Last updated October 23, 2025.

In April 2025, Visa launched two new initiatives: the Visa Commercial Enhanced Data Program (CEDP) and the Visa Acquirer Monitoring Program (VAMP). Each involves important modernizations to legacy programs and includes key changes that both merchants and acquirers need to understand.

CEDP is the next evolution of Visa’s Level 2 and Level 3 enhanced data program. It is aimed at improving enhanced data collection for corporate and government transactions. Launched in April 2025, it replaces Visa’s Level 2, Level 3 and Large Ticket (Non-GSA) interchange programs and impacts reporting and fees for merchants and acquirers handling B2B and B2G transactions.

The new standards required by CEDP are stricter than previous Level 3 data requirements. So, if any of your merchants currently depend on Level 2 or Level 3 transaction data to access strictly controlled contracts or unlock lower interchange rates, the change will impact you.

To help ensure you’re ready to seamlessly transition to the new system, let’s dive into the details of CEDP: how the new program works and what it means for you and your merchants.

How CEDP Works: Boosting Level 2 and Level 3 Data Quality

CEDP is a voluntary program that validates descriptive transaction data under a new set of standards and rewards compliant participating transactions with a 15 basis point (0.15%) reduction in interchange rates.

Starting on October 17, 2025, Visa Commercial Solutions (VCS) officially began validating the data from each submitted transaction by using machine learning. It will now also perform ongoing verification on merchants to analyze how consistently they meet the CEDP data quality standards. Based on the results, merchants will be classified into two categories: verified and non-verified.

Verified merchants will be eligible for interchange discounts with immediate, daily settlement. Non-verified merchants will still be eligible for incentives when they submit CEDP-compliant transaction data, but interchange incentives will be delayed and only applied after VCS has performed a data quality validation.

For acquirers, CEDP participation is completely voluntary. All participating relevant transactions carry a fee of 0.05% that acquirers will need to pay. But, as with previous L2 and L3 programs, CEDP enables acquirers to offer merchants lower fees and to benefit directly from lower interchange rates. It also enables acquirers to compete for merchants that sell into high-compliance business-to-business (B2B) and business-to-government (B2G) environments.

The CEDP program guide and new data requirements can be found in the Visa Enhanced Data Services File Specifications, available through Visa Online.

How Data Validation Will Work Under CEDP

CEDP now requires all transactions to offer “invoice-quality data” in order to qualify for Product 3 rates — the new program name for Level 3. The program will use advanced artificial intelligence and machine learning systems to check and validate submitted data in much higher detail than would’ve been possible at scale prior to the adoption of CEDP. While “invoice quality” is a bit of a loose term, it can be generally understood that transaction data must now be:

- Complete

- Accurate

- Highly-descriptive

- Error-free

While loosely filled out fields may have still qualified under the old Level 3 rules, the bar is much higher under CEDP. A quick description or a flat tax rate submitted instead of exact data could now endanger a transaction’s validation.

And there are a lot of reasons that a transaction’s data may fail to meet the new CEDP bar. In fact, there are over 100 data validation error codes that a transaction could return. Although that sounds daunting, it’s designed to give you and your merchants precise reasons for validation failure so that you can make corrections. And to ensure merchants have the opportunity to do just that, Visa will not revoke verified status based on just a few bad data points. However, repeated submission of incorrect or incomplete data without correction will eventually result in loss of status.

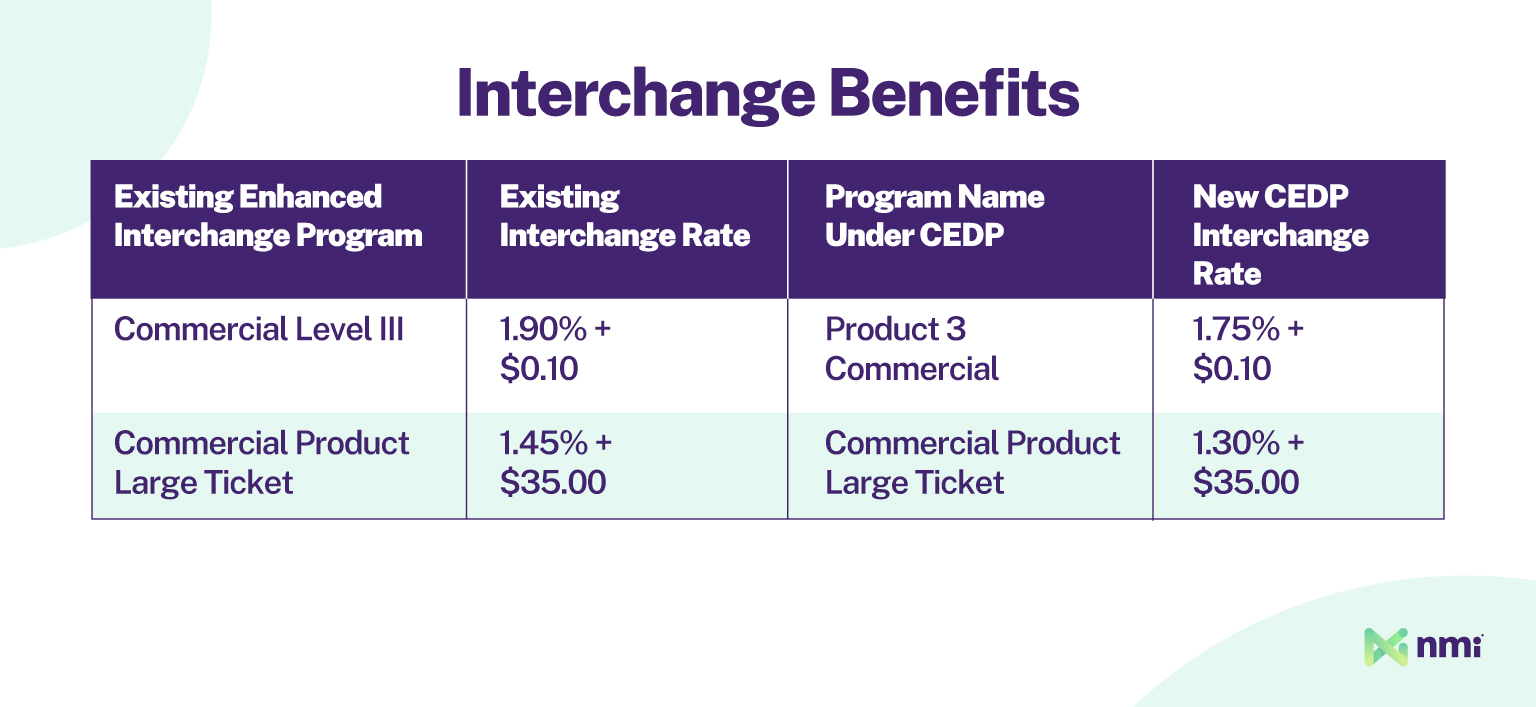

Visa CEDP Interchange Benefits

In April 2025, some of the previous interchange incentive programs became part of CEDP. They can be seen in the table below. There are other U.S. domestic small business products that also became eligible.

It’s important to note that Visa reserves the right to reclassify transactions as invalid and claw back interchange discounts if it finds errors in data. That reclassification could happen up to 45 days after settlement.

The Visa CEDP Timeline

CEDP is being rolled out in multiple phases over the course of 2025 and 2026.

April 12, 2025:

- Program was launched

- Participation fee of 0.05% applied to all CEDP transactions going forward

- Program does not include Fleet fuel-only Level 2 and GSA Government Large Ticket transactions

October 17, 2025:

- Beginning of VCS transaction data validation and merchant data verifications for submitted transactions

- New CEDP interchange incentives go into effect

- Deadline for merchants to fix any identified errors in their enhanced data to remain eligible for interchange discounts

April 17, 2026:

- End of previous Commercial and Small Business Level 2 interchange programs (except the Fleet fuel-only Level 2 program)

What Does CEDP Mean for NMI Partners?

The strict new data quality rules under CEDP mean that processors that currently map Level 3 data incorrectly will be putting their merchants at risk of losing their verified status and any potential interchange benefits.

Luckily, NMI Level III Advantage continues to be the simplest and most dependable way to ensure merchant data is collected and submitted accurately and in compliance with scheme requirements. Therefore, we recommend merchants continue to use Level III Advantage to automate their enhanced data collection. But it’s important to understand that, while Level III Advantage is a powerful mapping tool for CEDP, the raw data provided must be of good quality.

Under CEDP, Visa provides monthly reports to acquirers on merchant verification. Where applicable, please reach out to your acquirer for more information. These reports should be used to share non-verified status and any identified errors with merchants, so they can make necessary adjustments. But, while Level III Advantage is ready for CEDP, not all processors currently support the acceptance and processing of CEDP-compliant data.

Advanced Data Handling, Fraud Defense and Dispute Management

NMI offers a complete suite of tools designed to make staying ahead of changes like CEDP and VAMP simpler, including Level III Advantage, our advanced fraud prevention tools and our powerful reporting suite.

As an NMI partner, you can rest assured that you’ll always be at the cutting edge of the industry’s compliance evolution because we never stop updating and developing our payment solutions to ensure you’re covered.

However, it’s important to remember that while advanced fraud tools will assist you in this process, they will not provide specific error information or provide advice on how to rectify problems. To meet changing requirements and mitigate any related fees, it’s important to stay aware of changes and ensure your team has the tools and knowledge required to remain compliant. Your acquirer can help with this and should provide you with any additional information needed.

To find out more about how NMI can help you stay ahead of CEDP and VAMP, reach out to a member of our team today.