KYC (Know Your Customer) is a process required by financial institutions, businesses and organizations to verify the identity (and often financial profile) of their customers or clients. The primary objective of KYC is to prevent fraud, money laundering, terrorist financing and other illegal activities.

But let’s face it: with all the required paperwork (and slow verifications), traditional KYC processes can be a hassle. That’s why digital, automated KYC solutions are quickly gaining popularity.

In this article, we will explore what digital KYC is and how it makes merchant onboarding smoother, safer and more customer-friendly.

What is Digital KYC in Merchant Onboarding?

KYC is a crucial process in merchant onboarding. It’s all about getting to know your customers better and understanding who they are before you start doing business with them. The primary objective of KYC is to verify the identity and legitimacy of customers to ensure that they are who they claim to be.

When a company decides to onboard a new merchant, it must conduct a comprehensive KYC process to gather essential information about the merchant and their business. This practice helps businesses build trust with their customers, comply with regulations and mitigate potential risks associated with unauthorized or illegal activities. KYC plays a significant role in safeguarding customers’ data and maintaining the overall security of transactions.

Similarly, digital KYC is the process of conducting KYC checks with software tools rather than pens and paper. It allows businesses and institutions to verify the identity of their customers quickly and accurately.

There are 4 crucial steps in any KYC process:

1. Customer Due Diligence

Customer Due Diligence (CDD) involves knowing your customers and safeguarding your systems from criminals, terrorists and politically exposed persons (PEPs) who could pose higher risks.

In general, businesses offering merchant services must perform CDD to verify their customers’ identities, understand the monetary thresholds for reporting and record-keeping and follow the specific FinCEN (Financial Crimes Enforcement Network) rules that apply to different types of transactions.

Here are some tips that can help you determine what level of due diligence is appropriate:

-

Understand your customer’s customers

-

Collect details of all personal and business relationships

-

Approximate salary or annual sales

-

Understand all anti-money laundering (AML) policies and procedures

-

Research local market reputation

2. Enhanced Due Diligence

This step provides additional protection for high-risk accounts. Enhanced Due Diligence (EDD) can often uncover things that standard customer due diligence cannot.

Merchant acquirers commonly apply EDD procedures to client accounts such as:

-

Politically Exposed Persons (PEPs)

-

Special Interest Persons (SIPs)

-

Clients on sanction lists

-

Larger clients

3. Customer Identification Program

The Customer Identification Program (CIP) is vital to merchant onboarding, especially for ISOs and ISVs. CIP requires gathering customer information using a risk-based approach, ongoing monitoring, and integrating with KYC procedures.

The procedures for identity verification involve various methods, such as reviewing identification documents, using non-documentary methods (like cross-referencing customer information with consumer reporting agencies and public databases), or a combination of both.

4. Risk Management and Ongoing Monitoring

Only assessing a customer’s risk during the enhanced due diligence process of onboarding isn’t enough. You must also watch for signs of terrorist financing, suspicious activity, or other high-risk behaviors throughout your relationship with them.

Normally, once you identify and verify a customer, there’s no need to re-verify their identity. However, there are exceptions when there’s a trigger event, such as a change in the product or service you provide to them, concerns about previous information collected, or suspicions of money laundering.

Regularly review their information, transactions and accounts based on their risk profile. This helps you detect suspicious financial activities, keep records up to date, check for politically exposed persons (PEPs) or sanctions and identify unusual cross-border activities. Thankfully, tools like NMI’s MonitorX automatically track and analyze merchant behavior and send alerts if any red flags are detected.

Compliance Considerations in Digital KYC

When adopting digital KYC solutions for merchant onboarding, paying close attention to compliance considerations will ensure you adhere to relevant regulations and industry standards.

Two important rules govern KYC:

-

Financial Industry Regulatory Authority (FINRA) Rule 2090, also known as the “Know Your Customer” (KYC) rule.

-

FINRA Rule 2111, known as the “Suitability” rule.

According to FINRA Rule 2090, every broker-dealer must make reasonable efforts to know their customers and maintain records of each customer’s profile. They should also identify anyone authorized to act on the customer’s behalf.

On the other hand, FINRA Rule 2111 requires broker-dealers to ensure that their recommendations are suitable for each customer by considering their financial situation and needs. Before making any security transactions on behalf of the customer, the broker-dealer must review the customer’s current information, profile, securities and investments.

To prevent illegal activities like money laundering, both customers and financial institutions in the U.S. must also comply with KYC standards, as mandated by the Financial Crimes Enforcement Network (FinCEN) AML, or anti-money laundering. This encompasses various measures and processes used to meet regulatory requirements, with KYC being one of its components.

ISOs and ISVs are often heavily involved in payment processing, merchant services and financial technology solutions. This means they are considered “broker-dealers” and are subject to the above regulations.

To meet KYC compliance, ISOs and ISVs must understand the nature of the customer relationship, create a customer risk profile and use it as a reference point for spotting suspicious activities. Additionally, they must keep customer information current and regularly monitor accounts for any signs of suspicious or illegal behavior. If you identify any such activities, you must promptly report them as required.

Additionally, businesses will need to comply with PCI-DSS (Payment Card Industry Data Security Standard) requirements when onboarding merchants. Examples of PCI requirements include using up-to-date antivirus software, using and maintaining a firewall, etc.

PCI compliance ensures the secure handling of payment card data, reduces the risk of data breaches and fraud and enables businesses to maintain trust with customers, payment processors and financial institutions. Non-compliance can lead to severe financial penalties, reputational damage and potential loss of business opportunities.

Enhancing Security and Preventing Fraud through Digital KYC

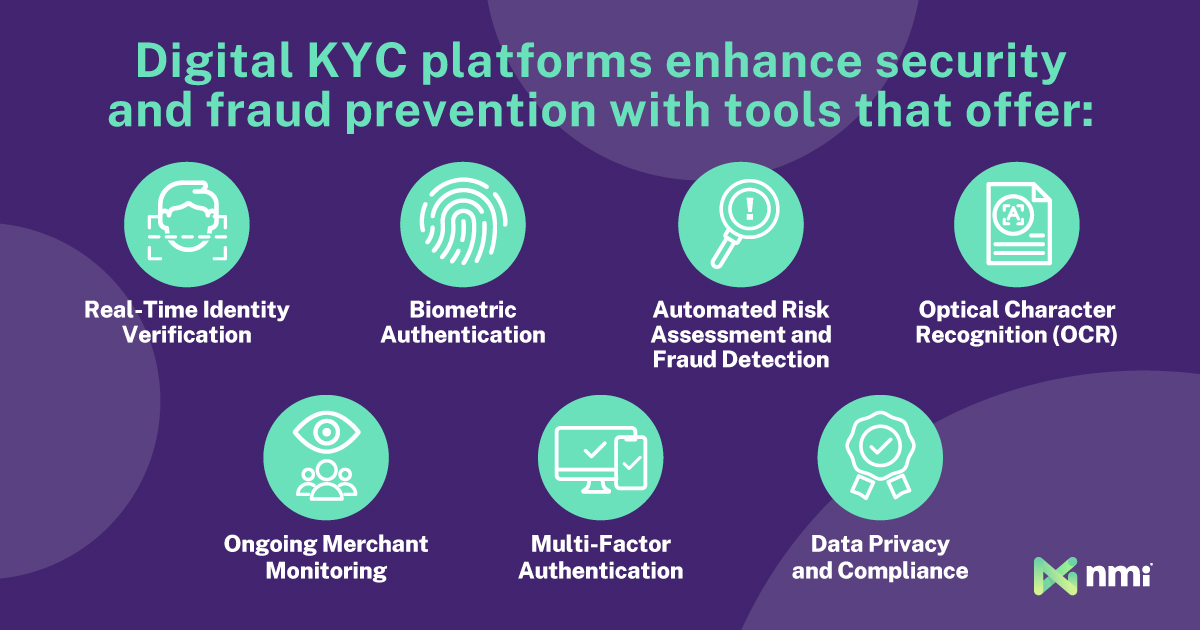

Ensuring security and preventing fraud are top priorities for any business during the merchant onboarding process. Digital KYC solutions play a crucial role in achieving these goals. Here is how some Digital KYC platforms enhance security and equip businesses with powerful tools to prevent fraud:

- Verify Identities in Real-Time: With Digital KYC, you can instantly verify the identities of your merchants in real-time. This means no more waiting for days to complete background checks. Simply upload the required documents, and the system will swiftly validate them, ensuring that your merchants are who they claim to be.

- Employ Biometric Authentication: Some Digital KYC solutions utilize cutting-edge biometric technology to add an extra layer of security. Incorporating fingerprint, facial, or voice recognition ensures that only authorized individuals can access your platform or services. This eliminates the risk of impersonation and unauthorized access.

- Conduct Risk Assessment and Fraud Detection: Digital KYC solutions use sophisticated algorithms to assess risk and detect fraudulent activities. By analyzing various data points and patterns, the system can flag suspicious behavior, reducing the chances of falling victim to fraudsters.

- Authenticate Documents with Optical Character Recognition (OCR): OCR technology allows you to swiftly and accurately extract information from uploaded documents. This ensures that the provided documents are genuine and haven’t been tampered with, further enhancing the credibility of your merchant onboarding process.

- Monitor and Update Merchant Profiles Regularly: Review data regularly to identify suspicious changes in merchant behavior. Tools like MonitorX help you keep track of your merchants’ activities and quickly spot any anomalies that might indicate fraud.

- Multi-Factor Authentication: Adding an extra layer of protection, multi-factor authentication (MFA) is an essential feature of digital KYC. It requires merchants to verify their identity through multiple avenues such as email, text, biometrics or geolocation. MFA adds additional hurdles for potential fraudsters to overcome.

- Ensure Data Privacy and Compliance: Digital KYC solutions prioritize data privacy and compliance with regulatory standards. Your customers’ personal information is protected, and you remain compliant with data protection laws, building trust among your clients.

Conclusion

Technology is making the merchant onboarding process more efficient and effortless. Embracing digital KYC solutions for your merchant onboarding process is a decisive step toward securing your business and bolstering customer trust.

Incorporating the actionable tips highlighted above will streamline your merchant onboarding process, enhance security and help prevent fraud. To learn more about digital KYC solutions and how this technology can make your business more compliant and secure, schedule a consultation with a member of our team.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.