In the not-so-distant past, technological advancements drove payment trends. Think Diners Club cards, magstripe, debit cards, and EMV technology. Now, however, the scales have tipped toward trends fueled by user preferences. With so many choices – from online payments, fintech solutions, and a variety of card-present options – its users, both consumers and merchants, are today’s trend makers.

Align with these payments trends in 2023, especially if your audience is behind the drive to make them mainstream.

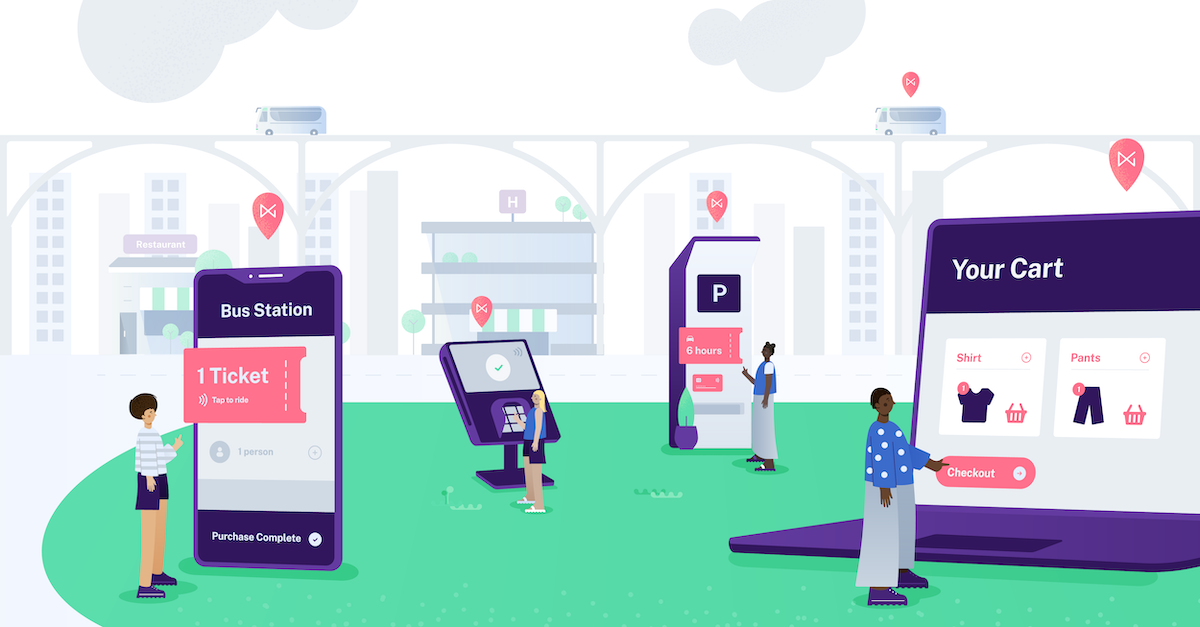

Payments Trends Driven by the Anytime, Anywhere Shopper

Consumers are embracing payments functionality embedded in software applications or “super apps.” Embedding payments in social media or other solutions that can offer in-app purchases make shopping (or impulse buys) easy.

However, don’t miss the growing adoption of mobile wallets based on the convenience and ease they provide. Although daily mobile wallet use in the U.S. and Canada is far behind China and other countries where credit card penetration isn’t as strong, growth is predicted in all regions around the world through 2025, when analysts expect 50 % of all adults will use mobile wallets. The rapid increase in contactless payments during the COVID-19 pandemic created an opportunity for more consumers to try this payment method and discover its benefits. Consumers learned that mobile wallets are a convenient way to pay on any channel, organize loyalty accounts – and leave the house with only a smartphone.

Another payments trend to watch in 2023 is buy now, pay later (BNPL). As inflation continues, BNPL can help consumers afford high-value items by splitting purchases into four more budget-friendly payments.

Payments Trends that Enhance In-Store Experiences

Whether due to the continued rise of millennial and Gen Z consumers or shoppers that learned to keep their distance during the pandemic, self-checkout and self-service payments adoption is growing. A study by restaurant tech platform Vita Mojo found that 84 % of Gen Z and 82 % of millennials choose restaurants with self-service kiosks over those that don’t have them. Additionally, Nice’s 2022 Digital-First Customer Experience Report states that consumers want more self-service options. Watch kiosks appear in more locations in 2023 in response to this demand.

However, self-checkout and self-service payments don’t have to take place only at free-standing kiosks. Look for innovative solutions that enable self-service payments in smart fitting rooms, with smart shopping carts, or with Amazon-like “Just Walk Out” technology. Minimizing dependence on store employees, giving consumers control, and minimizing payments friction will continue to trend.

Payments Trends Driven by Merchants

Digital transformation is gaining momentum across industries as businesses chase greater operational efficiency, cost control, and competitiveness – and it includes transforming payments and accounts receivable.

Emerging tap-to-mobile technology has captured merchants’ attention. This technology allows merchants to accept contactless payments directly on a smartphone and eliminates the need to invest in payment hardware. However, it also gives merchants the freedom to take payments anywhere, whether curbside, at a sidewalk or tent sale, at a community event, at a food truck counter, or a roadside farm stand.

The appetite for tap-to-mobile is strong, with 83% of consumers saying they’d use the payment method and 95% of small and medium-sized businesses (SMBs) saying they’d consider using the technology, including 92% of cash-only businesses.

In addition to watching B2C merchants look for ways to streamline transactions and simplify their IT environments, expect B2B merchants to do the same. B2B payments trends include electronic invoicing, online payments, virtual terminal payments, and recurring payments for subscriptions or payment plans. Moving away from traditional, paper-based AR processes save time and money, decrease errors, and improve cash flow.

How to Stay on Trend

With growing payment method options and consumers driving payments trends, it can be challenging to predict what’s coming next and how to ensure you can meet demands.

The best strategy is to partner with a payments company that enables a broad spectrum of payment types, continually innovates, and hasn’t given up on technology’s role as a trendsetter.

Talk to our team to learn how to stay on the cutting edge in 2023.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.