting:

Underwriting is time-consuming and error-prone. By leveraging AI-powered underwriting tools and risk analytics, you can automate much of the merchant approval process and make faster, more confident account decisions.

Risk Management:

The best full commerce enablement solutions provide comprehensive risk assessment and management features, including fraud detection, chargeback prevention and transaction monitoring.

Why Choose a Full Commerce Enablement Partner?

Full commerce enablement offers the technological and operational enhancements your business needs to compete (and thrive) in an ever-growing industry. Whether you want to facilitate payments with your branding or add embedded payments to your software solution, you need a partner who understands your unique needs and can help you along your path to success.

Compared with turnkey payment providers, full commerce enablement partners can provide:

- An all-in-one solution for merchant management, acquiring and payment processing

- Equitable revenue sharing

- Enhanced efficiency and productivity

- Unified reporting at the business and merchant levels

The right partner will also allow you to white label payments to match your business’ branding. That means that every transaction that passes through your system will have your logo, branding and name attached to it. Instead of a third-party processor, customers will see your name every time they make a payment. White labeling not only improves brand recognition but also builds customer trust and loyalty – a game-changing combination most turnkey providers simply can’t provide.

For all of the dreamers and hustlers out there who refuse to settle, full commerce enablement brings the expertise, support and resources you need to scale your business.

Go beyond traditional payment acceptance. Don’t settle for turnkey payment platforms that offer subpar services while overcharging your business. Instead, empower your merchants to take their businesses to the next level and unlock the operational enhancements that only a full commerce enablement provider like NMI can deliver.

To learn more, contact a member of our team and schedule a free consultation.