Merchants that lead their markets deliver the types of experiences their customers want. However, those preferences – and, frankly, customers themselves – change over time. Consumer habits and expectations evolve as the generations rise and age, and businesses need to respond by adapting to new payment trends.

Solution providers must consider the generational makeup of merchants’ customer bases, how they prefer to shop, and how they relate to the payment solutions businesses need.

A Breakdown of Shopping Preferences by Generation

Millennials

An evaluation of generational shopping habits and payment trends has to begin with a look at millennials. This group in their mid-twenties to early 40s – the “spending years” – is the largest demographic in the U.S. at 72.26 million according to the 2020 census, with an estimated $9.38 trillion in total wealth. Not surprisingly, many merchants are focusing on this cohort as they build their business roadmaps for the near future.

Millennial shoppers gravitate toward brands that share their convictions, such as sustainability, social justice, and support for charitable causes and their communities. Loyalty rewards also sway them. Retail Dive reports that 66 percent of millennials would switch brands in favor of a merchant that offers more loyalty rewards.

They’re also driving social commerce and expect the ability to see a product, click, and purchase as they’re scrolling through social media feeds.

Baby Boomers

Merchants need to remember that although millennials are the largest generation, they haven’t yet exceeded this older generation’s spending power. The Federal Reserve estimates the total wealth of consumers from their late 50s through mid-70s at $71.08 trillion.

This generation grew up window shopping and spending time on Main Street and in malls, and it was as much a social activity and entertainment as it was commerce. This glimpse into their past explains why excellent service in-store is important to them.

However, they’ve also discovered the convenience of browsing and shopping online, with 87 percent saying they research products on websites, and only 19 percent say they shop in-store only.

Gen X

Merchants will find Gen X, the cohort between boomers and millennials, tend to be the most conservative of their customers. However, their $42.16 trillion in wealth is nothing to overlook.

To capture their business, merchants need to earn Gen X shoppers’ trust and build relationships. Gen X consumers are also most likely to patronize local, independent businesses. They respond to deals and bargains, embrace store brands, and are generally open to sharing data to optimize their shopping experiences.

Gen Z

The youngest generational demographic, now building spending power, is Gen Z. This is the first digital-native cohort, and they’re accustomed to using social media and e-commerce sites to discover brands and find the products they need.

This generation isn’t digital-only, however. They also enjoy shopping in brick-and-mortar stores, and 65 percent prefer it. Bear in mind, though, that Gen Z shoppers will hold merchants to high standards for in-store experiences, preferring tech to enhance processes with efficiency and accuracy. Like millennials, Gen Z supports businesses that share their values, but they’re less likely to switch brands for a bargain.

Generational Payment Trends by Technology

In addition to engaging with merchants differently, consumers from different age cohorts also have different attitudes toward payment technologies.

-

Cash payments: Cash use is falling across the board. However, somewhat surprisingly, 37 percent of Gen Z consumers use cash, more than millennials and Gen X.

-

Contactless payments: Visa reports more than three-quarters of consumers changed their payment habits due to COVID-19, and contactless payment adoption increased. Millennials are most sold on this payment method, with 56 percent even saying they’re likely to avoid shopping in a store that doesn’t offer a contactless payment option.

-

Mobile wallets: Over half of Gen Z (57 percent) and millennial consumers (67 percent of young millennials and 53 percent of older millennials) use mobile wallets, making them the most likely age groups to tap and pay with their smartphones. Remember, though, that 46 percent of Gen X and 32 percent of baby boomers also use mobile wallets, representing millions of consumers expecting to complete transactions with this payment method.

-

P2P: PYMNTS reports that peer-to-peer (P2P) payments are gaining traction, primarily with Gen Z. About 75 percent of young consumers use a P2P product each month.

The Takeaway for Solutions Providers

If it doesn’t appear that one payment type or shopping journey is a clear preference among a particular generation of consumers, you’re right. Moreover, few merchants have customer bases that are comprised of only one generation of consumers.

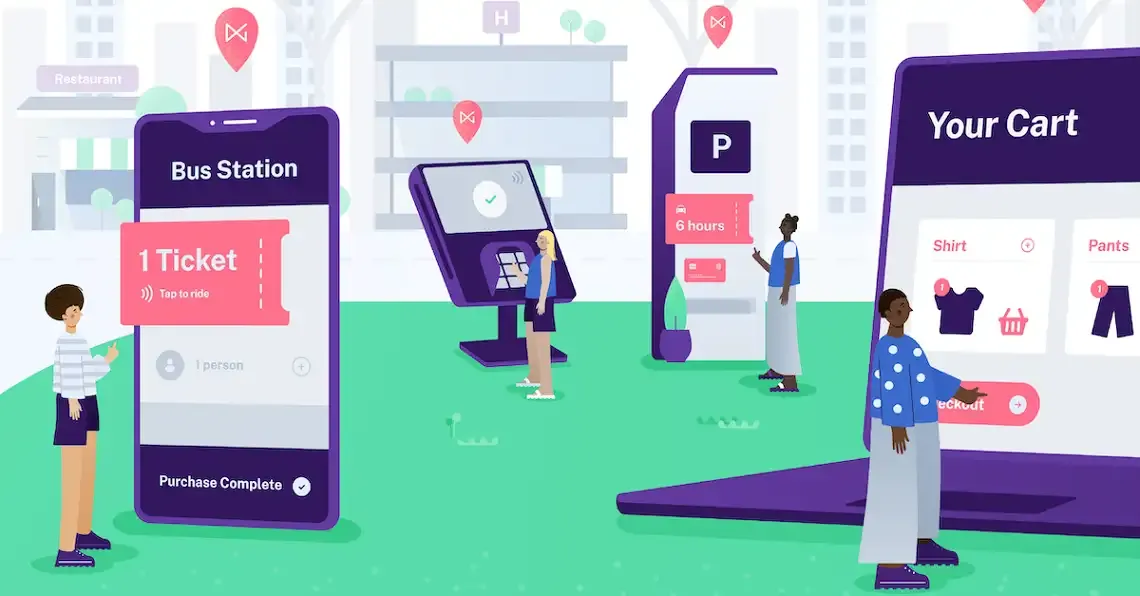

Equip your clients with the tools they need to create payment experiences that will delight their customers of all ages. This starts by integrating your solutions with a full commerce payments platform that enables all forms of payments, however consumers choose to engage.

NMI offers a full suite of payments solutions that provide a range of experiences that will meet all consumer preferences. Furthermore, NMI follows and analyzes payment trends and continually invests in new solutions that will meet consumer demands in the future.

Contact us to learn more about a payments platform for the generations.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.