Software is the future of payments.

Traditionally, businesses received their payment processing from banks and specialized financial organizations. Their operations—customer management, scheduling, inventory control and more—came from software companies. Now, many software providers are combining payment acceptance and operational tools by offering these two features in a single solution.

Today, 50% of merchants get their payment processing from a software platform instead of a traditional payments company. As more merchants prioritize the convenience of all-in-one software solutions, this number will likely grow.

Payments allow software providers to open new revenue streams and provide customers with an essential added service. For those looking to integrate payments into their software and become merchant acquirers or payment facilitators (PayFacs)—entities responsible for processing transactions for merchants—the payment industry can seem daunting.

Thankfully, adding payment acceptance to your tech stack doesn’t have to be difficult. By partnering with a reliable payment provider, software companies and SaaS (software-as-a-service) platforms can streamline payment integration and enable seamless software-based and in-app payment acceptance for their customers.

This article is part one of a 101-level series designed to provide software platforms with a foundational understanding of the payments industry, the merchant acquiring business and what they need to succeed in this demanding but highly lucrative space.

Merchant Acquirer or PayFac: Getting Started in Payments

Electronic transactions require numerous behind-the-scenes processes to function correctly. For instance, how does money move between banks? How do credit cards function? More importantly, where do merchant acquirers and PayFacs fit in, and what functions do they perform in the payments ecosystem (and what does any of this have to do with software providers)?

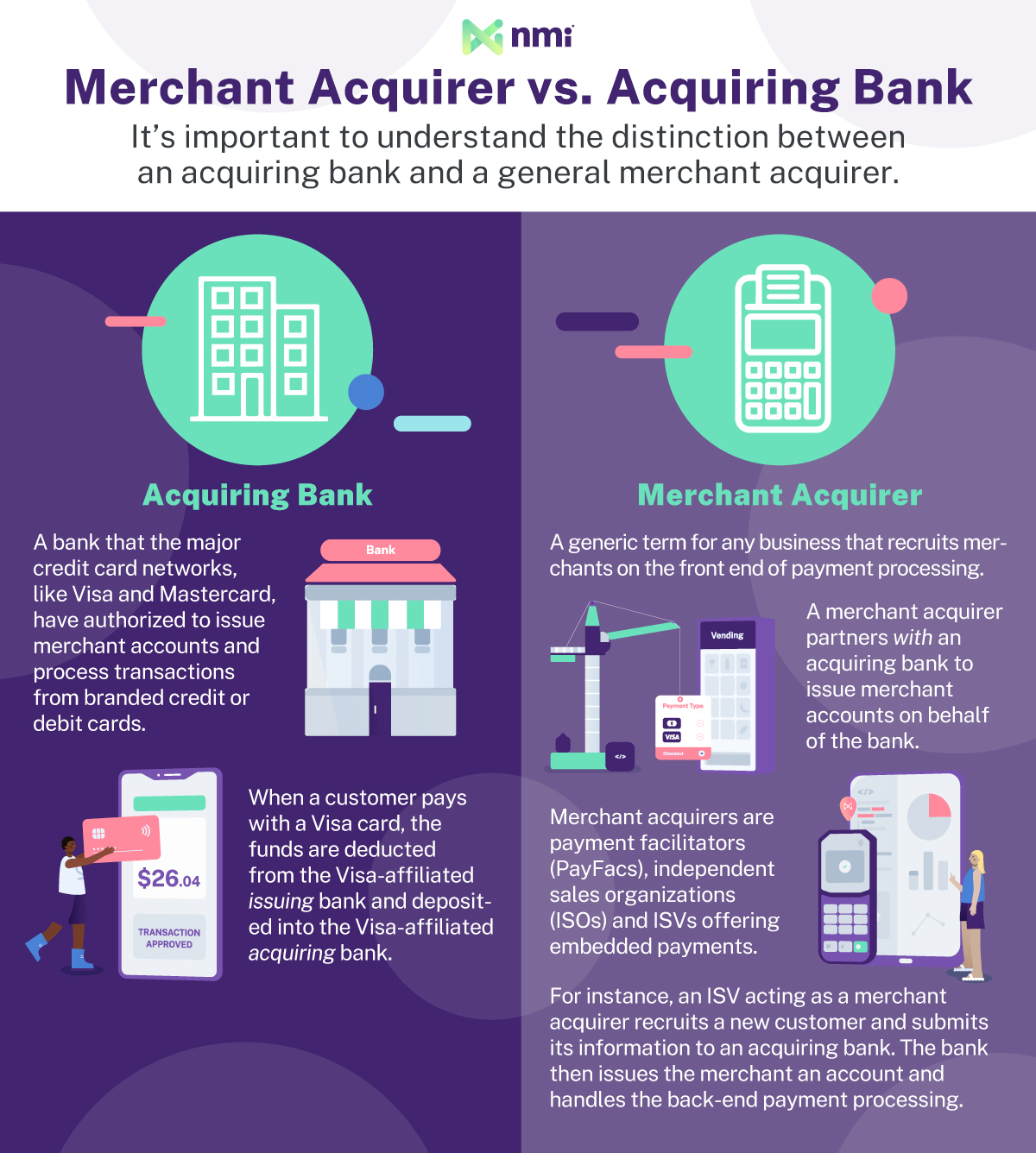

What Is a Merchant Acquirer?

Merchant acquirers are intermediaries that partner with acquiring banks to provide merchants with a merchant account—the special bank accounts needed to accept card payments. The acquirer handles their merchants’ payment needs and offers support, while the acquiring bank takes care of the behind-the-scenes processes (like payment processing, security, settlement and compliance).

In short, a merchant acquirer is responsible for:

- Recruiting businesses that need payments

- Providing them with a merchant account(s)

- Ensuring their payments are settled, and the money from each transaction is paid out

The acquiring process mainly focuses on recruiting and providing account services; a third-party partner almost always handles the settlement and payout process. The acquiring bank (or payment processing partner) stays in the background, while the software company is the primary point of contact. This is a great model for software providers who want to easily integrate payment solutions into their software without worrying about underwriting, compliance or risk management.

One of the primary downfalls of the merchant acquirer model is that the acquiring bank has more control over which merchants to accept. If a SaaS platform wants to onboard a high-risk merchant (such as a gambling business) but the acquiring bank refuses, they’re out of luck.

What is a Payment Facilitator?

Payment facilitators and merchant acquirers share several similarities—for instance, both facilitate payments on behalf of merchants. However, unlike merchant acquirers, PayFacs don’t directly acquire merchants. Instead, they act as intermediaries that sell payment services on behalf of payment processing or banking partners.

PayFacs often have more control over pricing and merchant onboarding than merchant acquirers. In this model, the payment facilitator acts as the primary merchant and recruits businesses as “sub-merchants.”

This means that transactions flow through the PayFac’s primary merchant account before going to the sub-merchant. Because they act as the primary merchant, PayFacs often undertake underwriting and risk management responsibilities. They must ensure the businesses they onboard as sub-merchants are trustworthy. While this means PayFacs have more control over who they accept as customers, they also have to bear more risk.

For the PayFac model to work, SaaS platforms must understand the complexities of the payments ecosystem and keep up with changing compliance regulations. Although becoming a PayFac is a common option for those looking to incorporate payment acceptance into their software, it’s easier (and more lucrative) for most software companies to partner with a payments provider instead of doing everything in-house.

Providing Merchant Enablement and Support

In addition to basic processing, merchant acquirers and PayFacs provide the supplemental services and support needed to keep payments running smoothly and securely. The best acquirer or PayFac will equip their customers with a payment gateway, fraud protection, data security, billing assistance, payment hardware and other services that the merchant needs. Ultimately, they should simplify merchants’ lives and streamline the payments experience.

Support is another critical aspect of acquiring. Fast, effective, centralized support will minimize merchant payment operations disruptions. By teaming up with the right payments provider, an ISV can leverage its partner’s decades of experience to provide excellent support.

Key Components of Merchant Acquiring

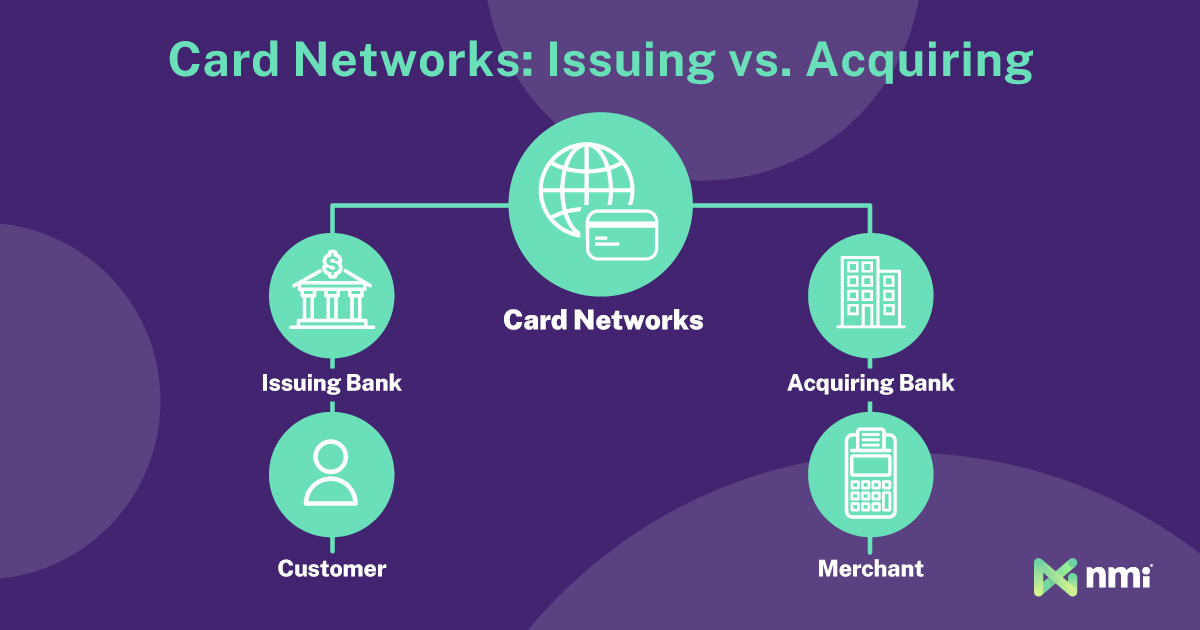

The payments space has two distinct, multi-level sides—issuing and acquiring. These two functions are major components that describe who a software company is offering payments deals to directly, what they sell, how they earn, and what they’re responsible for.

Payment Partners: Getting Off the Ground

While all merchant acquirers and PayFacs need a connection to an acquiring bank, only the largest have direct relationships. Generally, merchant acquirers and PayFacs will use an intermediary payment processor. The processor is a trusted partner; they provide infrastructure and banking connections so the software provider can focus directly on recruiting and serving end merchants.

The processing partner may also provide value-added services (VAS), risk management, technical assistance, payment hardware, support systems and more. Think about the payments industry as an inverted pyramid—it enables a small number of acquiring banks and card networks to serve millions of merchants around the globe.

For a SaaS platform, a direct payment partner is a valuable business relationship. The best partners equip software companies with the services they need to offer frictionless embedded software payments. They also give inexperienced providers the guidance and expertise they need to thrive.

Merchant Accounts: The Primary Product

Merchant accounts are central to traditional payment processing. They control how money from a card transaction moves from point A to point B.

Card transactions are typically tied to particular card networks. For instance, during a Visa transaction, money from the card holder’s credit account moves through the Visa network from buyer to seller. Since the money is in Visa’s network, it must be deposited into another bank account within Visa’s network.

It’s important to remember that not every bank or credit union is a member of every card network. Merchant accounts ensure that card payments are only routed to connected accounts. This distinction helps to prevent bounces and ensures that transactions are quick and efficient.

Other payment methods—like peer-to-peer (P2P) and account-to-account (A2A) payments—don’t require special accounts. However, credit and debit purchases always do. Merchant accounts ensure the infrastructure to facilitate a swift and secure transaction is always available.

Payment Processing: The Gears of the Machine

Processing involves everything from a customer initiating a credit card payment to a merchant receiving the money. To the customer and the merchant, that process is invisible. In reality, it involves authorizations, multiple anti-fraud scans, approvals, communication between three or more stakeholders, settlement, money transfers and more.

Thankfully, the software provider’s payment partner will handle this process on the software platform’s behalf. It happens entirely in the background, finishing in seconds for the end consumer and, generally, in one to two days for the merchant. When the process is finished, the money from a sale is deposited into the merchant’s bank account, and the transaction is complete.

Residuals: Getting Paid

SaaS platforms can turn payments from a cost center into an income stream in multiple ways. The simplest is a referral agreement; the software provider earns a commission on each lead they send to a third-party payment processor. Although effective, this strategy minimizes the software company’s potential earnings and adds friction for the merchant.

Earning direct residuals is a better opportunity. “Residuals” are the fees earned on transaction processing. Every card sale incurs a small fee charged to the merchant on top of the transaction amount. The bulk of that is called an “interchange fee”—the base fee set by Visa and Mastercard and owed to the acquiring bank.

Merchant acquirers and PayFacs can add their own markup to interchange fees and collect the additional revenue.

Each residual is a fraction of a percent of the transaction fee. While it may seem insignificant, residuals are earned on every transaction processed by every merchant, and they snowball. They also continue for the lifetime of a software provider’s relationship with its merchants. That means a software provider with a large portfolio of merchants, each doing tens (or hundreds) of thousands of transactions per year, can earn a lot in residuals.

Value-Added Services: Expanding Opportunities

Value-added services accomplish two important goals. First, they provide merchants with everything they need in one place—an increasingly important value proposition in today’s fast, digital world. The fewer vendors and partners a merchant has to juggle, the easier their lives are and, in turn, the happier and more loyal they’ll be.

Second, value-added services open up new revenue streams for acquirers and PayFacs beyond residuals. Offering value-added services enables SaaS platforms to charge for additional offerings on a monthly or transaction-by-transaction basis.

For example, many merchants are willing to pay a slightly higher fee per transaction to ensure each payment goes through advanced fraud screening. Software providers can set this feature to run passively in the background of a merchant’s account, earning them additional revenue without extra work.

Some common value-added extensions include:

- Rules-based fraud screening

- Advanced AI-based fraud screening

- Off-site card data storage

- Advanced data tokenization

- Automatic card updating

- Level II and Level III data processing

- Advanced buyer authentication with 3D Secure

- Accounting software integration

- Mobile SMS payments

The more value-added services a software platform offers, the better the merchant’s user experience is and the more money they can earn from embedded payments.

Support: The Heart of Long-Term Relationships

Every business takes payments. Unfortunately, interruptions or issues with processing can bring operations to a halt—costing merchants valuable time and revenue. To avoid these issues, merchant acquirers and PayFacs must provide support services that resolve problems quickly and effectively.

Naturally, most software providers are not payment experts. When a support request comes up, the partner must handle it directly or guide a support agent through resolution. If the partner can’t support the SaaS client, then they can’t support the end merchant. Because of this, software providers should select a partner with a top-quality and highly accessible support team, a long history of success with embedded payments and tools designed to streamline the support process.

Payment Card Industry Compliance: Keeping Things Secure

The Payment Card Industry Data Security Standard (PCI-DSS) is the set of security protocols laid out by major card companies to secure consumer payment data. Every party interacting with credit card data is responsible for PCI compliance to varying levels.

For instance, companies that store or transmit data directly have the highest compliance responsibility. Failing to comply increases the risk of a costly data breach and could result in hefty fines from the card networks.

The PCI-DSS is not simple; it has multiple levels of compliance depending on business type, twelve security standards, and physical and digital card data protection requirements. As a result, most merchants prefer to adopt systems with built-in PCI compliance.

Merchants expect their software provider’s embedded payment solutions to be fully PCI-compliant from the start. Software platforms can benefit from off-the-shelf solutions by building payment integrations around components like PCI-compliant payment gateways. Partners also play a role in meeting compliance standards. The right payment partner will provide access to PCI-compliant systems, minimize friction and offer years of compliance expertise.

Understanding what acquirers and PayFacs do and the key components of merchant acquiring is critical for software providers looking to integrate payments into their software. However, it’s also important to understand the industry’s complexities, the competitive landscape you’ll be entering and what it takes to succeed. Part two of our Merchant Acquiring 101 series will explore those topics and build on the foundational knowledge provided here.

To help your business navigate this unique environment, we’ve launched NMI Payments, a comprehensive embedded payments solution for software companies, independent sales organizations and other payment professionals. Our platform integrates easily with existing applications and payment solutions, offering a flexible, modular approach that expedites and streamlines payments.

With NMI Payments, you can take advantage of a flexible set of APIs and SDKs made for easy integration into any software platform or payment solution. Generate more revenue by offering payment solutions without the hassle or expense of designing a payment platform in-house. To learn more, reach out to a member of our team.