- What Is Embedded Lending?

- Why Does Embedded Lending Matter for SMBs?

- How Does Embedded Lending Work?

- Embedded Lending vs. Other Financial Tools

- What Are the Benefits of Embedded Lending?

- Choosing the Right Embedded Lending Partner

- Market Outlook and Future Opportunities

- Win Big With Embedded Lending

When your merchants are juggling supplier bills, payroll and plans to grow their business, even one late invoice can throw their cash flow off balance. That can lead to strained supplier relationships, missed opportunities and slower growth. In fact, 75% of small to medium-sized businesses (SMBs) already struggle with cash flow problems caused by overdue payments.

The good news is there’s a solution: embedded lending. Let’s look at what embedded lending is, how it works and how it helps merchants and business customers access working capital more easily. We’ll also touch on some new technologies and share tips to help you get started.

What Is Embedded Lending?

A Simple Definition

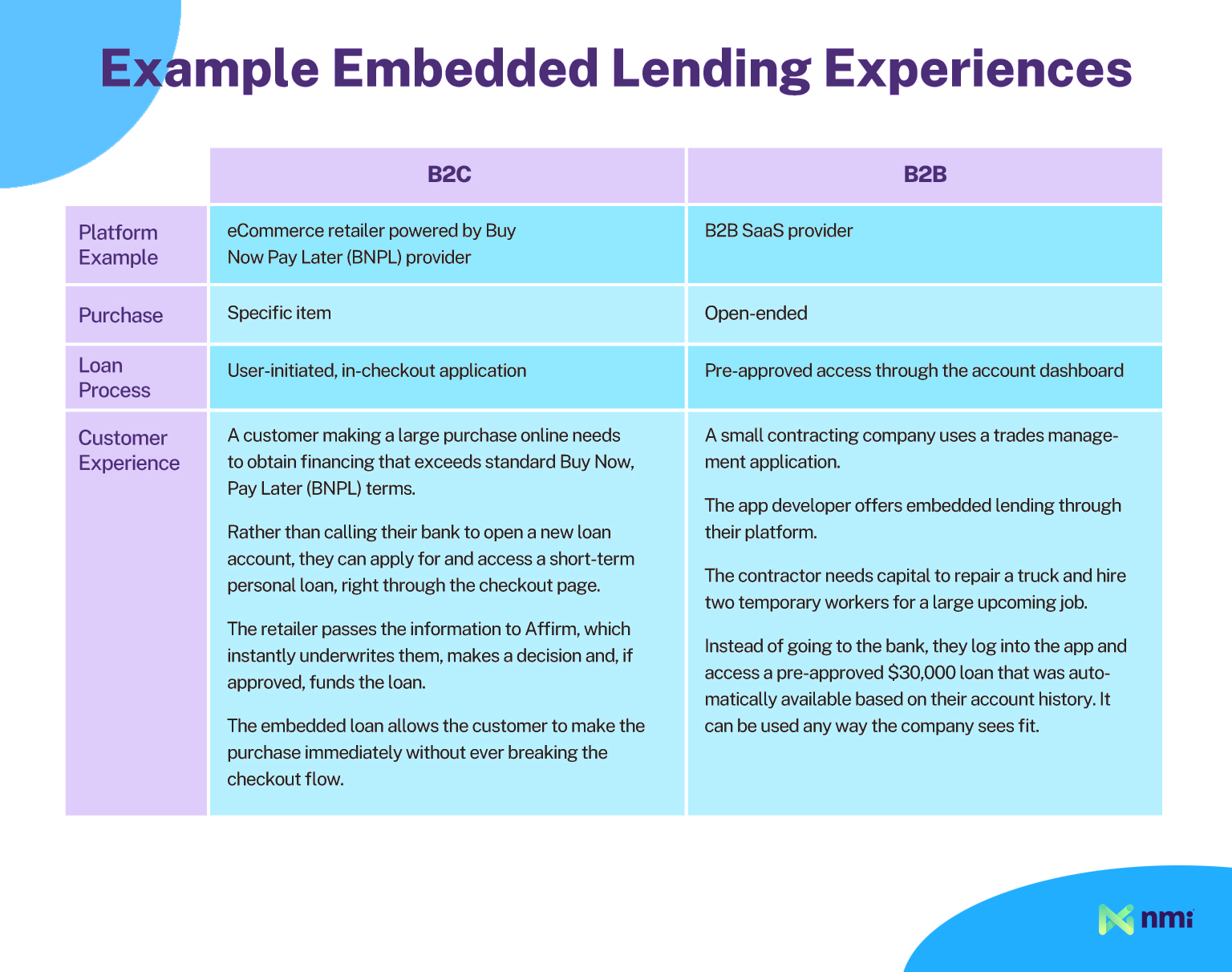

Embedded lending is when software platforms or payments platforms offer business loans or credit services directly within their own systems, so there is no need for merchants to leave the platform or apply through a traditional bank or outside lender. It lets merchants apply for and access credit right where they already do business, making it faster and easier to get the funds they need.

This technology falls under the broader trend of embedded finance, which also includes embedded payments and embedded banking. Together, these innovations enable businesses to offer financial services, like financing options, seamlessly within their platforms.

This is all made possible by open banking, which uses application programming interfaces (APIs) to give lenders real-time insights into a business’s financial health. With access to this data, lenders can make faster, more accurate funding decisions without requiring merchants to leave their usual workflows.

Lenders analyze a merchant’s sales data to match them with the best possible offer. These services are designed to give merchants the advantages of financing without the friction of a traditional loan process. Decisions are driven largely by the overall health of the business, giving merchants benefits such as:

- Faster access to capital with fewer manual steps

- Offers tailored to real sales performance

- A smoother, more seamless experience compared to traditional loans

A Real World Example

Let’s imagine you’re a small business owner assessing a loan offer within your business management software. You can:

- View personalized loan offers and apply right from your platform

- If approved, receive funding in as soon as 24 hours

- Use your dashboard to track loan account details

The business management platform will use open banking API connections to quickly validate cash flow and account activity before presenting a lending decision.

Why Does Embedded Lending Matter for SMBs?

Embedded lending is a support system for ambitious small- to medium-sized businesses (SMBs). Here’s how it helps them reach their goals.

Easier Access to Working Capital

Most SMBs know the exhausting challenges of applying for loans. Weeks of collecting paperwork and sales histories, proving income and business status, all with no guarantee of approval.

Embedded lending flips the script by placing funding options inside the platforms that merchants already use. This approach gives merchants faster, smoother access to working capital previously locked behind outdated processes. Lenders also leverage real-time financial insights to reduce risk, allowing them to approve more loans. This gives SMBs a more dependable path to securing working capital when traditional loan requirements are difficult to meet.

How Does Embedded Lending Work?

SMBs no longer have to put growth goals on hold just because traditional funding is slow or hard to secure. Embedded lending makes it easier for them to access the capital they need, quickly and directly through the platforms they already use.

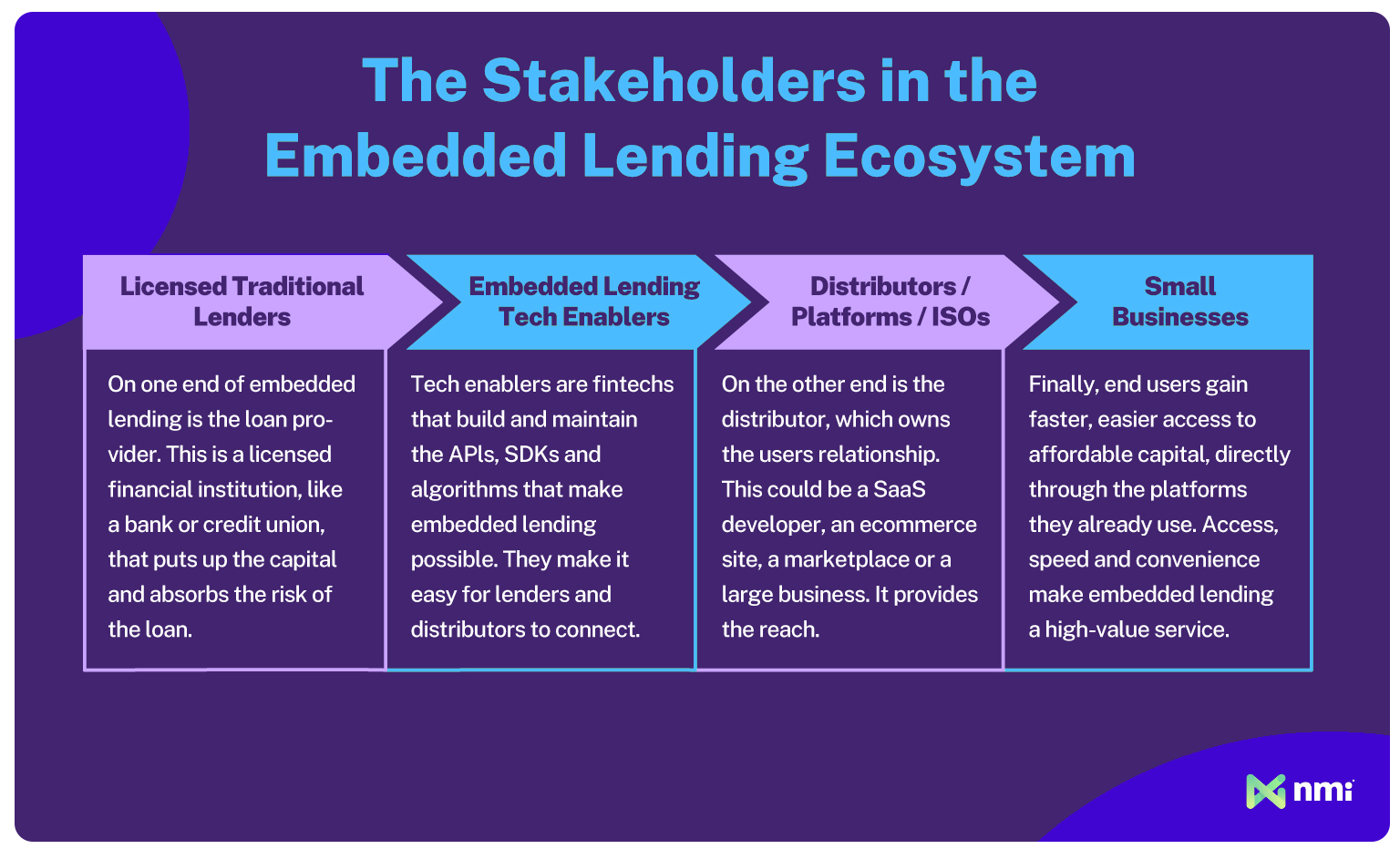

Behind the Scenes of Embedded Finance

A smooth embedded lending experience might feel simple, but there’s a lot happening in the background. Embedded finance platforms connect financial data, business operations and payment systems in real time, giving lenders a clear and up-to-date picture of how a merchant is doing.

Instead of relying on static reports, lenders get ongoing visibility into a merchant’s financial health. Embedded finance platforms also automate tasks that would normally take hours — like checking documents, verifying identities and managing underwriting. Many can even handle compliance workflows, including:

- Identity verification

- Regulatory reporting

All of this helps lenders make faster decisions, simplifies loan approvals and ensures funds can be delivered quickly and smoothly.

The Role of APIs and Automation

APIs are the tools that let different fintech systems communicate, ensuring processes run smoothly. In the case of embedded lending, financial data APIs, open banking APIs and payment APIs — all work together to support key steps such as:

- Streamlining everything from loan applications to getting funds out the door

- Providing real-time visibility into a business’s sales, cash flow, and payment history

- Instantly pulling financial data together for better risk assessment

- Automating credit decisions to reduce manual work and improve underwriting accuracy

- Enabling fast fund disbursements through real-time payment systems

Data from open banking APIs provides lenders with a real-time view of cash flow and account activity. Automated underwriting uses this data to accelerate credit decisions and reduce manual review.

Embedded Lending vs. Other Financial Tools

Embedded lending takes a much more modern approach and offers a very different experience than traditional banking. Here’s how it stacks up.

How It Compares to Traditional Banking

Traditional banking is notorious for long approval timelines, lots of paperwork and a clunky experience. Embedded lending removes many of these pain points by offering:

- Quick, easy access to credit within the business tools merchants already use

- Automated underwriting that uses real-time data

- Seamless integration with payment, accounting and business management systems

- Flexible credit options built around a merchant’s needs

Relationship to Embedded Finance and Open Banking

Embedded lending is part of the broader embedded finance ecosystem, sitting alongside tools like embedded payments, open banking and digital banking solutions. Together, these technologies bring financial services into the business software companies already use. This connected approach enables:

- Seamless payment experiences that draw on shared funding and accounting data

- Built-in compliance through secure, real-time data sharing

- Greater efficiency by integrating financial tasks with daily business operations

- Faster onboarding powered by live financial data accessed via APIs

These capabilities help SMBs access the working capital they need with fewer delays.

What Are the Benefits of Embedded Lending?

For many merchants, traditional financing can be slow, complex, or simply out of reach. Embedded lending offers a more accessible way to get the capital they need. Here’s what each group stands to gain.

Merchant Benefits

Cash flow problems are one of the biggest challenges for small businesses, with 82% of SMB failing due to poor cash flow. For merchants facing cash flow issues, on-demand capital can be a lifeline, giving them access to funds when they’re needed most, without the traditional lending hurdles. Access to working capital helps them:

- Act on growth opportunities sooner with faster, simplified funding

- Access loans based on their business performance, often with better terms

- Use flexible repayment options, based on their sales volume and without affecting their credit score

Payment Provider and SaaS Platform Benefits

Payment Provider and SaaS Platform Benefits

For payment companies and Software-as-a-Service (SaaS) platforms, embedded lending can be much more than an add-on; it supports growth and creates stronger customer relationships by offering:

- New partner revenue opportunities, such as lending commissions

- Increased customer stickiness and loyalty through better user experiences and bundled financial tools

- A competitive edge by offering tailored finance solutions

When paired with embedded payments, embedded lending becomes part of a more cohesive financial experience for users.

Choosing the Right Embedded Lending Partner

Selecting the right partner is essential for long-term success. Here are key features to look for when evaluating providers:

- Technology compatibility: The solution should integrate seamlessly with your existing workflows and platforms

- Reliability and security: Opt for a provider that complies with data security standards, industry regulations and has a solid uptime track record

- Flexible product offerings: Choose a partner that offers optional loan types and adaptable terms for diverse customer needs

- Scalability: The platform must handle growth in volume and complexity as your business expands

- Strong partnership: Work with providers who offer on-hand support and a commitment to innovation

Effective partners support automated underwriting and open banking API integrations to ensure accuracy and faster onboarding.

Market Outlook and Future Opportunities

Embedded finance is evolving fast, and understanding where the market is headed can help businesses stay ahead.

Growth of the Embedded Finance Market

What started as a niche idea has become a major movement in financial services. The embedded finance market is expected to reach $138 billion by 2026 and hit $7.2 trillion by 2030, up from just $22 billion in 2020. Growth is especially strong across industries like ecommerce, fintech and health care, where businesses are increasingly demanding financial experiences that are as simple and seamless as consumer transactions.

What’s Next in Embedded Lending

Embedding lending into everyday business tools is only the beginning. The next wave of innovation will likely include:

- AI-driven underwriting for faster, more accurate credit decisions

- Dynamic capital offers that update automatically as business needs change

- Industry-specific lending models tailored to the challenges and opportunities of different sectors

Win Big With Embedded Lending

The outlook for embedded lending is strong, supported by new technologies and rising expectations for seamless financial experiences. With the right approach, your business, your merchants and their customers can use these tools to ride the wave and unlock long-term growth and efficiency.

To learn more about how we’re using embedded payments to stay at the forefront of payments innovation, reach out to a member of our team.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.