Macro consumer behavior trends aren’t static. They evolve and change. Concerns related to the economy, news and media influence, and technology that enables shopping on different channels all play a role in shaping what consumers buy and whether they make card-not-present or card-present transactions.

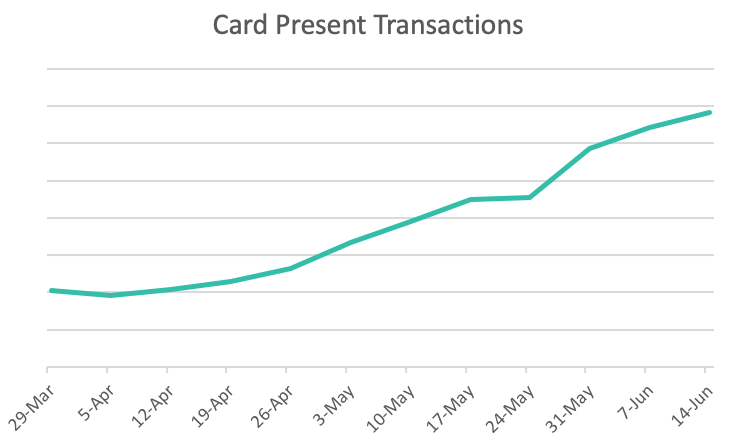

NMI monitors the volumes of card-present and card-not-present transactions on our payment platform. We have valuable data, from the time when most U.S. consumers were adapting their purchasing habits in response to stay-at-home orders, social distancing, and their concerns over COVID-19 to recent weeks when businesses could reopen.

Overall, purchases have trended up from the week of March 29 to June 14. However, the volume of card-present transactions has increased, while the number of card-not-present transactions is virtually flat. Since this period coincides with widespread shutdowns across the U.S. to the first weeks of businesses reopening, it appears that consumer behaviors are evolving again, taking advantage of the opportunity to make purchases in person, now that they have the opportunity to do so.

What card-present and card-not-present data shows

You can trace changes in consumer behavior during the COVID-19 coronavirus pandemic back to a few drivers. Many consumers faced uncertainty about their income and the future of their jobs, so they focused on purchasing essentials rather than luxuries. They were also more tuned in than usual to news about the spread of the virus and swayed by group influence — evidenced by shortages of certain items like bath tissue, hand sanitizer and thermometers.

Perhaps the biggest shift, however, was not in what they purchased, but how they purchased it. Forced to stay in as much as possible, consumers made card-not-present purchases for the things they needed. Many software developers can attest to the fact that their merchants responded by enabling online payments during the crisis — and getting their websites ready for new customers. A study by Arlington Research and PFS found that about 40 percent of consumers shopped via a brand’s website for the first time during the COVID-19 crisis, and, based on positive experiences, 45 percent of those shoppers plan to continue to make purchases on those sites.

With increased e-commerce activity in 2020, eMarketer projects that online sales in the U.S. will increase 18 percent to $709.78 billion, up from $601.65 billion in 2019. Some consumers opted to make online orders for home delivery, but buy online pickup in store (BOPIS) and curbside grocery order pickup blew past projections at the start of the year.

- At the end of May 2020, BOPIS purchases increased by 248 percent from pre-COVID levels, enabling consumers to avoid crowds or lines when making purchases.

- Consumers also discovered the convenience of ordering groceries online, with 52 percent of consumers surveyed in March 2020 stating they were first-time online grocery shoppers. As a result, online grocery orders are expected to grow 40 percent this year.

As competitive merchants scramble to provide their customers with the services and experiences they demand, they’re faced with the challenge of trying to prepare for an uncertain future. They need to determine, as the economy begins to reopen, will these trends continue?

Consumer behaviors that probably will continue

Based on NMI’s data, it appears that consumers won’t continue to avoid card-present transactions at the same level associated with COVID-19 shutdowns and stay-at-home orders. There are some trends that may persist, however.

Accenture points out that some behaviors that were trending in 2019 seem to be accelerated by the pandemic. Their survey in April reveals that consumers plan to:

- Limit food waste, 68 percent

- Shop more health-consciously, 59 percent

- Make more sustainable choices, 54 percent

- Shop more cost-consciously, 49 percent

- Shop local, 46 percent

- Make fewer shopping trips, 39 percent

Savvy software developers will focus on niches and clients that align with these consumer behaviors, which may give your business the greatest chances for growth.

As for the card-present vs. card-not-present question, you’d also be wise to provide your clients with a solution that manages both and gives them the flexibility to adapt to the unexpected and to changing consumer demands. Card-present transactions, at least for the foreseeable future, may not return to pre-COVID-19 levels, but our data confirms that your clients need the ability to accept and manage them as well as taking payments online.

This, too, will give your business its best chances for growth.

To learn more, reach out to a member of our team today.