You have one item in your basket. A quick purchase – hopefully. You go to checkout and see a familiar sight – the registers are all understaffed, and there are massive lines leading up to each. You look down at your basket. You want that item, but do you need it right now? The answer is no. You put it back and walk out the door.

We’ve all been there. The business lost a sale, and you left frustrated and empty-handed – all because there wasn’t a more convenient way to checkout.

Patience is no longer a given – especially among younger generations. Consumers are used to frictionless online shopping experiences and avoid the long lines and slow checkouts at traditional brick-and-mortar (B&M) retailers. Evolving customer demands have led to an unattended payments revolution, rapidly changing how merchants sell everything from electronics to meals to clothes and beyond.

To keep traffic flowing, reduce costs and keep customers happy, many merchants are turning to self-serve retail.

What is Self-Serve Retail?

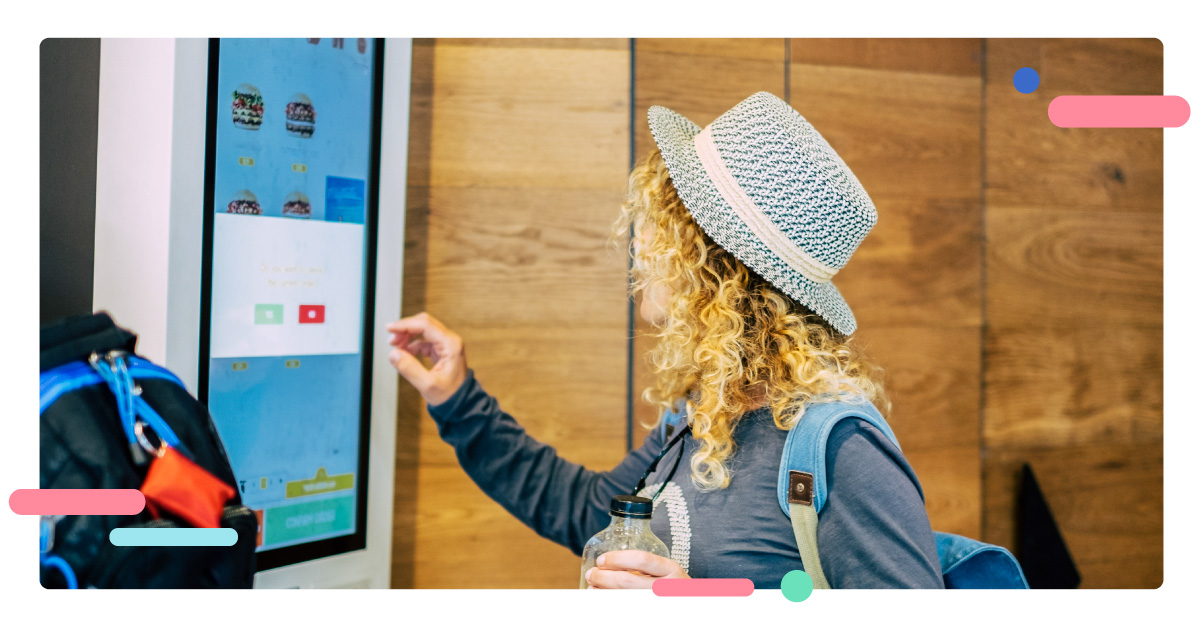

Self-serve retail, or unattended retail, is any real-world checkout system that removes the cashier from the equation. That could include anything from a kiosk that prints a ticket, a scanning and bagging area at a grocery store, a vending machine, a mobile payment device (like an app) and beyond.

Self-serve retailers recognize that not all purchases require a human cashier. Instead, eliminating the need to go through a cashier puts the customer in control of their payment experience – simulating the convenience, speed and feel of online shopping in a brick-and-mortar environment.

Why is Self-Serve Retail Becoming So Popular?

Self-serve retail represents a rare win-win for both merchants and consumers. On the consumer side, self-serve checkouts offer a fast, digital-first experience where customers can interact with workers as much (or as little) as they want. According to research from PYMNTS.com and Toshiba, 66% of self-checkout users cite speed as a primary reason they skip the traditional checkout, while 49% say they use self-checkout so they don’t have to wait in line.

More than ever, digitally-native consumers expect speed and convenience in brick-and-mortar retail settings. Adopting unattended retail systems enables merchants to keep up with changing customer preferences – a must for staying competitive in an era where consumer loyalty is ebbing.

Self-serve checkouts also benefit merchants in other ways, from limiting in-store congestion to reducing labor costs. As a result, self-serve retail not only enables merchants to compete better – it also helps them operate more efficiently and profitably.

Types of Self-Serve Retail

Self-serve retail comes in various flavors across multiple verticals. The following are some of the most common. However, as fintech and digital payments evolve, more channels will begin to move towards self-serve retail.

Self-Serve Checkouts:

Most people are familiar with self-checkout lanes at grocery stores and big box retailers like Walmart and Target. Self-serve checkouts allow customers to scan and bag their items, select their payment option, complete the transaction and leave – all with zero employee interaction. By adopting self-checkout options, retailers can shift responsibility to the customer while simultaneously improving the buying experience.

Some innovative players are taking things a step further and have introduced smart basket technology to the market. Smart baskets are cutting-edge retail technology that eliminates the need to scan products at a checkout station before paying and leaving the store. Instead, smart baskets can tell what products customers want to buy using RFID or near-field communication (NFC) technology – similar to contactless debit and credit cards.

This means a shopper can simply fill their basket and place it at the checkout when they’re ready to leave. The basket automatically calculates the total charge based on its contents. Then, the system accepts payment at the point of sale or bills the shopper automatically through an app. In the case of Amazon’s smart shopping carts and “Just Walk Out” technology, shoppers can skip the checkout altogether and view receipts on their online accounts.

Self-Serve Kiosks:

Small kiosks are growing in popularity, especially in cases where transactions don’t involve a physical product. Everything from baggage upgrades to movie tickets to driver’s license renewals can now be purchased through unattended kiosks, significantly reducing lines and wait times.

Organizations can install kiosks almost anywhere, enabling people to access government, business and even medical services without going to a crowded office or store.

Self-Serve Vending Machines:

Vending has always been unattended. However, most machines now feature card readers or in-app purchasing options instead of requiring coins or cash. This move toward contactless payments eliminates the hassle of collecting and processing change and makes it easier for customers to make quick purchases.

As the self-serve market grows, so do the types of retailers using this technology. Gone are the days of vending machines carrying only soda, snacks and coffee. Today, customers can purchase everything from clothing and pre-made meals to electronics and cars. Vending has become so popular that 80% of consumers say they’d like to buy more non-traditional items from vending machines.

The Business Case for Self-Serve Retail

Most consumers are familiar with (and prefer) self-guided checkouts and payments. As a result, businesses adopting this technology can feel confident that their customers will take advantage of these new tools.

The real risk for B&M merchants is alienating consumers – especially younger ones – by not offering self-checkout. Luckily, self-serve retail makes as much sense for merchants as it does for consumers for three main reasons: cost, capacity and consumer preference.

Cost and Operational Efficiency:

Uniqlo, a Japanese casual-wear company operating stores on four continents, now offers smart self-serve checkouts that automatically scan RFID tags on individual items. The system enables customers to drop a basket or a bundle of clothing in the checkout area and pay without scanning each item. More importantly, it allows Uniqlo to keep employees on the floor instead of behind a POS, significantly increasing the quality of customer experience without raising labor costs.

Self-serve retail systems are powerful tools that enable merchants to manage one of a retailer’s highest costs – wages – and reallocate employees so they can focus on customers rather than repetitive tasks like scanning items and counting change.

Improved Capacity:

Self-serve retail systems enable merchants to sell to more customers by improving capacity. Some of the ways it does so include:

Freeing up valuable space (such as seating in a restaurant)

Eliminating long lines

Allowing businesses to operate beyond regular hours

Improving employee productivity and efficiency

Giving customers more ways to pay

For merchants like B&M retailers and restaurateurs, getting customers served and out the door faster is invaluable. In sectors like vending and kiosks, where a physical storefront is unnecessary, merchants can sell 24/7 without incurring additional costs. This added flexibility gives businesses a decisive advantage over their traditional competitors.

Choice, Convenience and Control:

Customer loyalty can be hard to come by. That’s why merchants offering the best experience will be the ones to win sales and unlock long-term growth.

Self-serve systems are ideal for merchants who want to meet customer demands for choice and convenience while also maintaining traditional checkouts. Because they’re so compact, a retailer can add multiple self-checkout stations in the same space a conventional lane would require, making it easier to serve large numbers of buyers. In addition, because they don’t require staffing, these systems allow stores to open up additional checkouts without taking on unnecessary costs.

Offering both self-serve and traditional buying options gives customers the choice, convenience and control they demand. Self-serve payment options also provide more flexibility, improving the end-to-end shopping experience and allowing merchants to develop stickier, more loyal customers.

Things to Consider Before Investing in Self-Serve or Unattended Retail

Merchants have a lot to gain by adopting unattended retail systems. However, there are some wrinkles to consider before diving in. Security and compliance considerations are two big ones since self-serve checkouts often require additional safety measures. There may also be regional differences for larger merchants operating stores across different areas.

Compliance

On the compliance side, self-serve hardware must meet the same PCI standards as any other payment system. Unfortunately, because self-serve systems are generally unattended, they can become attractive targets for fraudsters. That means merchants adopting self-serve retail technology should also consider investing in advanced fraud protection.

Security

The unattended nature of self-serve checkouts can also make them a target for shoplifters. As a result, self-serve systems may require heightened security monitoring. The good news is that fraud monitoring tools (and a few extra security cameras) are much cheaper than staffing an attended checkout.

Payment Processing

Payment processing is another critical factor to consider. Not all processors have the expertise, services, functionality or hardware necessary to offer frictionless self-serve solutions. Fewer still offer the advanced fraud protection tools needed to make self-serve security airtight.

For merchants, adopting this technology may require switching to a different processor – an easy enough proposition in today’s market.

However, for independent sales organizations (ISOs) and payment facilitators (PayFacs), failing to find a processing partner with the right unattended services could lead to lost business. That’s why partnering with the right payments provider, like NMI, is essential to a successful self-serve strategy.

To learn more about NMI’s unattended solutions and how to get started, contact a member of our team to schedule a free consultation.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.