Business-to-business (B2B) and business-to-government (B2G) companies regularly spend too much on interchange fees. Most of the time, they don’t even realize it.

A fundamental aspect of every credit card transaction is the customer and seller data submitted with it. In most cases, transactions only require the most basic details to be collected, including card data, the seller’s name and the merchant category code (MCC). However, there are times when transactions require more.

The level of information required grows as purchases become more complex and high-value, such as certain B2B and B2G transactions. In these cases, providing more detailed information about a transaction minimizes the associated risk – something that card companies are happy to reward businesses for by passing on lower rates.

Unfortunately, not every payments system can collect the extra data necessary to facilitate complex transactions. To unlock this functionality (and lower interchange costs), B2B and B2G merchants need access to platforms that offer Level 2 and Level 3 payment processing.

Understanding Advanced Payment Processing

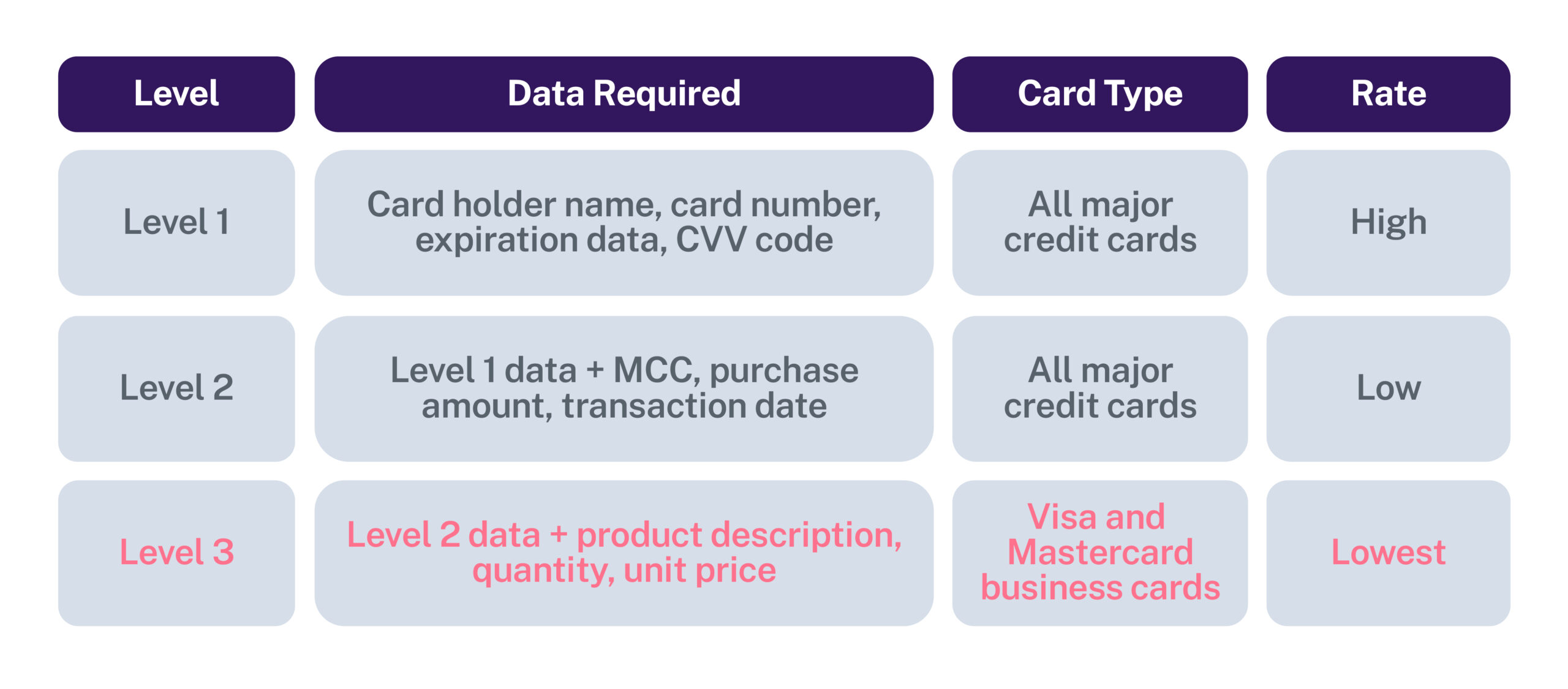

Level 1, Level 2 and Level 3 payment processing have different purposes and unique requirements. Level 1 processing requires the least data, while level 3 requires the most. Major credit card companies update rates and data requirements every year in April and October.

More information about a transaction means easier tracking, verification, accounting and fraud resistance – all of which are extremely important to large B2B and B2G players. As a result of that additional transparency and security, Level 2 and Level 3 transactions generally offer lower interchange rates – savings that can be used to either entice buyers or boost profits.

Level 2 and Level 3 processing benefit a wide range of merchants, regardless of what verticals they sell in. With that in mind, let’s take a deeper look at each level and why advanced processing is so important to merchants and independent sales organizations (ISOs) alike.

Level 1 Processing

Level 1 is the simplest form. It’s suitable for standard consumer transactions and makes up the vast majority of payments. In addition to basic payment data like card number and CVV, it usually requires merchants to submit four extra data points:

- Total purchase amount

- Purchase date

- Merchant category code

- Seller name

Level 1 interchange rates are the highest of the three.

Level 2 Processing

Level 2 is more advanced, typically used for business-to-business (B2B) and corporate card transactions. Depending on the card brand, it requires additional data points, including:

- Tax amount

- Tax ID

- Tac indicator

- Customer code/PO number

There are also half a dozen optional data points that can be included with Level 2 payments. This additional information gives businesses greater control over their transactions, allowing them to cut costs and manage their operations more efficiently. Level 2 interchange rates are lower than level 1 but higher than level 3.

Level 3 Processing

Level 3 processing is the most detailed of the three options. It is ideally suited for large B2B and B2G transactions requiring comprehensive information to ensure security and correct/authorized use of funds. The added transparency provides a layer of security and trust that is crucial where public money or publicly traded companies are involved. Depending on the card brand, Level 3 requires all the same data as Level 1 and 2, plus information like:

- Duty

- Commodity codes

- Product codes

- Item quantities

- Unit of measure

- Unit of cost

- Discount rates

- Discount per line item

- Line item total

- Shipping amount

- Destination zip and country codes

Level 3 interchange rates are the lowest – allowing eligible businesses to save on each transaction.

Business Benefits of Level 3 Processing

While Level 2 processing offers greater control and transparency for businesses, Level 3 opens the door to tremendous opportunities. For ISOs, enabling those benefits and opportunities is a significant competitive advantage.

Key benefits that Level 3 processing unlocks include lower interchange fees, improved compliance (and access to highly regulated contracts,) better reporting and tighter fraud detection.

Lower Interchange Fees:

Because Level 3 transactions are more secure and less prone to fraud, major card brands offer discounts to incentivize them. Merchants accepting Level 3 transactions could see interchange reductions that are roughly double the discount for Level 2 transactions.

Although these savings may not seem like a big deal at first glance, they add up fast – especially on large and ongoing government purchases. For B2B merchants, an extra percent can go a long way towards shoring up profits. For B2G organizations, these savings can ensure they have the funds to outbid the competition for government contracts.

Compliance With Government and Industry Regulations:

For large B2B and B2G transactions, Level 3 data isn’t just nice to have; it’s a minimum requirement. There are often stringent reporting rules attached to institutional purchases, and any merchant unable to collect Level 3 data is disqualified from bidding, regardless of how good their price or service may be. That means Level 3 capability not only ensures compliance and reduces risk but also unlocks a valuable door for merchants looking to respond to government and industry proposals.

Enhanced Reporting Capabilities:

More detailed transaction data gives businesses an in-depth view of their spending patterns and business activities. This valuable insight aids in decision-making and business forecasting. Level 3 reporting also helps with accounting and reconciliation processes. By automatically producing and importing data into account systems, Level 3 ensures records are as accurate as possible while saving time.

Greater Security and Fraud Prevention:

Level 3 processing adds layers of protection to transactions and creates more loopholes for fraudsters to jump through before they can breach a company’s defenses. With fraud rates skyrocketing, greater security protects everyone – merchants, ISOs and their customers.

Finding the Right Level 3 Payments Partner

Identifying the need to offer Level 2 and Level 3 processing is the first step towards accessing lower rates, better security and new selling opportunities. The next critical step is finding a reliable payments partner with a proven track record of providing Level 3 collection capabilities – something not all processors can offer.

To find the right partner, you’ll need to conduct thorough research, find credible recommendations and ask potential partners about their advanced payment processing services. Remember, even if Level 3 processing isn’t part of the plan now, choosing a partner that offers it provides the flexibility to expand your operations in the future without the disruption of migrating to a new partner or platform.

A trusted payments partner like NMI will offer not only advanced processing but also the experience and expertise required for a smooth onboarding experience.

Level III Advantage With NMI

To ensure you have the tools to succeed, we are excited to announce a new value-added service: Level III Advantage. Level III Advantage optimizes B2B and B2G interchange rates on your behalf, reducing transaction costs and mitigating risk. With Automated Data Optimization, you can enjoy lower rates without spending hours entering data manually.

Offer your clients a cutting-edge solution that delivers tangible financial benefits while differentiating your services in the market.

If you’re ready to expand your offerings and leverage the benefits of Level III Advantage, we’d love to talk with you. Contact a member of our team for more information.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.