White-Label the

Perfect Payment

Solution

Transform the payments experience for your merchants. Give them flexible, modular, easy-to-use solutions that further strengthen their trust in your bank or financial institution. The NMI payments platform makes more possible.

Talk to Our Team

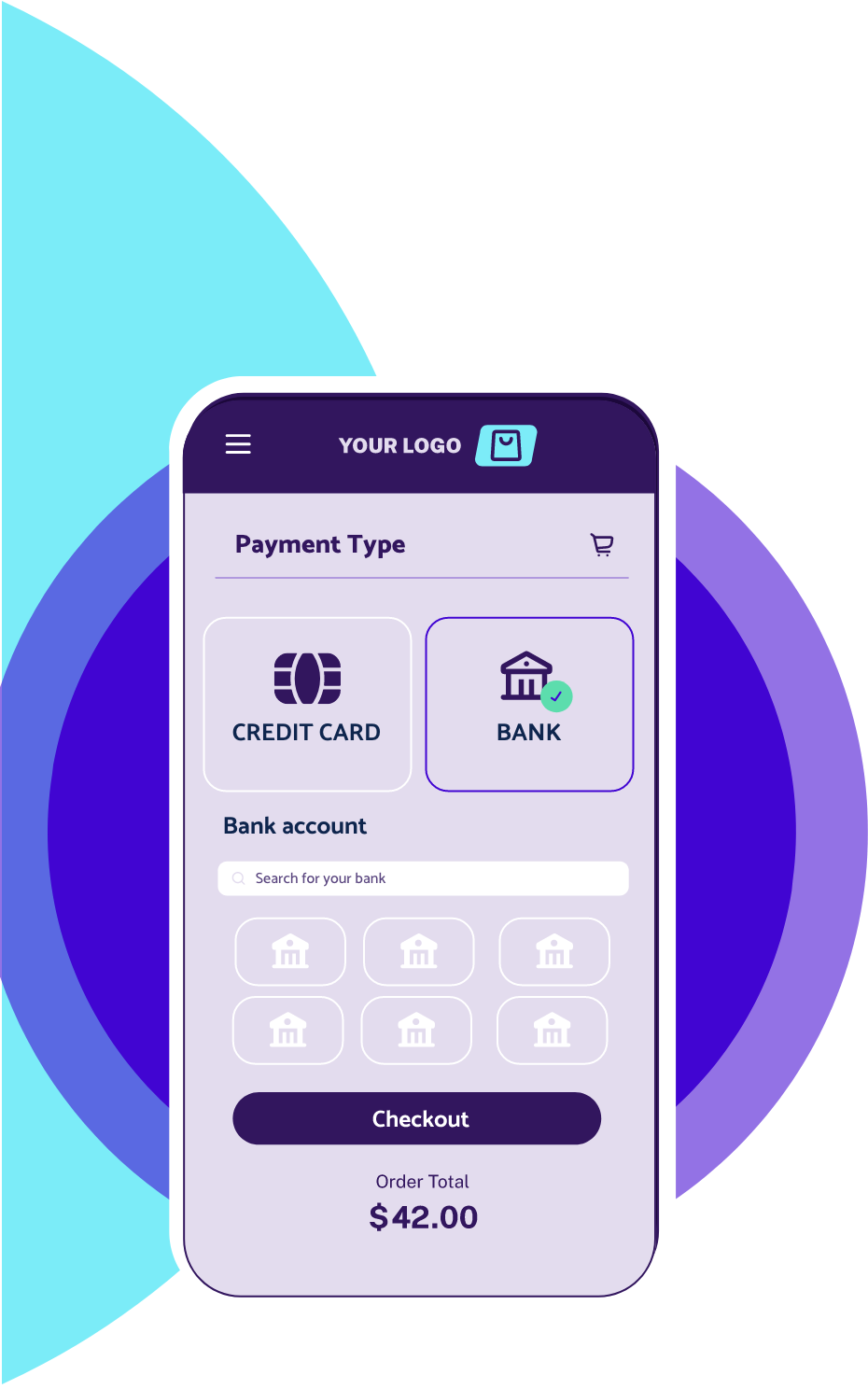

Your Customizable

Payment Platform

Some payment providers force merchants to use their

hardware—but when you white label with NMI’s payment

solutions, you’ll be giving your merchants the freedom of

choice to select from thousands of processor / device / checkout combinations.

With NMI, payments can easily be rerouted to a different

provider without any device interruption—so you’re never locked in.

Monetize

More Parts

of Your

Relationship

Expand Value-Added Services

Add-on services and extensions like NMI Customer Vault, Text-to-Pay, and NMI Bill Connect bolster your merchant relationships while generating revenue.

Entering New Channels

For payment providers that have traditionally specialized in one or just a few channels, shifting to an omnichannel strategy will keep merchants happy while potentially increasing payment volume.