Updated June 2025. Scope: APAC/Canada/EU/U.S. See Visa’s VAMP FAQs for region-specific updates

April 2025 saw the launch of two new Visa initiatives: the Visa Commercial Enhanced Data Program (CEDP) and the Visa Acquirer Monitoring Program (VAMP). Each involves important modernizations to legacy programs and includes key changes that both merchants and acquirers need to understand.

CEDP is the next evolution of Visa’s Level 2 and Level 3 enhanced data program and impacts reporting and fees for merchants and acquirers handling B2B and B2G transactions. VAMP rolls multiple monitoring programs into a single, unified system and changes the thresholds for acceptable fraud and dispute rates and the penalties for exceeding them.

In this article, we’ll take a look at CEDP and VAMP, dig into what they do, and provide insight into what each program means for payment providers.

The Visa Commercial Enhanced Data Program Boosts Level 2 and Level 3 Data Quality

The CEDP is a new program aimed at improving enhanced data collection for corporate and government transactions. Launched on April 12, 2025, it replaces Visa’s Level 2, Level 3 and Large Ticket (Non-GSA) interchange programs.

CEDP is a voluntary program that validates descriptive transaction data under a new set of standards and rewards compliant participating transactions with a 15 basis point (0.15%) reduction in interchange rates.

How CEDP Works:

On October 17, 2025, Visa Commercial Solutions (VCS) will begin officially validating the data from each submitted transaction using machine learning. It will also perform ongoing verification on merchants to analyze how consistently they meet the CEDP data quality standards. Based on the results, merchants will be classified into two categories: verified and non-verified.

Verified merchants will be eligible for interchange discounts with immediate, daily settlement. Non-verified merchants will still be eligible for incentives when they submit CEDP-compliant transaction data, but interchange incentives will be delayed and only applied after VCS has performed a data quality validation.

For acquirers, CEDP participation is completely voluntary. All participating relevant transactions carry a fee of 0.05% that acquirers will need to pay. But, as with previous L2 and L3 programs, CEDP enables acquirers to offer merchants lower fees and to benefit directly from lower interchange rates. It also enables acquirers to compete for merchants that sell into high-compliance B2B and B2G environments.

The CEDP program guide and new data requirements can be found in the Visa Enhanced Data Services File Specifications, available through Visa Online.

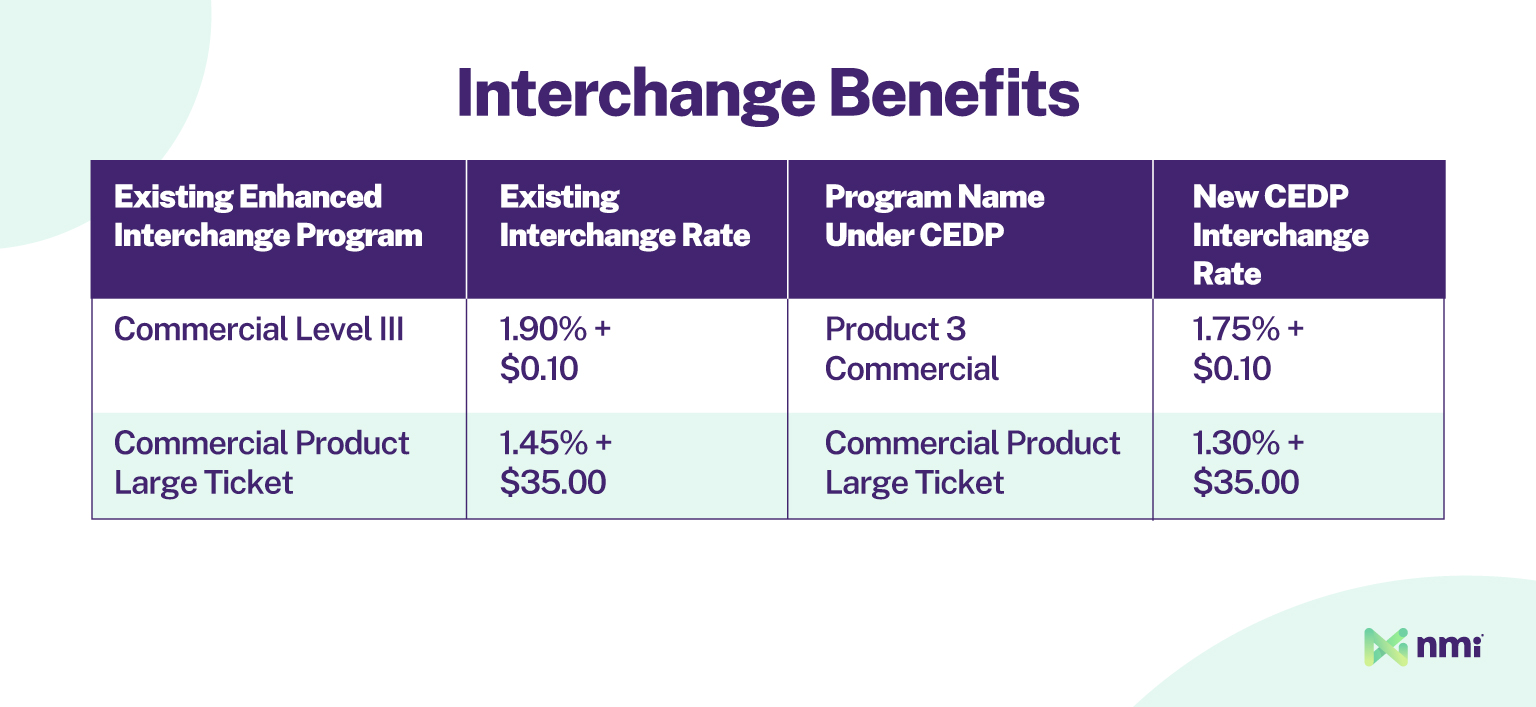

Interchange Benefits:

On April 12, 2025 some of the previous interchange incentive programs became part of CEDP. They can be seen in the table below. There are other U.S. domestic Small Business products that also became eligible.

CEDP Timeline:

CEDP is being rolled out in multiple phases over the course of 2025 and 2026.

April 12, 2025:

- Program was launched

- Participation fee of 0.05% applied to all CEDP transactions going forward

- Does not include Fleet fuel-only Level 2 and GSA Government Large Ticket transactions

October 17, 2025:

- Beginning of VCS transaction data validation and merchant data verifications for submitted transactions

- New CEDP interchange incentives go into effect

- Deadline for merchants to fix any identified errors in their enhanced data to remain eligible for interchange discounts

April 17, 2026:

- End of previous Commercial and Small Business Level 2 interchange programs (except the Fleet fuel-only Level 2 program)

What Does CEDP Mean for NMI Partners?

NMI Level III Advantage continues to be the simplest way to ensure merchant data is compliant with scheme requirements. Therefore we recommend merchants continue to use the Level III Advantage templating system to automate their enhanced data collection. It is important that the data provided is of good quality.

Under CEDP, Visa provides monthly reports to acquirers on merchant verification. Those reports should be used to share non-verified status and any identified errors with merchants, so they can make necessary adjustments. It’s important to note that while Level III Advantage is ready for CEDP, not all processors currently support the acceptance and processing of CEDP-compliant data. Reach out to NMI for a full list of CEDP-ready processors.

The Visa Acquirer Monitoring Program Realigns Fraud and Dispute Management

VAMP is Visa’s new streamlined fraud and dispute management program. According to Visa, it combines five existing programs and 38 remediation processes, most notably replacing the Visa Fraud Monitoring Program (VFMP) and Visa Dispute Monitoring Program (VDMP).

VAMP is part of Visa’s next-generation anti-fraud efforts and aims to reduce chargeback abuse, enumeration fraud and card fraud as a whole. The program also comes with a new set of rules and metrics that change the way Visa measures fraud and the thresholds merchants have to beat to avoid program enrollment and potential fines.

How VAMP Works:

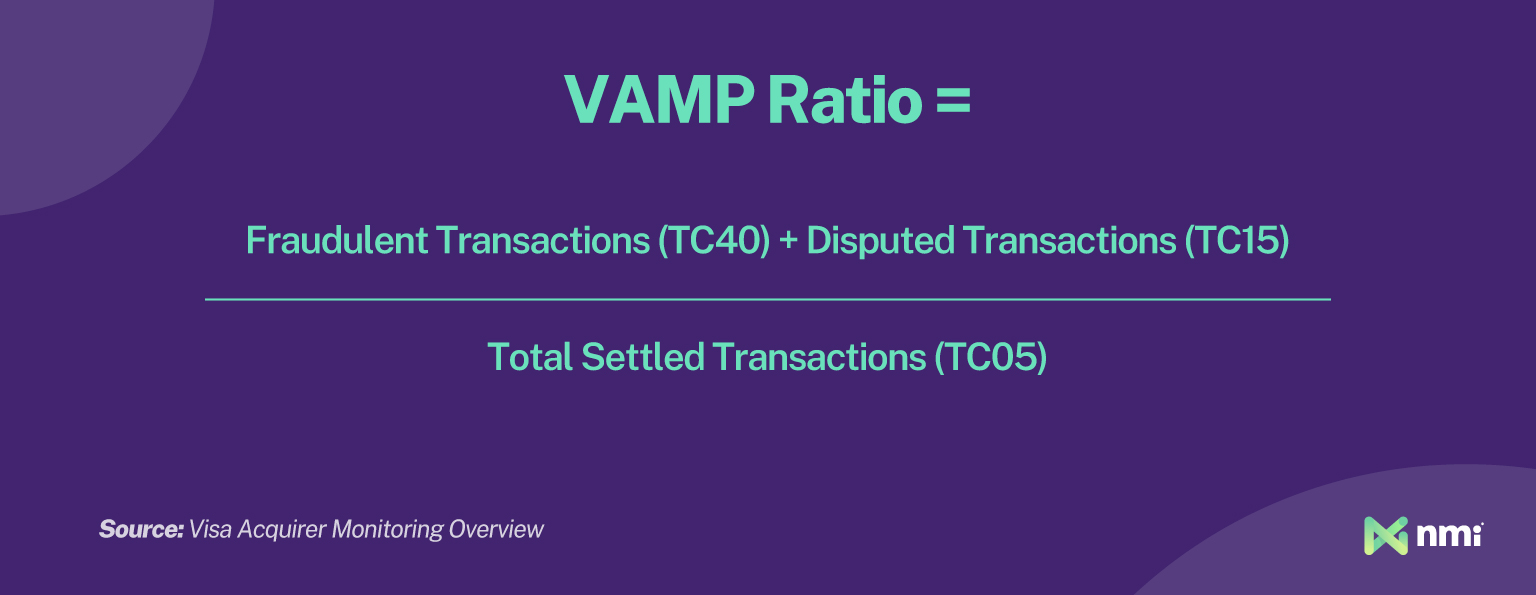

VAMP introduces a brand new metric called the VAMP ratio. This ratio is used to determine whether a merchant falls above or below the new thresholds for above standard and excessive chargeback rates.

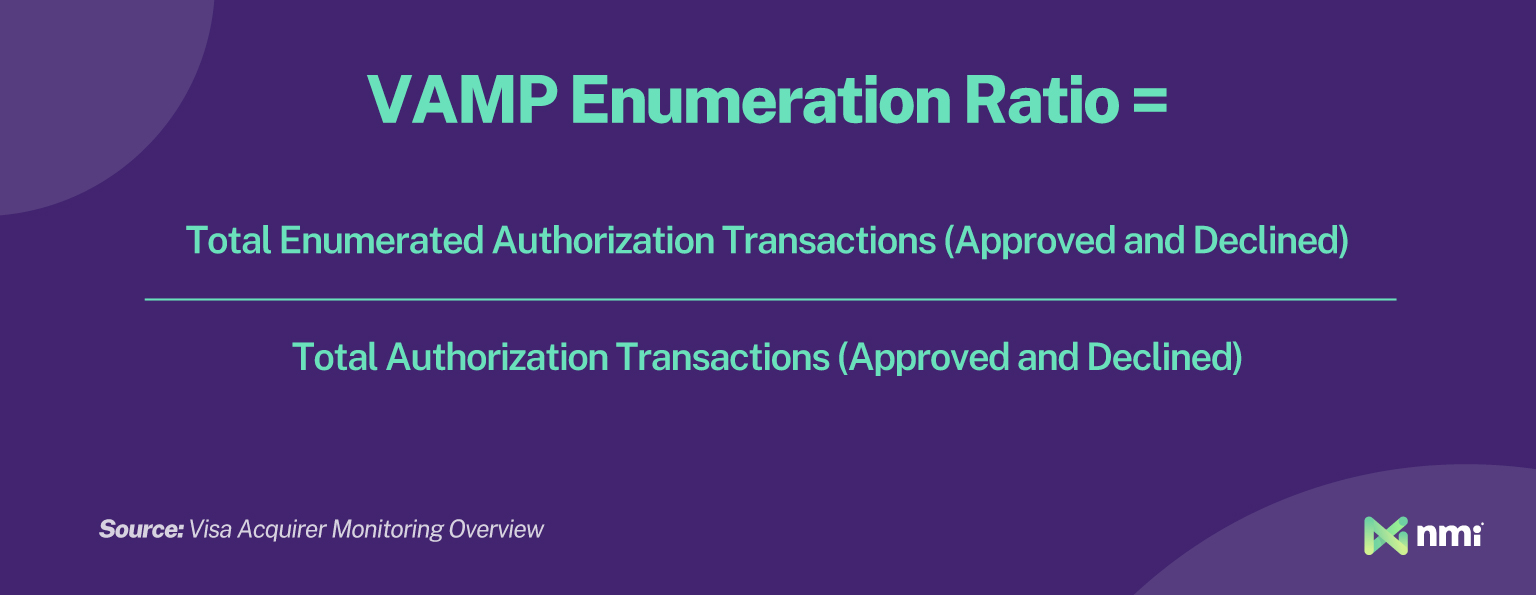

There is also a separate ratio calculated for enumeration fraud.

As of June 1, 2025 the VAMP ratio applies to merchants and acquirers with 1,500 or more applicable transactions, and the enumeration ratio applies to merchants with 300,000 or more enumerated transactions.

New VAMP Thresholds

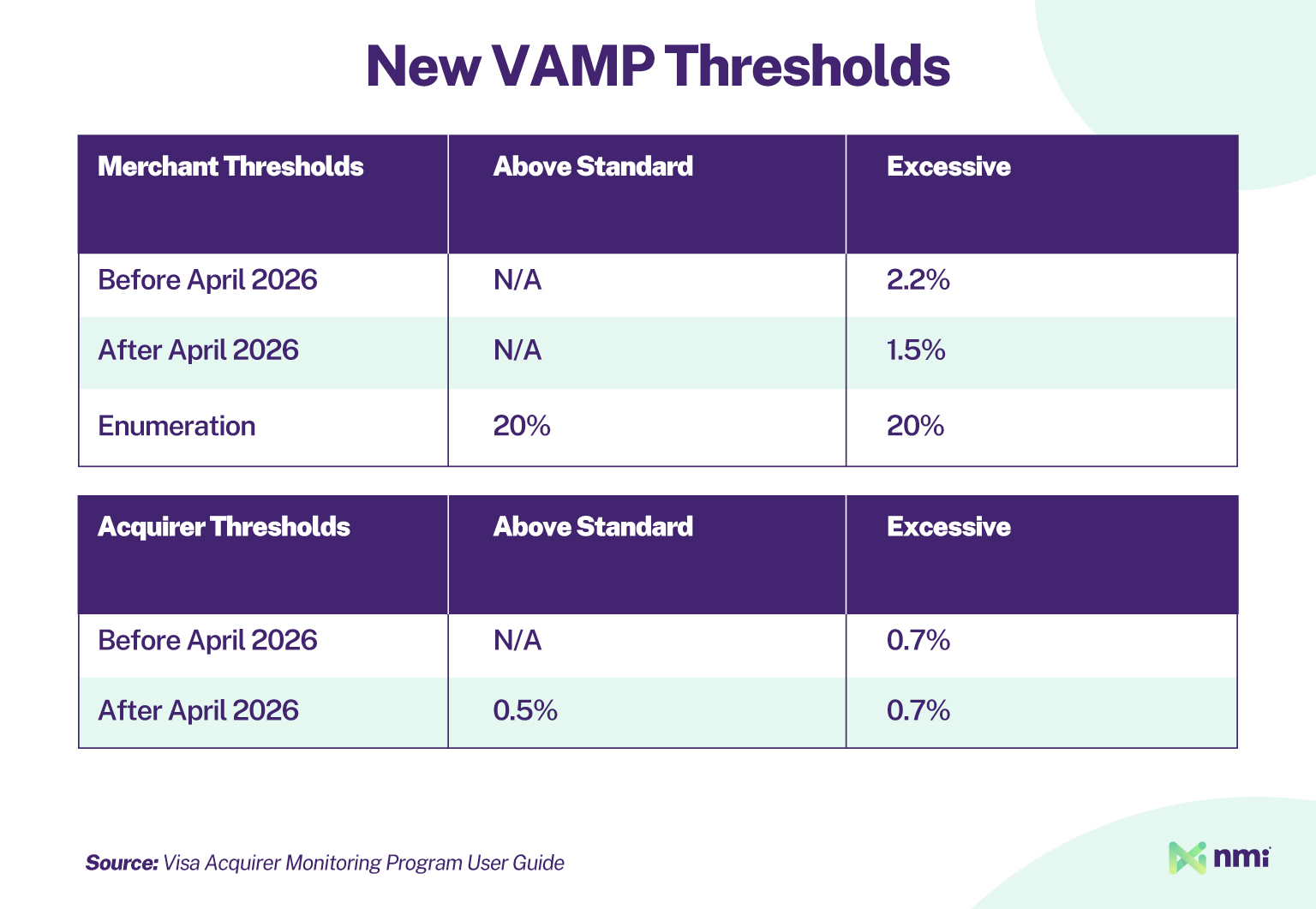

VAMP scores will be used to classify both merchants and acquirers based on the new monthly thresholds. However, it’s important to remember that these specifics are subject to change and will vary by region. The following applies to North America, the EU and Asia Pacific:

VAMP Enforcement Fees

Merchants and acquirers exceeding these VAMP ratios will be registered for monitoring and will face enforcement fees until issues are resolved and the ratio falls into an acceptable range.

For acquirers in the above standard category, a $4 fine will be applied to all fraud (TC40) and non-fraud dispute (TC15) transactions for any merchant with a VAMP ratio at or above 0.5%. Fines double to $8 per transaction for acquirers in the excessive category.

Merchants in the excessive category will be fined $8 on every TC15 and TC40 transaction.

It is important to note that what is described above are those VAMP ratios that Visa will be using for enforcement. It is highly likely that acquirers will establish their own ratios and fees in order to balance ratios over their merchant portfolio.

Source: VAMP User Guide, ChargebackGurus

*This article was last updated in June 2025. Please refer to Visa’s official website for the most up-to-date and regional rates.

Early Warning is Now a Courtesy

One more notable change is that, while Visa says it may send early warning notifications to acquirers when their VAMP ratio falls between 0.4% and 0.5%, the company makes a point to note that there is no longer any official “Early Warning” identification category as there was with VDMP and VFMP.

What is Enumeration Fraud?

Enumeration fraud is a type of card-not-present fraud where bad actors rapidly test different combinations of card information to find valid cards. It is a type of brute force attack where fraudsters start with a list of stolen primary account numbers (PANs) and programmatically test them with different expiry dates and CVV numbers. Like card spinning, it can be devastating for merchants.

VAMP Timeline:

April 1, 2025:

- VAMP goes live

- VAMP replaces Visa’s existing fraud and dispute monitoring programs

June 1, 2025:

- Updates to the program thresholds effective

October 1, 2025:

- The VAMP advisory period ends and the new VAMP ratio and thresholds go into full effect for all merchants and acquirers

January 1, 2026:

- Stricter (Above Standard) VAMP thresholds go into effect for merchants and acquirers

What Does VAMP Mean for NMI Partners?

For NMI partners, the elimination of the early warning category and the low thresholds for enrollment in VAMP mean four key things:

- VAMP ratios will vary from acquirer to acquirer: given that acquirers will be looking to balance the ratios over their merchant portfolio it is important for partners and merchants to understand how this may impact them. Seek an understanding of the ratios and fees early and often.

- Fraud prevention tools are more important than ever: occasional non-fraud disputes are an unavoidable part of doing business, but fraud and chargeback abuse can be significantly cut down using NMI’s advanced fraud prevention tools like Kount. Reducing rates is the frontline defense against VAMP enrollment.

- Proactive monitoring beats VAMP monitoring: merchants and partners can avoid VAMP enrollment by keeping a close eye on chargebacks and fraud internally. Merchants that aren’t already making extensive use of our fraud and dispute reporting tools should consider using them to track problem transactions and periodically calculate their own estimated VAMP score.

- Acceptable internal thresholds should be tightened: partners should consider their internal thresholds for merchant risk and dispute rates. With tighter rules under VAMP, merchants that were borderline cases under VFMP and VDMP thresholds may need to be remediated or terminated earlier.

Advanced Data Handling, Fraud Defense and Dispute Management

NMI offers a complete suite of tools designed to make staying ahead of changes like CEDP and VAMP simpler, including Level III Advantage, our advanced fraud prevention tools and our powerful reporting suite.

As an NMI partner, you can rest assured that you’ll always be at the cutting edge of the industry’s compliance evolution because we never stop updating and developing our payment solutions to ensure you’re covered.

However, it’s important to remember that while advanced fraud tools will assist you in this process, they will not provide specific error information or provide advice on how to rectify problems. To meet changing requirements and mitigate any related fees, it’s important to stay aware of changes and ensure your team has the tools and knowledge required to remain compliant. Your acquirer can help with this.

To find out more about how NMI can help you stay ahead of CEDP and VAMP, reach out to a member of our team today.