The subscription commerce model can be an excellent source of revenue for merchants (and their payment providers). It allows consumers to opt-in to receive a recurring service or product without reentering their payment information for each purchase. It also provides businesses with a sticky customer base and stable income.

Subscriptions are a win-win for everyone involved. But how do subscription payments work?

In part one of our Subscription Payments 101 series, we explored what subscription payments are and why they’re so lucrative for businesses. Here, in part two, we’ll dive into the different types of subscription payment models and how they work.

Types of Subscription Payment Models

Offering subscription payments to your merchants or integrating subscriptions into your software solution will help you attract happier, stickier customers and generate stable, recurring profits. With the market anticipated to be worth $1.5 trillion by 2025, adopting this model is a no-brainer for many businesses.

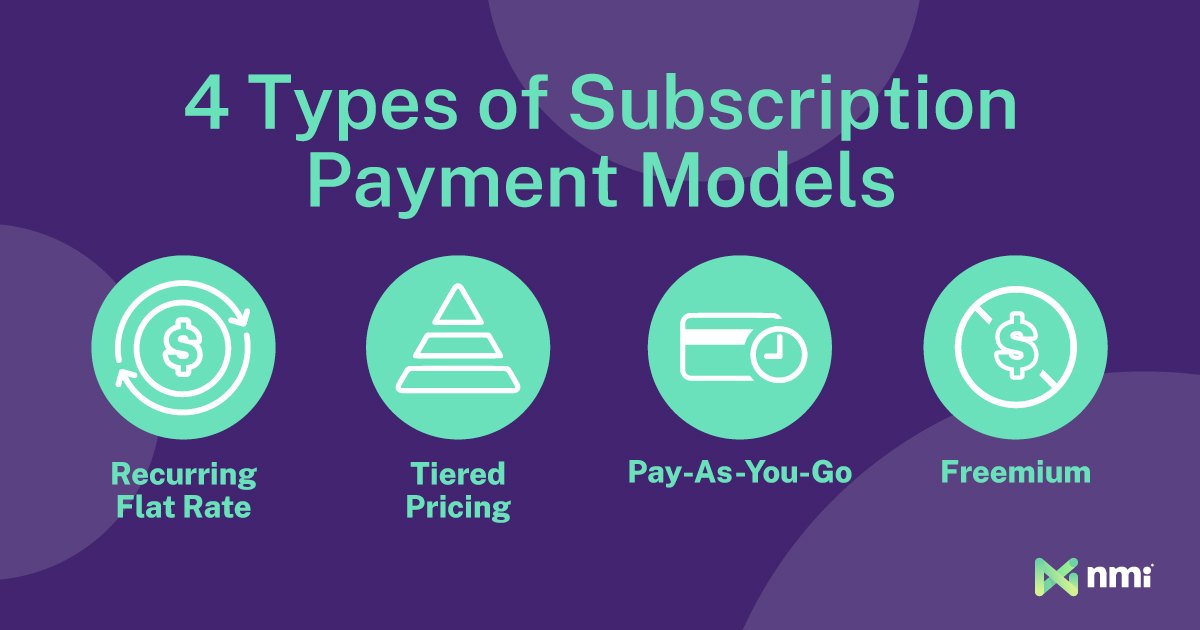

However, as an independent sales organization (ISO), payment facilitator (PayFac) or software provider, there are several subscription models to consider before adopting this technology or offering it to your merchants. These include recurring flat rate, tiered pricing, pay-as-you-go and freemium models. Your customers’ options depend heavily on their goals for adopting subscriptions, what they’re selling and what their customers expect.

Recurring Flat Rate

The recurring flat rate model is the most straightforward. It offers a flat price for a product or service, billed in pre-set cycles. Many businesses use flat rate models to give a discount for annual billing. Customers pay the same price for a single service level in these cases.

A subscription to The New York Times digital edition is an example of a flat-rate subscription payment. All subscribers get access to the same content for the same price.

This model is straightforward. Simplicity matters in subscriptions because customers are becoming increasingly wary of complex pricing. One study from 2022 found that more than half of consumers want to spend less than $50 per month on subscriptions, although they pay 40% or more than that on average. That means consumers are already losing track of their subscriptions.

Clear, transparent and easy-to-understand pricing is a selling point as more industries adopt this model. The downside of flat-rate subscriptions is that they do not allow customers to tailor their individual experiences to their wants and needs.

Tiered Pricing

The tiered pricing subscription model is what most consumers are most familiar with. It is a flexible and customer-centric approach to billing. It has multiple pricing levels, each with distinct features and functionalities.

The lowest tier targets the most casual users, offering essential services at an affordable rate. As the tiers go up, the features expand, allowing merchants to appeal to a broader spectrum of customers.

Netflix memberships are an example of a tired pricing subscription payment. On the low end, customers can use two supported devices and stream with ads. For a higher price, they can remove the ads and receive more perks. Finally, with a premium membership, the whole family can stream on multiple devices at once, ad-free and at the highest resolutions. In addition to streaming services, this tiered pricing is also widely used by software-as-a-service (SaaS) providers.

Its adaptability makes the tiered pricing model particularly effective for both the provider and the consumer. As a customer’s needs change over time, the tiered model enables them to update their subscription easily. Ultimately, this model optimizes revenue for the provider and offers the customer a level of control and customizability that flat rates can’t.

Pay-As-You-Go

The pay-as-you-go subscription model is a billing approach most commonly used in the SaaS world. Unlike tiered pricing models, this model charges based on usage. This could be measured in various ways, such as the number of transactions processed, data consumed or application program interface (API) calls made. Pay-as-you-go pricing is often combined with tiered or recurring flat rate models so that a customer’s total subscription payment comprises a set periodic amount plus usage fees.

For instance, many phone and internet plans charge a flat monthly fee for a certain amount of data. If you use more than the allotted data for your plan, you may have to pay additional fees to cover that usage.

The pay-as-you-go approach allows businesses to have a more direct correlation between the cost of the service and their actual needs. This makes it especially attractive for companies with highly variable volume requirements or those looking to minimize upfront expenses.

It also offers unparalleled flexibility, as companies only pay for what they use, allowing them to adapt to seasonal variations or sudden spikes in demand without reconfiguring their subscription. However, this can also be a drawback, making subscription payments (and revenue) less consistent and more complicated to plan and budget for.

The Freemium Model

In the freemium subscription model, the most basic subscription level is free. This allows users to sample a product or service’s core features without financial commitment.

Freemium subscriptions give potential customers a risk-free way to evaluate the product as a conversion strategy. Then, once a customer is familiar enough with the service to commit to it (or their needs grow beyond the basic free plan), they can upgrade to a paid plan with more advanced features, higher capacities or premium support.

Freemium subscriptions lower the barrier to entry, making it easier for people to start using a service. This model is prevalent in software, gaming and streaming. Spotify, for instance, operates on a blended freemium and tiered pricing model.

While the freemium model effectively drives user adoption, it also presents unique challenges. Specifically, merchants must find the right balance between offering enough features to entice users to try the service but not so many that they’re disincentivized from upgrading to a paid plan. Finding that balance is complex and can lead to poor conversions if not done well.

Subscription Models in Action

From the straightforward appeal of the recurring flat rate model to the flexible and customer-centric tiered pricing model, businesses have a variety of options to choose from, each with its unique advantages and challenges.

In the next installment of our Subscription Payment 101 series, we will explore the key components of the subscription payment process, from sign-up and onboarding to renewals and cancellations. Keep reading to learn about the intricacies of each component and how to make them work for your business.

In the meantime, to learn more about NMI’s recurring payment solutions, reach out to a member of our team and schedule a free consultation.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.