In April 2025, Visa launched two important new programs: the Visa Commercial Enhanced Data Program (CEDP) and the Visa Acquirer Monitoring Program (VAMP). While CEDP only impacts merchants who use Level 2 and Level 3 transaction data, VAMP is critically important to all of your merchants because it centers around fraud and dispute monitoring, the redefining of acceptable rates and the penalties for exceeding them.

In this article, we’ll break down everything you need to know about VAMP, including what it means for both you and your merchants and what can be done to keep dispute and fraud rates on the right side of the new rules.

The Visa Acquirer Monitoring Program Realigns Fraud and Dispute Management

VAMP is Visa’s new streamlined fraud and dispute management program. According to Visa, it combines five existing programs and 38 remediation processes, most notably replacing the Visa Fraud Monitoring Program (VFMP) and Visa Dispute Monitoring Program (VDMP).

VAMP is part of Visa’s next-generation anti-fraud efforts, and it aims to reduce charge-back abuse, enumeration fraud and card fraud as a whole. The program also comes with a new set of rules and metrics that change the way Visa measures fraud and the thresholds merchants have to beat to avoid program enrollment and potential fines.

How Does VAMP Work?

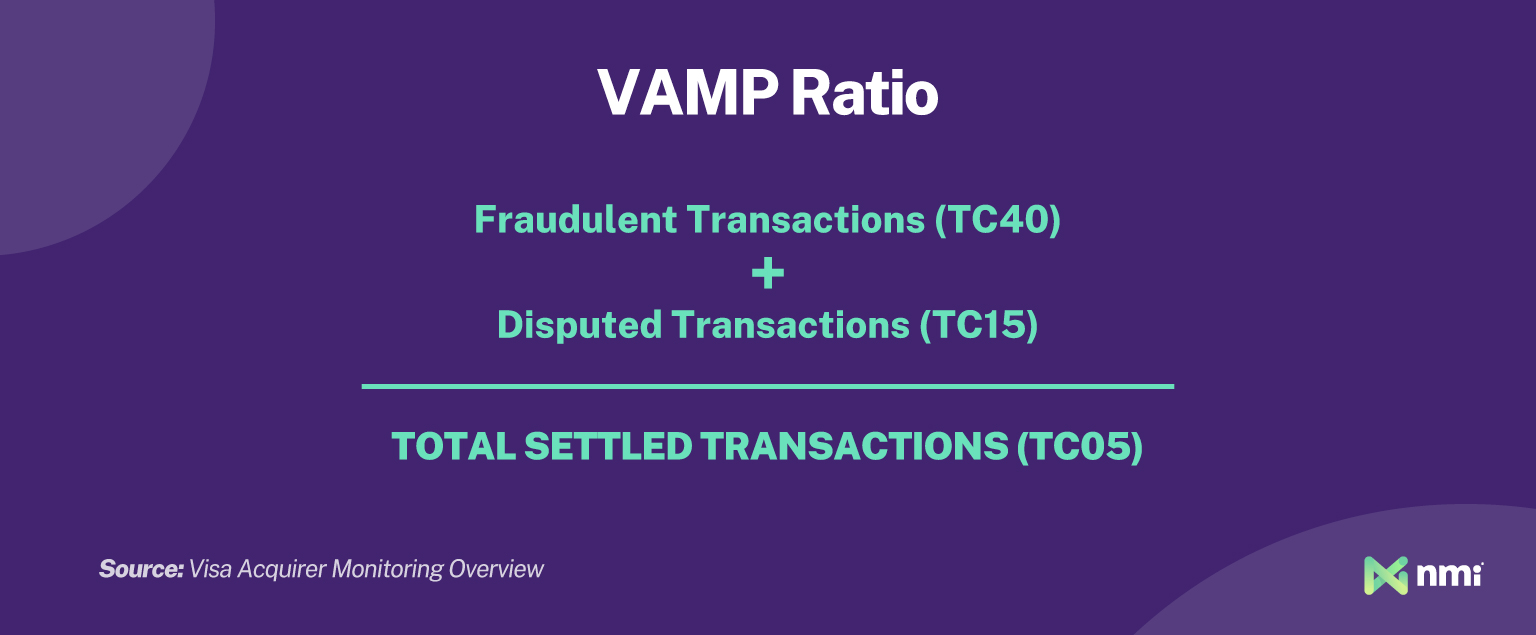

VAMP introduces a brand new metric called the VAMP Ratio. This ratio is used to determine whether a merchant falls above or below the new thresholds for above-standard and excessive charge-back rates.

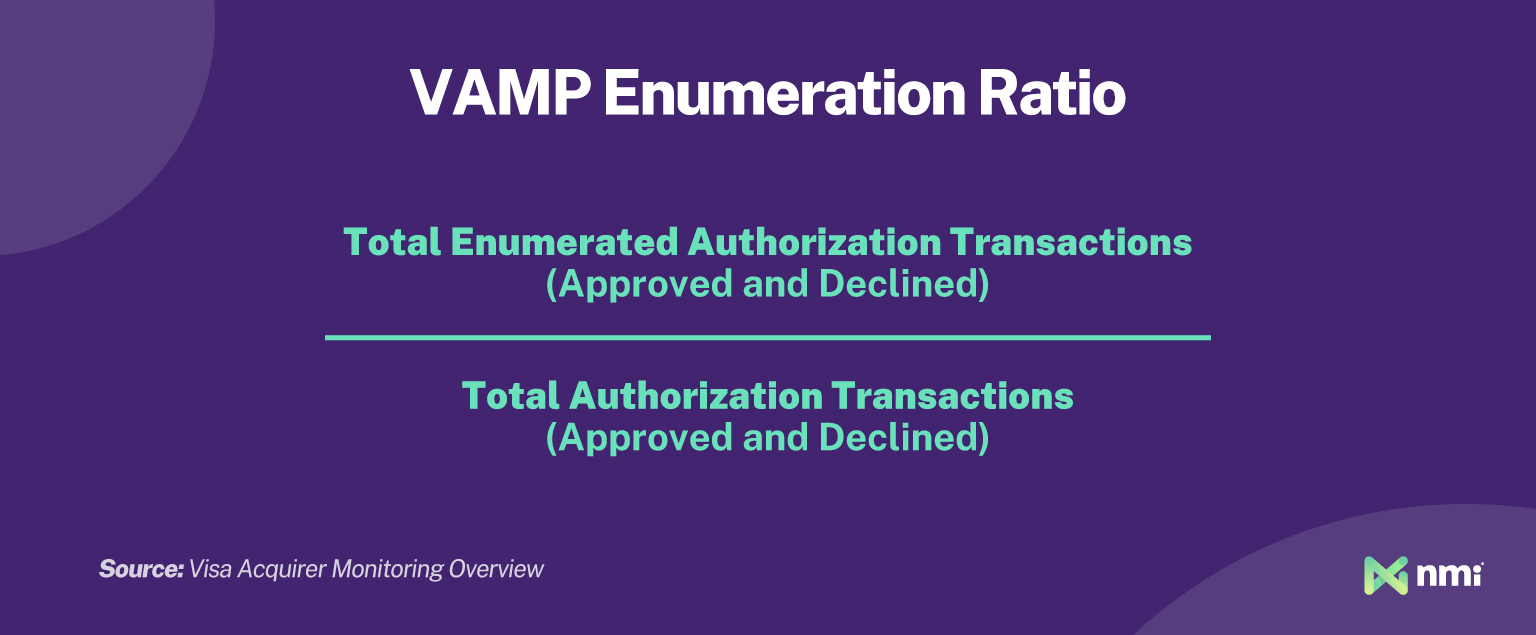

There is also a separate ratio calculated for enumeration fraud.

As of June 1, 2025, the VAMP ratio applies to merchants and acquirers with 1,500 or more applicable transactions, and the enumeration ratio applies to merchants with 300,000 or more enumerated transactions.

New VAMP Thresholds

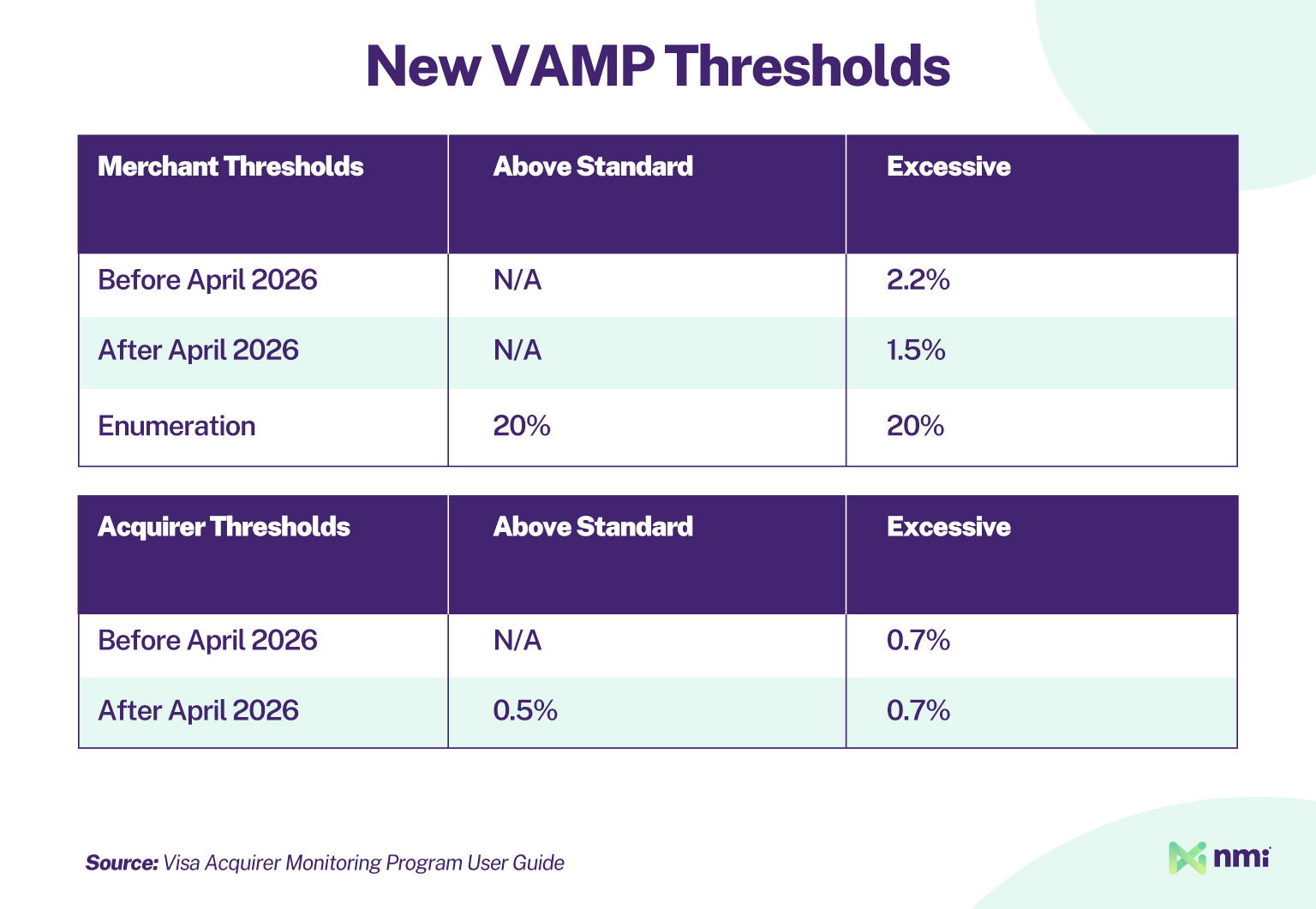

VAMP scores will be used to classify both merchants and acquirers based on the new monthly thresholds. However, it’s important to remember that these specifics are subject to change and will vary by region. The following applies to North America, the European Union and the Asia-Pacific region:

VAMP Enforcement Fees

Merchants and acquirers exceeding these VAMP ratios will be registered for monitoring and will face enforcement fees until issues are resolved and the ratio falls into an acceptable range.

For acquirers in the above standard category, a $4 fine will be applied to all fraud (TC40) and non-fraud dispute (TC15) transactions for any merchant with a VAMP ratio at or above 0.5%. Fines double to $8 per transaction for acquirers in the excessive category.

Merchants in the excessive category will be fined $8 on every TC15 and TC40 transaction.

It is important to note that what is described above are the VAMP ratios that Visa will be using for enforcement. It is highly likely that acquirers will establish their own ratios and fees in order to balance ratios over their merchant portfolio.

Source: VAMP User Guide, ChargebackGurus

Early Warning Is Now a Courtesy

One more notable change is that, while Visa says it may send early warning notifications to acquirers when their VAMP ratio falls between 0.4% and 0.5%, the company makes a point to note that there is no longer an official “Early Warning” identification category as there was with VDMP and VFMP.

What Is Enumeration Fraud?

Enumeration fraud is a type of card-not-present fraud where bad actors rapidly test different combinations of card information to find valid cards. It is a type of brute force attack where fraudsters start with a list of stolen primary account numbers (PANs) and programmatically test them with different expiry dates and CVV numbers. Like card spinning, it can be devastating for merchants.

VAMP Timeline

April 1, 2025:

- VAMP goes live

- VAMP replaces Visa’s existing fraud and dispute monitoring programs

June 1, 2025

- Updates to the program thresholds are effective

October 1, 2025:

- The VAMP advisory period ends, and the new VAMP ratio and thresholds go into full effect for all merchants and acquirers

January 1, 2026:

- Stricter (Above Standard) VAMP thresholds go into effect for merchants and acquirers

What Does VAMP Mean for NMI Partners?

For NMI partners, the elimination of the early warning category and the low thresholds for enrollment in VAMP mean four key things:

- VAMP ratios will vary from acquirer to acquirer: Given that acquirers will be looking to balance the ratios over their merchant portfolio, it is important for partners and merchants to understand how this may impact them. Seek an understanding of the ratios and fees early and often

- Fraud prevention tools are more important than ever: Occasional non-fraud disputes are an unavoidable part of doing business. Thankfully, fraud and charge-back abuse can be significantly cut down using NMI’s advanced fraud prevention tools like Kount. Reducing rates is the frontline defense against VAMP enrollment

- Proactive monitoring beats VAMP monitoring: Merchants and partners can avoid VAMP enrollment by keeping a close eye on charge-backs and fraud internally. Merchants that aren’t already making extensive use of our fraud and dispute reporting tools should consider using them to track problem transactions and periodically calculate their own estimated VAMP score

- Acceptable internal thresholds should be tightened: Consider using internal thresholds for merchant risk and dispute rates. With tighter rules under VAMP, merchants that were borderline cases under VFMP and VDMP thresholds may need to be remediated or terminated earlier. As a best practice, internal thresholds should be set well below VAMP’s

How To Help Merchants Stay Within VAMP Thresholds

When it comes to VAMP, the most important thing you can do for your merchants is educate them so that they understand the stakes and the potential costs of failing to stay under the new limits. To help you do that, we’ve prepared a Partner Playbook on VAMP that includes talking points for merchant conversations, email templates and access to a white-labelable merchant guide that you can brand as your own.

But, as an NMI partner, it’s important to go beyond just education. That’s why we offer a full suite of tools to help your merchants keep fraud and charge-back numbers low.

3D Secure (3DS): 3DS is a security protocol that requires cardholders to verify their identity using a one-time password, PIN or biometric authentication. Branded examples include Visa Secure and Mastercard EMV 3-D Secure. By enabling 3DSecure, your merchants can significantly reduce card-not-present fraud.

Kount Advanced Fraud Protection: Kount is an AI-powered fraud detector that offers screening both before and after a transaction occurs. With billions of transactions driving its machine learning, Kount is far more effective than simpler rules-based screeners, enabling it to catch more fraudulent transactions and minimize false positives.

Network Tokens: Network tokenization uses unique tokens issued directly from the major credit card companies like Visa and Mastercard. By issuing the tokens themselves, the networks reduce complexity and minimize fraud. And, in the case of a charge-back, network tokens make it easier to prove that a transaction was legitimate and secure, making cases easier to win.

Dedicated Chargeback Management: Disputes are inevitable, but far too many merchants rack up charge-backs without properly fighting back. We’ve teamed up with Chargebacks911 and Kount to offer post-transaction dispute management, making it easier for merchants to monitor cases and submit the compelling evidence needed to win more cases and push charge-back rates down. This is accessible via our Partner Portal’s “VAMP Guidance” page.

As an NMI partner, you can rest assured that you’ll always be at the cutting edge of the industry’s compliance evolution because we never stop updating and developing our payment solutions to ensure you’re covered.

To find out more about how NMI can help you stay ahead of both VAMP and CEDP, reach out to a member of our team today.